[ad_1]

- Bitcoin price extended decline towards USD 42,500.

- Ethereum dived to USD 3,300, XRP declined 9% and tested USD 0.72.

- BNB, SOL, and DOT are down over 9%.

Bitcoin price failed to recover and extended decline below USD 45,000. BTC even broke the USD 44,000 and USD 43,500 levels. It is currently (12:26 PM UTC) down 7% and is trading near USD 42,800.

Similarly, most major altcoins declined heavily. ETH traded below the USD 3,550 and USD 3,400 support levels. XRP even spiked below the USD 0.750 level. ADA is struggling to stay above the USD 1.20 level.

(Learn more: Selloff in Crypto Triggered by Hawkish Fed as Tech Stocks Drop Too)

Total market capitalization

Bitcoin price

After a bearish reaction, bitcoin price failed to stay above the USD 45,000 level. BTC traded below the USD 44,500 and USD 44,000 levels. It even spiked towards the USD 42,500 level. The next key support is near USD 42,000, below which the price could even test USD 40,000.

On the upside, an initial resistance is near the USD 43,800 level. The first major resistance is near USD 44,000, above which the price might test USD 45,000.

“For a few weeks now, we’ve been clearly in a downtrend and there are no signs of a decisive reversal in sight. However, striking similarities between the current price action and the market moves between mid-May and August do give reasons for cautious optimism in the medium term,” Mikkel Morch, Executive Director & Risk Management at crypto/digital assets hedge fund ARK36, said in an emailed comment.

According to him, a bounce to around USD 47,000 per BTC in the next few days could corroborate that thesis while further losses would largely invalidate it.

“In any case, only a clear break above USD 50,000 would signal a major reversal in the trend and investors should keep in mind the inherently volatile nature of the digital asset market,” Morch stressed.

Ethereum price

Ethereum price declined almost 12% and there was a strong move below the USD 3,500 level. ETH even broke the USD 3,350 level and tested USD 3,300. The next key support is near USD 3,250, below which the price could test USD 3,120.

An immediate resistance is near the USD 3,450 level. The next key resistance is near USD 3,500, above which the price might attempt a decent recovery wave.

ADA, BNB, SOL, DOGE, and XRP price

Cardano (ADA) is down over 9% and there was a clear break below the USD 1.22 level. The price is now struggling to stay above the USD 1.20 level. If there is a close below USD 1.20, the price might decline towards the USD 1.12 level.

Binance coin (BNB) is down almost 10% and there was a break below the USD 465 support level. It even tested the USD 455 support level. The key support is USD 450, below which there is a risk of a move towards the USD 432 level.

Solana (SOL) dropped almost 13% and the price declined below the USD 165 support. It is now consolidating near USD 145. A close below USD 150 might spark another decline towards the USD 132 level.

DOGE declined below the USD 0.162 support. The price even spiked below the USD 0.150 support before recovering. If the bears remain in action, the price could decline towards the USD 0.140 level.

XRP price gained pace below the USD 0.765 level. It even spiked below USD 0.75. It seems like the bears might test the USD 0.70 level. Conversely, the price may perhaps attempt a recovery wave towards the USD 0.780 level.

Other altcoins market today

Many altcoins are down over 15%, including LRC, ICP, AXS, EGLD, XTZ, VLX, THETA, RUNE, GALA, COMP, CRV, and NEXO. Out of these, ICP declined 19% and broke the USD 30 level.

To sum up, bitcoin bears gained strength for a move below the USD 43,500 level. If BTC fails to stay above USD 42,000, it could even test the USD 40,000 level.

_____

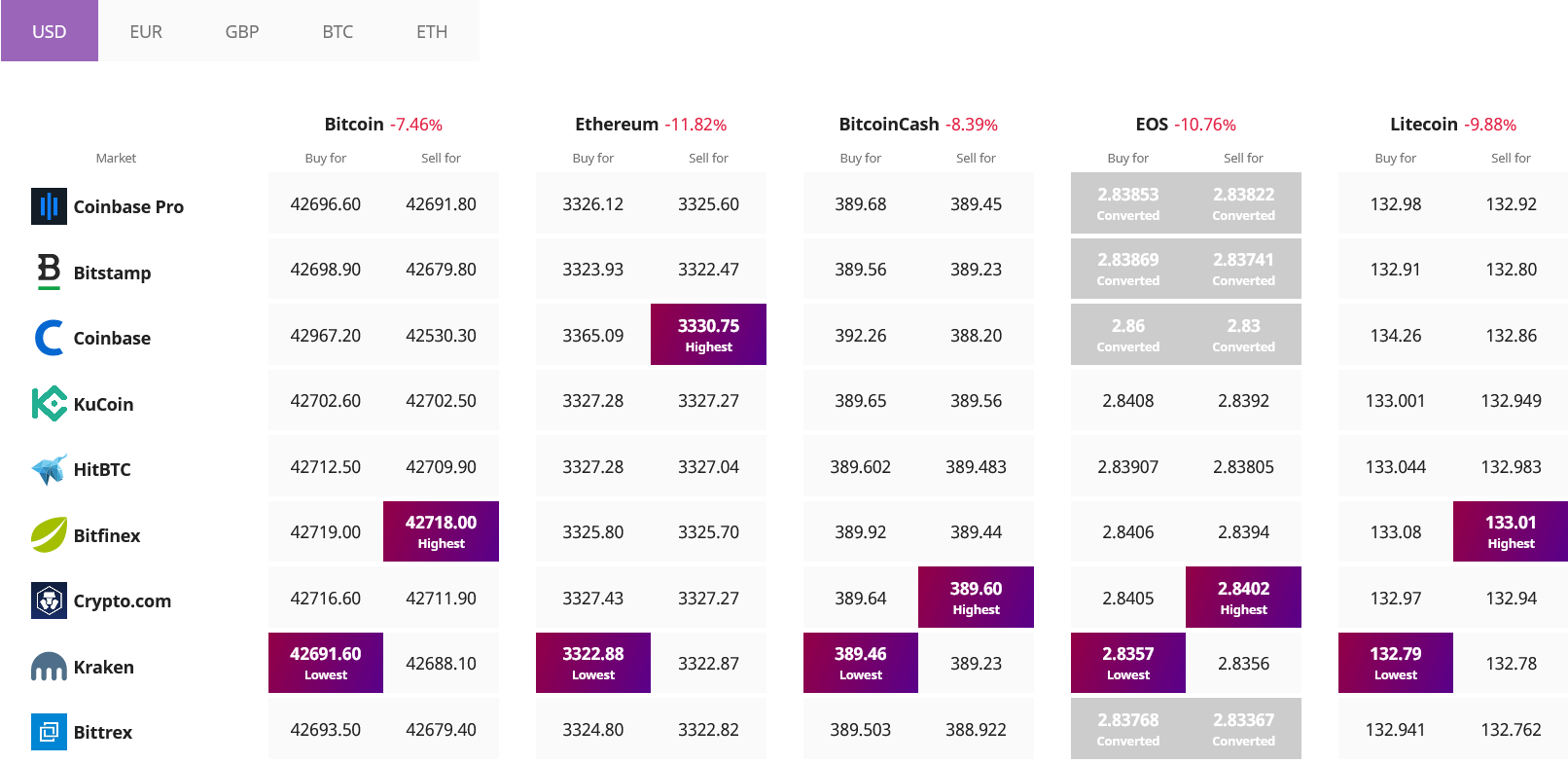

Find the best price to buy/sell cryptocurrency:

___

(Updated at 13:01 UTC with comments from Mikkel Morch.)

[ad_2]

cryptonews.com