[ad_1]

Recent price action in Bitcoin showcases the asset’s volatility and susceptibility to market rumors. Earlier on Monday, Bitcoin surged from just under $28,000 to $30,000 in a matter of minutes.

This rapid climb was attributed to unconfirmed whispers on social media platforms that the US SEC had greenlit BlackRock’s iShares spot Bitcoin ETF application.

Cointelegraph was among the first to spread the word but hastily retracted its statements, underscoring the fragility of information in the crypto space.

For more details, see our coverage: Bitcoin Price Pumps From $28,000 to $30,000

CIBC’s Bold Take on US Economic Growth and Federal Rate Hikes

Contrary to prevailing market sentiments, the Canadian Imperial Bank of Commerce (CIBC) holds an optimistic outlook on the US economy.

Where most anticipate Federal Reserve passivity:

- CIBC foresees an uptick in its US growth projections.

- The bank challenges the consensus by predicting an extra Fed rate hike this year, going against the 8% and 30% market expectations for hikes in November and December, respectively.

Highlights from CIBC’s upcoming report:

- Predicts Q3 GDP’s jump from 2.5% to an impressive “nearly 4%.”

- Recognizes slowdown indicators, such as slowing bank lending and subdued housing activities. Yet, they maintain a positive stance.

- Emphasizes that strategic decisions by the central bank can prevent a major recession, eyeing potential rate reductions only by the second half of 2024.

On future rate decisions:

- CIBC points out that if long rates drop due to a missing fed funds hike in October, we might see another hike before 2023 wraps up.

- However, they have no plans to modify their BOC terminal rate forecast, believing current rates already strike the right growth balance.

Coming up next:

- The financial community is set to closely follow speeches by Williams and Chair Powell next week, searching for cues on the effects of longer-term yields on rate adjustments.

- Also, the FOMC’s blackout period starts next Saturday, intensifying the anticipation in financial circles.

CIBC’s optimistic stance on US economic growth and potential rate hikes could bolster BTC as investors seek hedging alternatives. Such economic shifts, paired with monetary policy adjustments, often drive cryptocurrency market sentiment and price dynamics.

Bitcoin Price Prediction

On October 16, Bitcoin (BTC) traded for $28,119, marking an impressive surge of nearly 4.5% in the past 24 hours. This upward movement is supported by a substantial 24-hour trading volume of $24.57 billion.

Bitcoin remains the uncontested leader in the broader cryptocurrency landscape, clinching the top spot with a robust market cap of $548.76 billion. Currently, the circulating supply of Bitcoin is 19.52 million, with its maximum limit set at 21 million BTC.

From a 4-hour chart view, Bitcoin’s pivot point is $27,690. On the upside, immediate resistance is observed at $28,465, followed by subsequent levels at $29,235 and $29,920.

Conversely, if the price faces downward pressure, immediate support can be found at $27,240, with the next notable support at $26,575.

As a general thumb rule in technical analysis, an RSI reading above 70 suggests overbought conditions, while a value below 30 signifies oversold conditions. An RSI above 50 leans towards bullish sentiment; conversely, below 50 indicates bearish sentiment.

The 50-day Exponential Moving Average (EMA) for Bitcoin is priced at $27,240. With the current price slightly above this level, it denotes a short-term bullish trend for the digital asset.

In conclusion, Bitcoin’s current trajectory appears bullish, particularly if it exceeds the pivotal $27,690 level.

Considering its current momentum and support levels, there’s potential for Bitcoin to challenge higher resistances in the upcoming sessions.

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the world of digital assets by exploring our handpicked collection of the best 15 alternative cryptocurrencies and ICO projects to keep an eye on in 2023.

Our list has been curated by professionals from Industry Talk and Cryptonews, ensuring expert advice and critical insights for your cryptocurrency investments.

Take advantage of this opportunity to discover the potential of these digital assets and keep yourself informed.

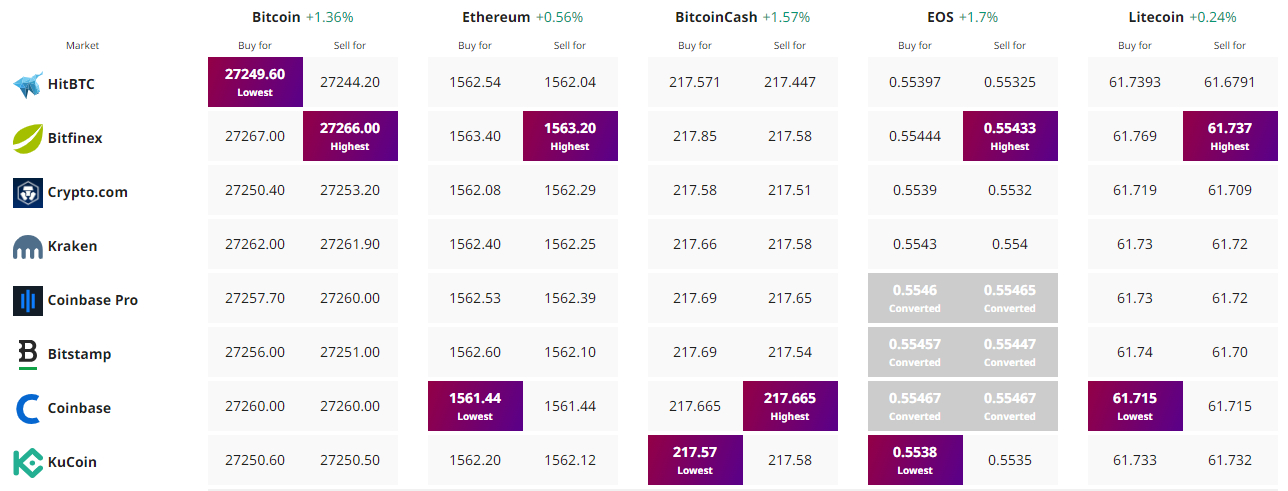

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

[ad_2]

cryptonews.com