The U.S. Department of Justice filed a lawsuit against Apple Thursday, accusing the company led by CEO Tim Cook of engaging in anti-competitive business practices. The allegations include claims that Apple prevents competitors from accessing certain iPhone features and that the company’s actions impact the “flow of speech” through its streaming service, Apple TV+.

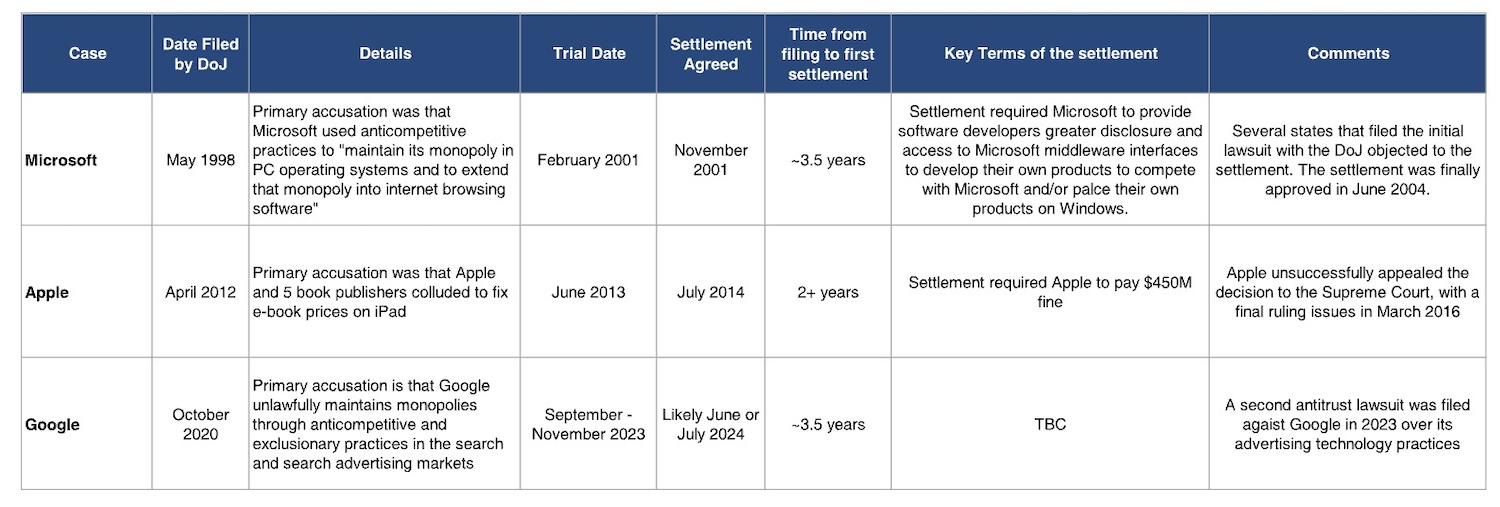

However, even if the DOJ proves any of the allegations, it is highly unlikely that Apple will face material changes for years, as history shows that such lawsuits often take a significant amount of time to reach the trial, let alone a resolution. The DOJ’s ongoing case against Google, filed in 2020, only went to trial in 2023, with no remedies or financial implications expected for up to two more years.

This is not the first time Apple has faced legal action from the DOJ. In 2012, the agency sued Apple for conspiring with publishers to increase ebook prices, a lawsuit that was not settled until 2016.

“Precedents suggest that resolution of the complaint will take three to five years, including appeals,” Bernstein analysts wrote in a note.

Morgan Stanley analysts said Friday that the current lawsuit could also favor Apple, as many similar allegations have already been ruled on by a judge in the Apple vs Epic case, with the ruling stating that Apple does not violate antitrust laws. The DOJ filing also only makes a relatively passing mention of Apple’s $10b+ search deal with Google and doesn’t cite the App Store as one of its five principal examples of monopolistic behavior.

Previous major antitrust cases. (Image: Bernstein)

Bernstein analysts added, “While the DoJ’s charges are focused on iPhone, we do not see likely remediation as materially impacting Apple financially or undermining the iPhone franchise: worst case, Apple pays a fine, and loosens restrictions for competition across the iOS platform, which we believe will have limited impact on iPhone user retention or on Services revenues.”

Which led Morgan Stanley analysts to conclude that the DOJ’s lawsuit creates “more of a headline risk than a near-term event risk” for Apple.

They added:

Said differently, yes, this lawsuit creates a stock overhang, but the market has a short term memory and in our view, fundamentals are more likely to drive Apple’s stock price over the next 12 months (and several years), rather than this lawsuit. We can cite a number of historical instances where companies in the thick of litigation threatening their core product/differentiating value proposition have outperformed despite the legal overhang: 1) Apple/Epic, where the stock outperformed by 15 points in the 18 months following Epic’s first legal filing threatening App Store take rates in August 2020, and 2) USA vs. Google, where the stock has nearly doubled since the DOJ first announced its investigation into Alphabet’s search practices. Our point being, regulation/litigation is a greater longterm tail risk for Apple than it has been historically, but the underlying drivers of the stock for the foreseeable future will almost certainly be fundamentals-based, especially given this lawsuit might not be resolved until at least 2028 (or even 2030) based on past cases.

techcrunch.com