[ad_1]

Traders bid the price of bitcoin (BTC) up strongly in the market today even before a new Executive Order by US President Joe Biden laid out plans for what was seen as a positive approach to digital assets. Also, an improved sentiment sent US stock futures higher, helping BTC too.

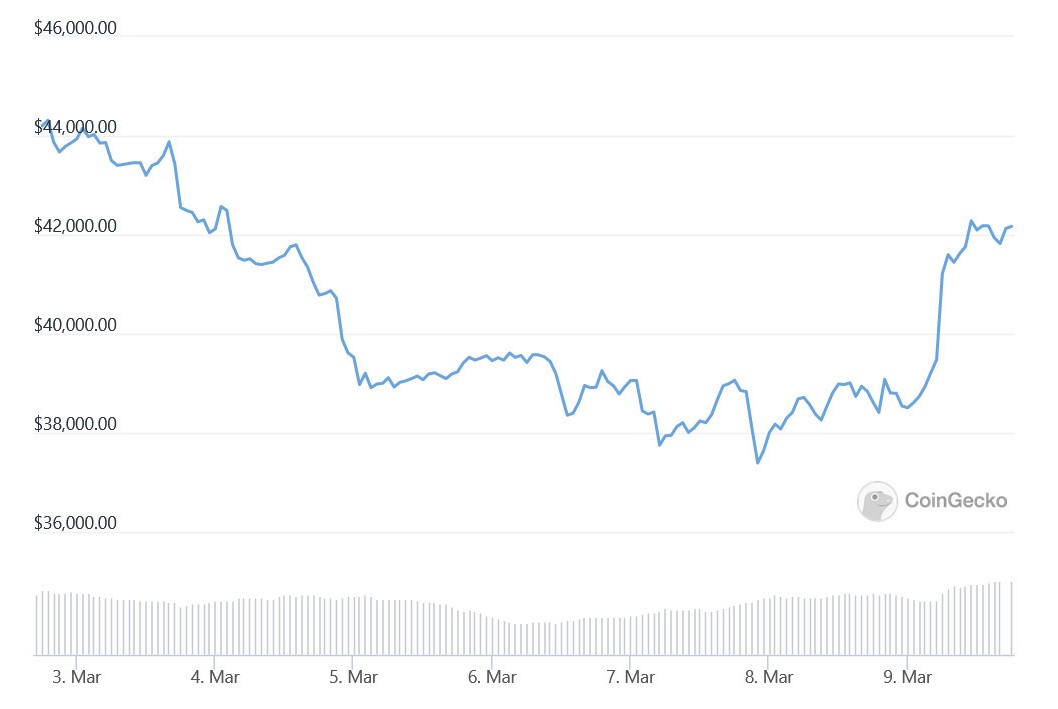

The gains at the time of writing (14:20 UTC) sent the price of bitcoin up more than 8% for the past 24 hours, reaching a high for the day of just over USD 42,500 before a slight retracement began. The price is still down around 5% in a week.

The rise in the price of bitcoin happened even before the Biden administration announced their highly anticipated Executive Order on digital assets, which observers generally described as supportive of innovation.

According to Jeremy Allaire, co-founder and CEO of crypto payments company Circle, the order was “a watershed moment for crypto” in the US, while FTX CEO Sam Bankman-Fried called it “a constructive [Executive Order] to discuss customer protection and economic competitiveness in digital assets.”

Supporting the rising bitcoin price, US S&P 500 stock index futures also pointed to a strong opening on Wall Street. At the same time, gold fell back from its high of USD 2,070 yesterday, trading just under the key USD 2,000 mark at the time of writing (14:20 UTC).

The gains for the stock market today followed heavy losses earlier this week, with the war in Ukraine, sanctions, and sharply rising energy prices weighing on investors’ sentiment.

The gains today also come ahead of US inflation data for February set to be released tomorrow. Analysts expect the consumer price index (CPI) to come in at 7.9% year-over-year, up from 7.5% the month before, which already marked the highest inflation rate in 40 years.

Commenting on the current state of the bitcoin market, Travis Kling, founder & chief investment officer of the crypto-focused asset manager Ikigai, said that there has been “significant demand” for BTC in the low USD 30,000 region since last summer.

He added that the group that still holds BTC at the current level is “weighted more heavily toward idealistic bulls,” while identifying USD 38,000-39,000 as “an important level” for the coin.

“Unequivocally, the value proposition for Bitcoin has become more compelling in the last month, not less,” Kling said.

