[ad_1]

Despite a relatively respectable return for bitcoin (BTC) of about 60% in 2021, shares of not just tech companies, but also of some of America’s largest banks and retailers, have outperformed the original cryptocurrency for the year.

According to data compiled from MicroStrategy’s overview of returns of different assets versus BTC, a total of 212 companies out of the 500 that make up the broad S&P 500 index, did perform better than bitcoin on a 12-month basis as of January 6.

Among the companies were several of the largest tech companies in the world, including Apple, Microsoft, and Google-owner Alphabet, the data showed. In addition, traditional retailers such as Home Depot and Costco, and financial institutions including Bank of America and JPMorgan, also outperformed BTC.

Out of these companies, the strongest return versus BTC was posted by Alphabet, which gained 46% in bitcoin terms and close to 65% in US dollar terms.

Apple, meanwhile, delivered returns of about 39% in USD, and 23% when using BTC as the baseline, leading Bloomberg TV anchor Joe Weisenthal to call Apple’s performance “just astounding.”

“It’s much bigger than Bitcoin, and delivering higher returns, with smaller drawdowns, and smaller swings overall,” he wrote.

Responding to him, however, Bitcoin proponent and Chief Strategy Officer at the Human Rights Foundation, Alex Gladstein, pointed out how different the two assets are, given that Bitcoin is an open network and Apple stocks can only be purchased through regulated brokerages with know-your-customers (KYC) checks in place.

“A shame that so few people globally can access Apple stock, though,” Gladstein wrote, adding:

“I’m very grateful we have a ~ trillion-dollar asset with similar performance over the last 12 months that anyone can obtain without regard to their nationality or identity.”

Index also beats BTC

And with many individual stocks outperforming BTC over the past 12 months, it is perhaps no surprise that the index as a whole also did better than the number one cryptocurrency.

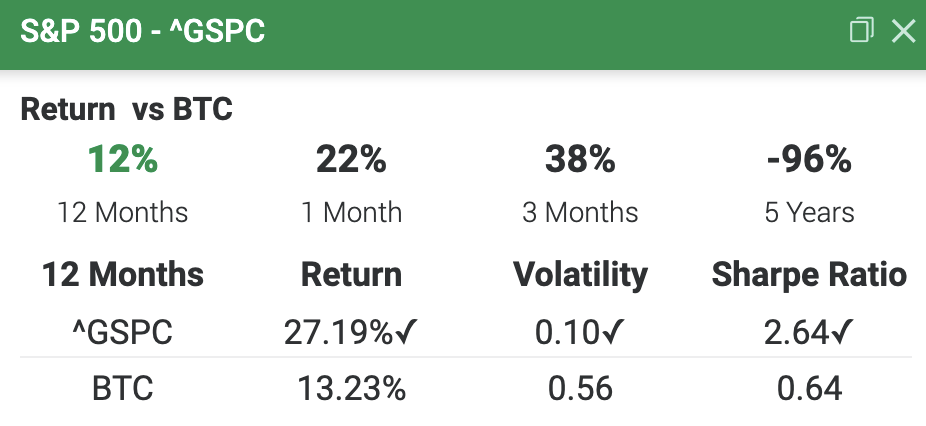

As of January 6, the S&P 500 index was up by 12% against BTC and 27% in US dollars on a 12-month basis. This means that even holding a common passive index fund – a popular piece in many people’s investment portfolios – would have generated better returns than bitcoin last year.

Important to note, however, is that the number of companies that saw better performance than the original cryptocurrency has grown in the days since December 31 due to a drop in the price of bitcoin since the end of last year.

Meanwhile, a report from late December from digital asset researcher BitOoda Research showed that the correlation between bitcoin and the S&P 500 over the past 60 days has remained fairly high at 17%.

The correlation with the stock market is generally higher for bitcoin than for other cryptoassets, with ethereum (ETH), binance coin (BNB), and solana (SOL) seeing only weak correlations of between 1% and 8%, according to the report.

This high correlation between bitcoin and stocks is in line with comments from Bitcoin advocates like Blockstream’s Chief Strategy Officer Samson Mow, who earlier this week said that bitcoin over the short-term behaves as a risk asset like stocks, although it “does its own thing” over longer time horizons.

As of January 6 at 13:57 UTC, the S&P 500 index has fallen by 1.4% since the end of 2021, while bitcoin has dropped by 6.6% over the same time period.

____

Learn more:

– Blame Fed and Leveraged Traders for This Crypto Seloff

– Bitcoin Could Reach USD 100K in Five Years If It Takes on Gold – Goldman Sachs

– Bitcoin and Ethereum Price Predictions for 2022

– USD 100K per Bitcoin ‘Hopium’ Now Moved to Mid-2022

– How Global Economy Might Affect Bitcoin, Ethereum, and Crypto in 2022

[ad_2]

cryptonews.com