[ad_1]

Apple just saw its highest-ever quarterly shipments in India in Q3. The numbers come as the country’s overall numbers remain flat. Between July and September, the Cupertino firm shipped more than 2.5 million iPhone units in India, analyst firm Counterpoint said on Wednesday. The record shipments marked a 34% year-on-year increase.

The iPhone 14 accounts for more than a third of iPhone sales in India in 2023, Counterpoint told TechCrunch.

Apple has a single-digit market share in India that has thus far failed to crack the top five, but the company has started drawing many customers as the world’s second-largest smartphone market has begun shifting toward premium models. The iPhone maker has also been bullish on the South Asian nation and is expanding its local manufacturing footprint in the country as it looks beyond China for production.

Last year, Apple had a 4.5% market share, which is expected to grow to 6% in 2023, Tarun Pathak, research director at Counterpoint, told TechCrunch.

“While overall smartphone shipments are likely to decline by 5% in 2023, Apple will grow by 38% in India,” he said.

Counterpoint said the country’s overall smartphone shipments remained flat in the third quarter. However, the market is “showing signs of recovery,” with consumer demand gradually picking up ahead of the festive season.

“We saw some interesting launches, with key features like 5G and higher RAM (8GB) diffusing to affordable smartphones (sub-INR 10,000, ~$120),” said Shilpi Jain, senior research analyst at Counterpoint. “India’s smartphone market will experience growth in the coming quarter due to pent-up demand, elongated festive season and faster 5G upgrades.”

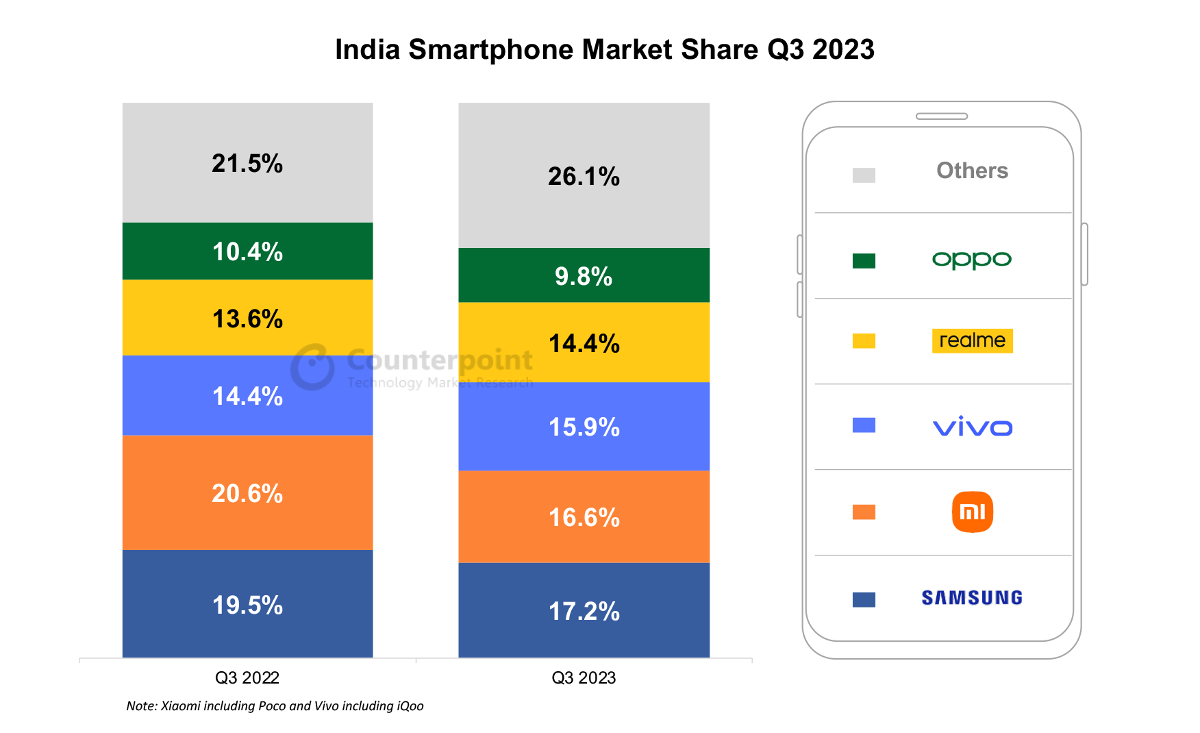

Samsung continued to be the biggest vendor in the market, with a 17.2% share, followed by Xiaomi’s 16.6% share. However, both Samsung and Xiaomi saw a decline in their shares from the same quarter last year, down from 19.5% and 20.6% share, respectively.

Image Credits: Counterpoint

Vivo emerged third in Q3, becoming the fastest-growing brand among the top five, with an 11% year-on-year growth. The Chinese company captured 15.9% of the total smartphone market, up from its 14.4% share in Q3 2022.

The shift toward premium models helped Vivo sibling and BBK Electronics subsidiary OnePlus become the top brand in the affordable premium segment (under $360–$540), with a 29% share. However, in the overall market, Transsion brands, including Infinix, Itel and Tecno, grew the fastest, with 41% year-on-year growth.

Nokia (owned by HMD) and Motorola both also experienced year-on-year growth during Q3, with Nokia at 31% and Motorola at 27%. Additionally, Realme and Google saw single-digit growth of 7% and 6%, respectively.

[ad_2]

techcrunch.com