[ad_1]

As the digital gold rush continues, Bitcoin remains at the forefront of the crypto landscape. Despite a recent hiccup where it struggled to breach the $28,000 threshold, dropping to $27,100 on Wednesday, enthusiasts remain optimistic.

The entire cryptocurrency market cap stands at a staggering $1.05 trillion, though it witnessed a dip of 1.50% in the past day. Currently priced at $27,100, Bitcoin’s modest uptick may find its roots in the subtle recovery of the US stock markets.

Furthermore, with the Lightning Network boasting a phenomenal 1,000% growth in just two years, the question on everyone’s lips is: Are we on the brink of a widespread Bitcoin adoption?

Moreover, investors are cautious and refrain from taking strong positions due to escalating global tensions.

Notably, the ongoing Israel-Hamas conflict is having a more severe impact than initially anticipated, potentially influencing the world economy. This could be seen as one of the key factors that kept the BTC price lower.

Bitcoin’s Lightning Network Records Massive Transaction Growth

According to a recent study by River, there has been a 1,212% surge in transactions on Bitcoin’s Lightning Network since August 2021. In August 2023, a total of 6.6 million transactions were recorded.

This significant growth can be attributed to various factors, with activities such as gaming, social media tipping, and streaming contributing to 27% of the overall increase.

Despite a 44% drop in Bitcoin’s price and a 45% decrease in interest, the growth of the Lightning Network has been impressive. It’s also worth noting that the average Lightning transaction size is around $11.84, enabling small payments over the internet.

River estimates that there are between 279,000 and 1.1 million monthly active Lightning users as of September 2023. Furthermore, the Lightning Network is becoming increasingly global, with consistent node, channel, and capacity growth.

However, custodial users still dominate the network, and making non-custodial options more attractive might require significant effort and investment. Thus, the news about the substantial surge in Bitcoin’s Lightning Network transactions clearly indicates its growing utility and adoption in the cryptocurrency realm.

While this might not trigger an immediate change in Bitcoin’s price, it presents a positive long-term outlook. It showcases how Bitcoin is expanding its real-world applications and enhancing its infrastructure, potentially drawing more investors in the future.

Revolutionizing Bitcoin Transactions with Smart Contracts

Another factor that has boosted Bitcoin is an exciting proposal by a developer. They have introduced a new idea in a white paper released on October 9, called ‘BitVM: Compute Anything on Bitcoin.’

This proposal, authored by Robin Linus of ZeroSync, aims to bring smart contracts to Bitcoin without altering its core rules, similar to Ethereum’s.

Hence, the proposal of ‘BitVM: Compute Anything on Bitcoin’ can positively influence Bitcoin’s price by expanding its utility and competitiveness with smart contracts, potentially attracting more interest and investment.

US Economic Strength: Potential Positives for Bitcoin

On a positive note, the recent robustness of the US economy, as demonstrated by an unexpected addition of 336,000 jobs in September, could be advantageous for Bitcoin (BTC). Lucas Kiely, the chief investment officer at Yield App, interprets this as a favourable sign.

Even with the Federal Reserve’s move towards stricter monetary policies, the economy continues to expand, a fact underscored by the employment data.

Should the decline in the bond market stabilize, it could augur well for higher-risk assets like Bitcoin. Concurrently, regulatory decisions, especially the potential approval of a Bitcoin exchange-traded fund (ETF), have a profound influence on Bitcoin’s short-term pricing. An endorsement for such an ETF could lead to an influx of Bitcoin investors.

Moreover, the Federal Reserve’s decisions remain pivotal. A halt in interest rate hikes could catalyze a surge in several assets, cryptocurrencies included.

In essence, the overarching economic landscape and regulatory determinations are crucial in shaping the trajectory of Bitcoin’s value and the broader cryptocurrency market.

Bitcoin Price Prediction

On October 11, BTC/USD showcased its technical standing on a 4-hour chart, trading at $26,780. The pivotal point for this cryptocurrency pair is marked at $27,000.

For resistances, immediate levels to monitor stand at $27,300, followed by $27,745, and extending up to $28,280.

On the downside, BTC/USD finds its immediate support at $26,414, with subsequent supports at $26,186 and $25,989.

As Bitcoin maneuvers around these key price levels, investors and traders will be observing its movement keenly, especially around the pivot point, to gauge the potential future direction.

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the world of digital assets by exploring our handpicked collection of the best 15 alternative cryptocurrencies and ICO projects to keep an eye on in 2023.

Our list has been curated by professionals from Industry Talk and Cryptonews, ensuring expert advice and critical insights for your cryptocurrency investments.

Take advantage of this opportunity to discover the potential of these digital assets and keep yourself informed.

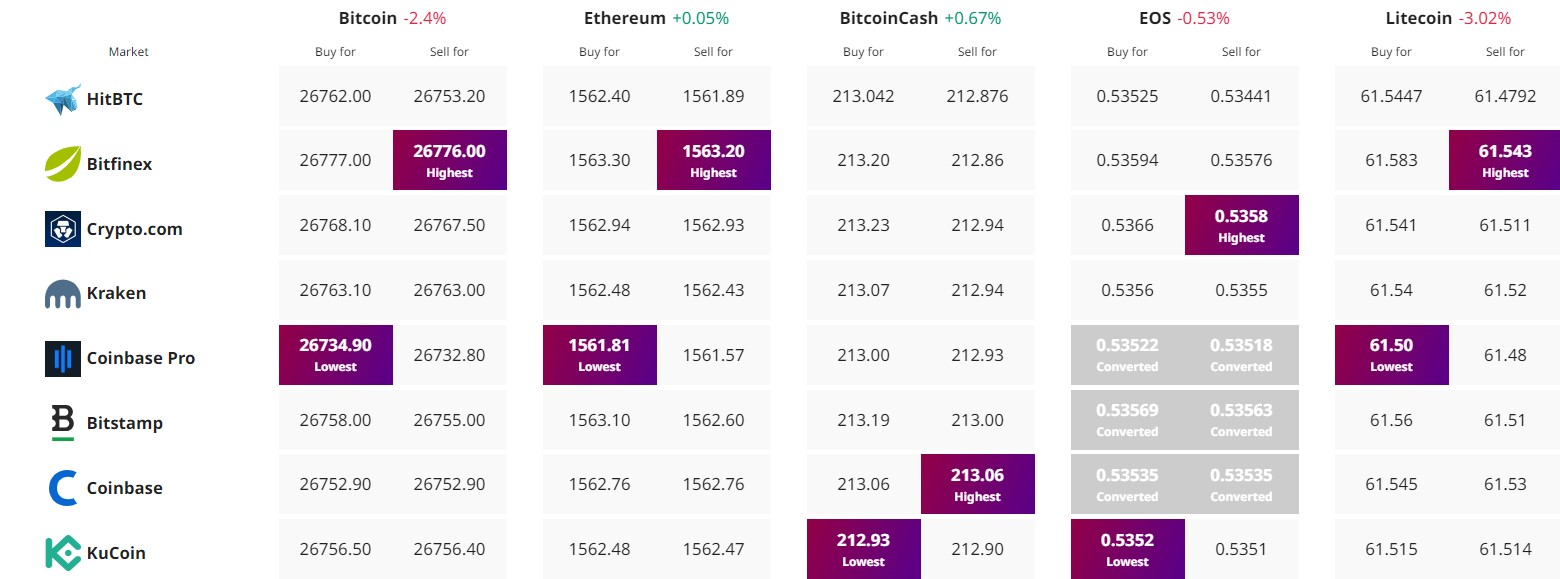

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

[ad_2]

cryptonews.com