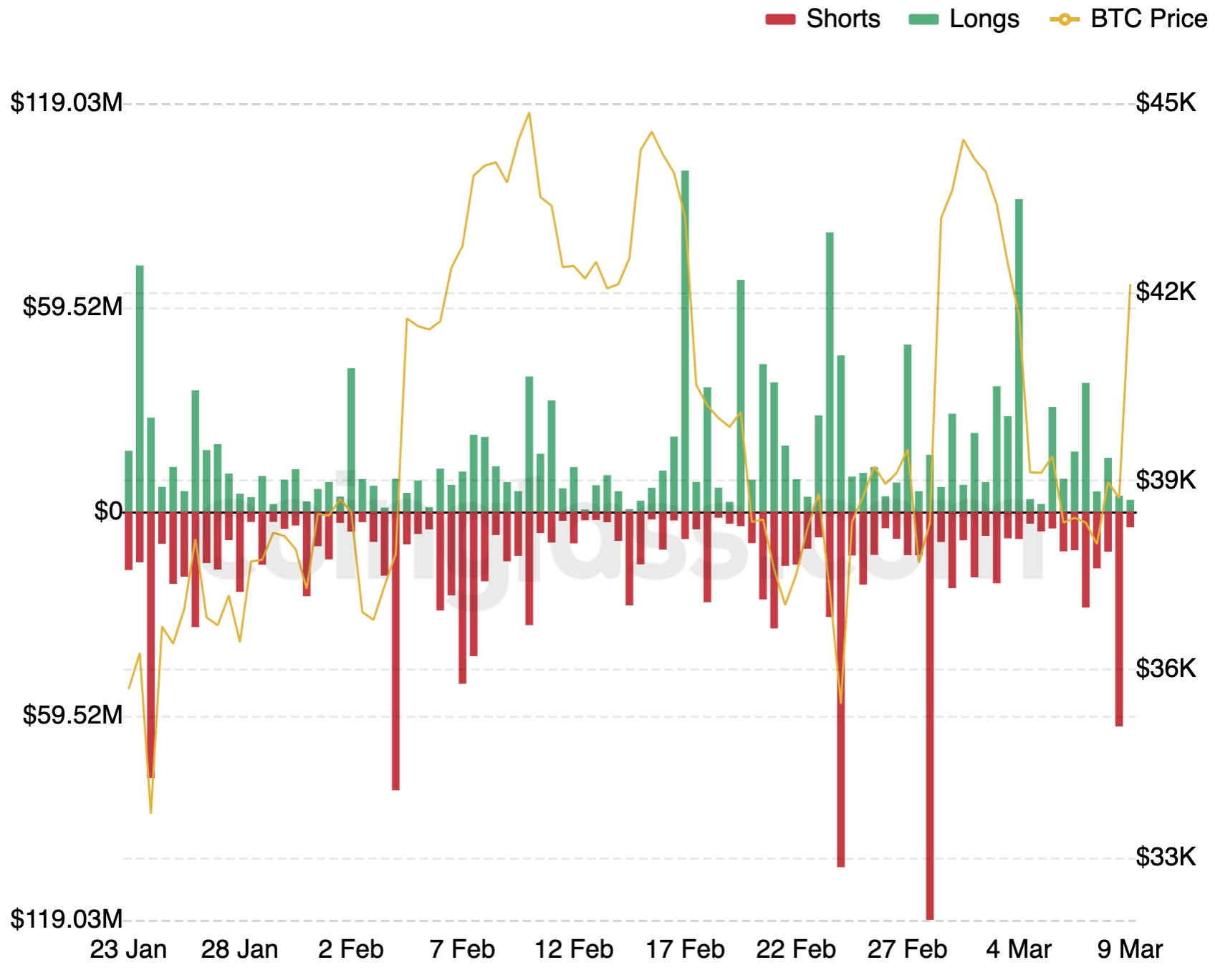

Not surprisingly, a strong rise in the price of bitcoin over the past 24 hours led to a flurry of liquidations of traders who held leveraged short positions in bitcoin futures contracts.

According to data from Coinglass, USD 62.67m worth of BTC short positions were liquidated across exchanges between midnight and noon UTC time on Wednesday, as the price of bitcoin spiked.

For the entire crypto market, short liquidations reached USD 115m, with nearly 44% of the liquidations seen on the OKX exchange.

Bitcoin futures liquidations per 12 hours:

According to Marcus Sotiriou, an analyst at the UK-based crypto broker GlobalBlock, the rally can partly be explained by traders buying back into BTC after selling earlier in anticipation of President Biden’s Executive Order on crypto.

“As many investors had prepared for the downside risks of this event by waiting on the sidelines, we are seeing many buy bitcoin back in what appears to be a spot-driven rally,” Sotiriou said in emailed comments.

A similar sentiment was also shared by Bitfinex’s trading team, which said in a commentary shared with Cryptonews.com that Biden’s order was seen as “constructive” by the market.

“Bitcoin is leading the cryptocurrency market higher after US Treasury Secretary Janet Yellen’s early publication of statements revealing that President Joe Biden plans to take a constructive approach in regulating the digital token space,” they said.

The traders added that the market has “clearly been heartened” by talks of supporting innovation in the US, and said the approach to regulating crypto in the country looks “constructive.”

___

Learn more:

– Three Predictions for Crypto Regulations in 2022

– Correlation Between Bitcoin and Traditional Markets Might Break This Spring – Pantera

– Russia Sanctions Means Countries May Transition to Bitcoin Reserves – Pantera’s CEO

– ‘Far More Bearish’ Survey Predicts Doubling of Ethereum Price This Year

[ad_2]

cryptonews.com