[ad_1]

The total use of energy for Bitcoin (BTC) mining is “inconsequential,” and it is “rapidly becoming more efficient,” MicroStrategy CEO Michael Saylor said, as the mining industry is preparing for a hearing in the US House of Representatives this week.

Saylor was speaking during a quarterly briefing by the Bitcoin Mining Council (BMC) on Wednesday.

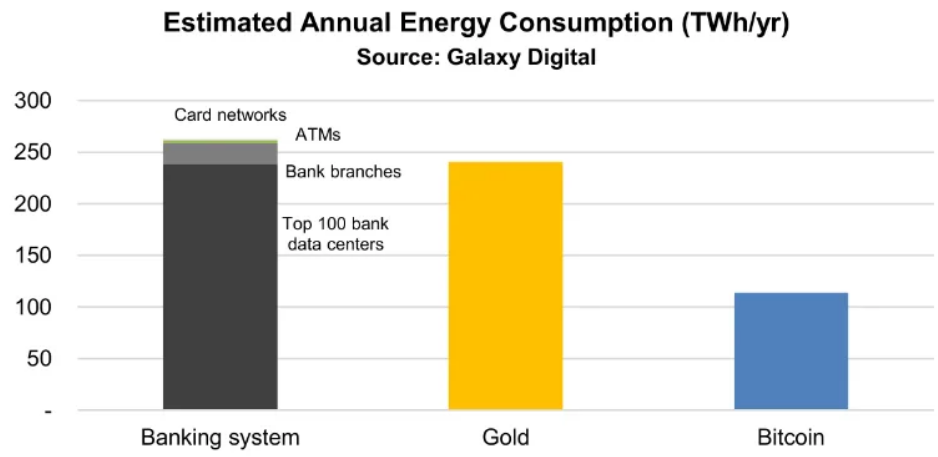

According to the CEO, the amount of energy Bitcoin is using makes up no more than “a rounding error” in other major industries, and is “negligible” when compared to total world energy usage.

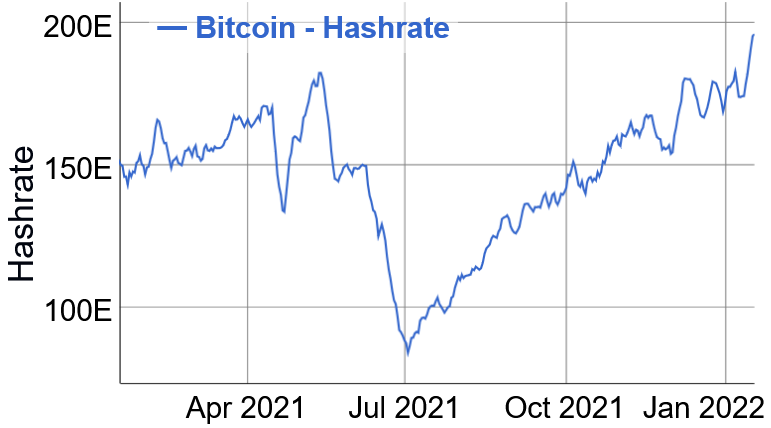

“Relative to the world-wide energy usage, [bitcoin] uses about 14 basis points,” Saylor said, noting that this is up over the past quarter given that Bitcoin’s hashrate, or the computational power, has “increased dramatically.”

Further, the prominent Bitcoin bull said that mining is not only very efficient in its current state, but stressed that it also keeps getting more efficient over time.

“It’s already the most cost-efficient major industrial user of energy in the world, it’s extraordinary in its efficiency,” Saylor said, adding that “the important point is it’s getting more efficient.”

In addition to Saylor, Coin Metrics co-founder and Castle Island Ventures general partner Nic Carter also joined the briefing. In his remarks, Carter focused on the recently published misleading memo prepared for an upcoming hearing in the US House of Representatives on the impact of crypto mining, saying the memo contains figures relating to e-waste from mining that “we know to be false.”

“The claim is that Bitcoin mining generated 30,000 metric tons of e-waste in 2021,” Carter said, adding that this is based on a paper that assumes a 1.29-year depreciation cycle for ASIC Bitcoin mining machines.

“[Bitmain’s S9 mining machines] represent 25% of the network hashrate, and that was an ASIC released in 2016,” Carter said, explaining that most mining firms use depreciation assumptions that are “much longer” than 1.29 years.

“We’ve seen in practice that ASICs generally have lasted far longer than most people expected,” Carter said, adding that the depreciation cycle nowadays “is probably more like 5 years effectively.”

Intel inside Bitcoin mining

During the online discussion, Michael Saylor also touched on the recent news that the major American chipmaker Intel might launch a new type of Bitcoin mining machine with greatly improved energy efficiency.

According to the CEO, Intel’s entry into the space has the potential to accelerate the energy efficiency of Bitcoin mining, calling it “indicative of the vitality of the network and a good thing overall.”

The new chip, which has been described as an “ultra-low-voltage energy-efficient Bitcoin mining ASIC,” is rumored to be unveiled during a company presentation on February 23, Cryptonews.com reported yesterday.

____

Learn more:

– Misleading Memo for US House Hearing on Bitcoin & Ethereum Mining Includes ‘Basic Errors’

– Bitcoin & Crypto Mining in 2022: New Locations, Technologies, and Bigger Players

– How Bitcoin Mining Might Help Nations With Domestic Energy Production

– A Closer Look at the Environmental Impact of Bitcoin Mining

– Bitcoin Miners Adapt Fast As EU Mulls ‘Climate-Friendly Cryptoassets’

[ad_2]

cryptonews.com