[ad_1]

The major cryptocurrency exchange Binance will continue to dominate the bitcoin (BTC) futures market in 2022, with competition from FTX heating up. At the same time, more stringent regulations mean all centralized exchanges will be challenged by decentralized alternatives in the new year, crypto researcher Arcane Research has predicted.

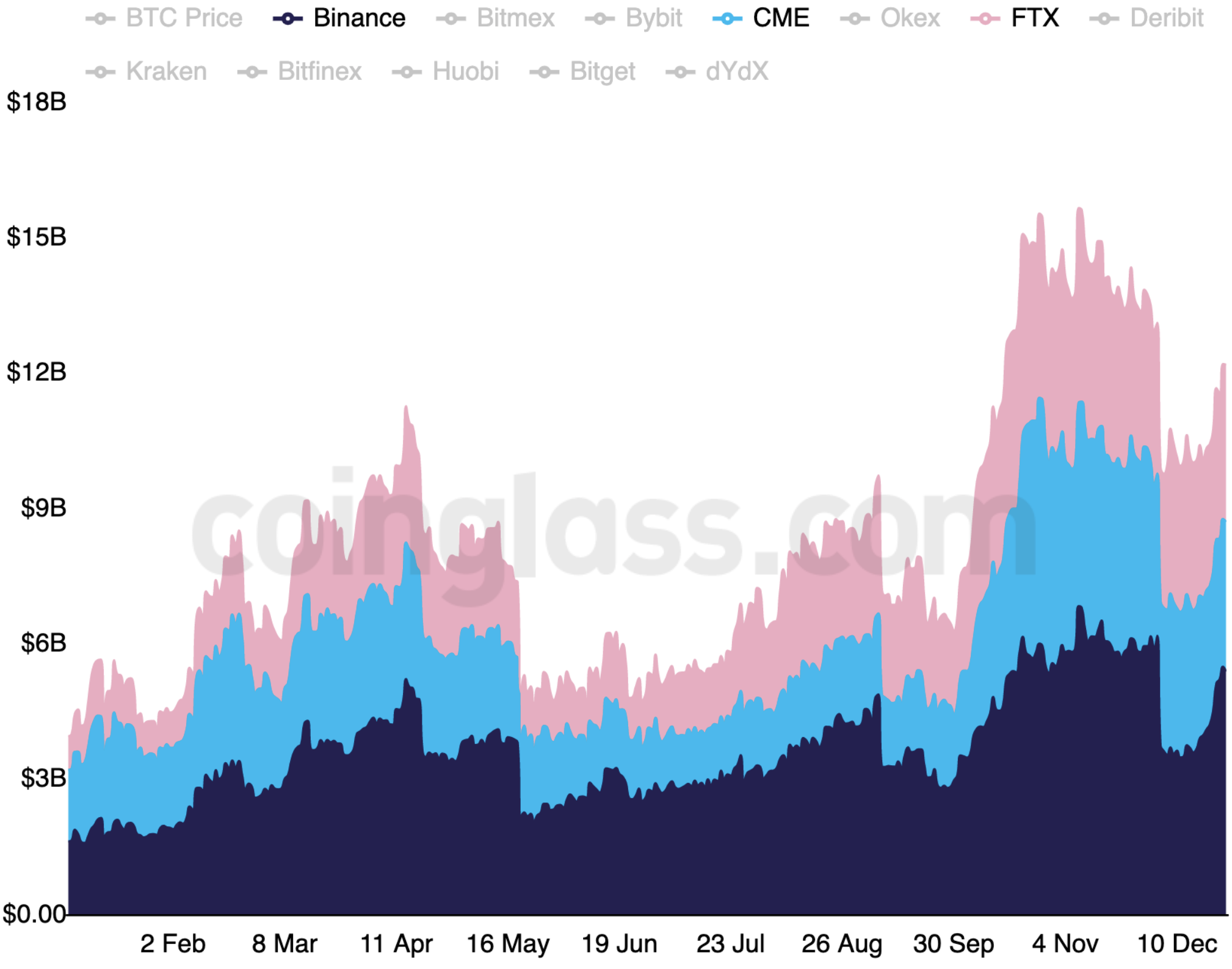

Activity in the market for bitcoin futures trading has undoubtedly been dominated by Binance over the past year, Arcane Research wrote in a new report. The exchange, which originally started as a spot-only exchange, was the largest bitcoin futures exchange by open interest for 308 days out of the 360 days covered, the report said, while also showing that the trend in market share has been up for Binance throughout the year.

But while the popular exchange is gaining market share from some competitors, others are putting up a fight. Most notable among these is FTX, which has seen its share of open interest in the bitcoin futures market grow throughout the past year.

Looking into the crystal ball for the next year, Arcane said that,

“Binance will maintain its position as the biggest bitcoin futures exchange by open interest,” but it will also “face fierce competition” from FTX.

After consistent growth in its market share throughout 2021, FTX’s market share of bitcoin futures trading has in December been almost identical with the more institutionally dominated Chicago Mercantile Exchange (CME), with both exchanges seeing from 15% to 20% of the overall open interest.

Bitcoin futures open interest on Binance, CME and FTX in 2021:

For 2022, Arcane predicted that this will be a year when derivatives trading on decentralized exchanges (DEXes) goes more mainstream, and attracts futures traders at the expense of the traditional centralized exchanges like Binance and FTX.

“The market will experience even more stringent regulation, making it challenging to maintain modus operandi as a free port for all who seek to trade with high leverage,” the report said.

It added that for this reason “decentralized derivatives exchanges will attract more traders, despite the associated protocol risk.”

Bitcoin options ‘critical signal’ for the market

In terms of the other major segment of derivatives space – the options market – Arcane said it has already grown significantly in importance.

“Option flows have become an increasingly critical signal from the market,” the report said, adding that some indicators from the options market are now widely used to assess the overall state of the bitcoin market.

The report further noted that the crypto derivatives exchange Deribit has cemented its position as the dominant marketplace for bitcoin options through 2021. Since the beginning of the year, the exchange’s share of open interest in the bitcoin options market has grown from 82% to more than 90% as of the end of December, the report said.

Looking into 2022, Arcane predicted that Deribit’s position will be challenged, with new competitors emerging from the legacy financial system, known in crypto circles as ‘TradFi’.

“Deribit will experience increased competition from tradfi venues,” Arcane’s report predicted.

____

Learn more:

– DEX vs. CEX Tokens: Who Performed Better This Year?

– DeFi Trends in 2022: Growing Interest, Regulation & New Roles for DAOs, DEXes, NFTs, and Gaming

– Slow Start for Third Bitcoin ETF, Lower Costs Could Attract More Capital

– Argentinian Futures and Options Exchange Readies Bitcoin Index Move

– Crypto Industry Insiders Share Top Ethereum, DeFi, Gaming, and TradFi Trends for 2022

– Bitcoin and Ethereum Price Predictions for 2022

[ad_2]

cryptonews.com