[ad_1]

The selling pressure witnessed in the Bitcoin (BTC) market that drove the price to lows of $29K happened as high supply returned to crypto exchanges.

Market insight provider Santiment explained:

“Exchanges have seen a massive 0.52% of Bitcoin’s supply returning to exchanges in just a week. With high volatility and polarizing perspectives toward BTC during this pullback, this is the fastest rise of supply returning to exchanges in 16 months.”

Source: Santiment

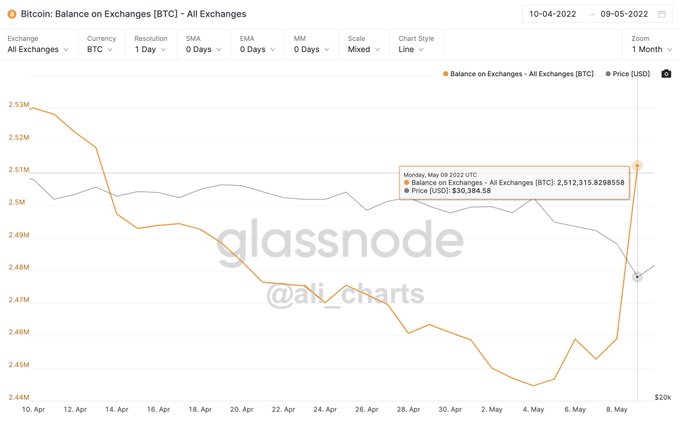

Crypto analyst Ali Martinez echoed similar sentiments and stated:

“Data shows that more than 53,000 BTC have been deposited in known cryptocurrency exchange wallets in the last 24 hours.”

Source: Glassnode

Coins are usually returned to exchanges for liquidation purposes. Therefore, it is bearish because it increases selling pressure.

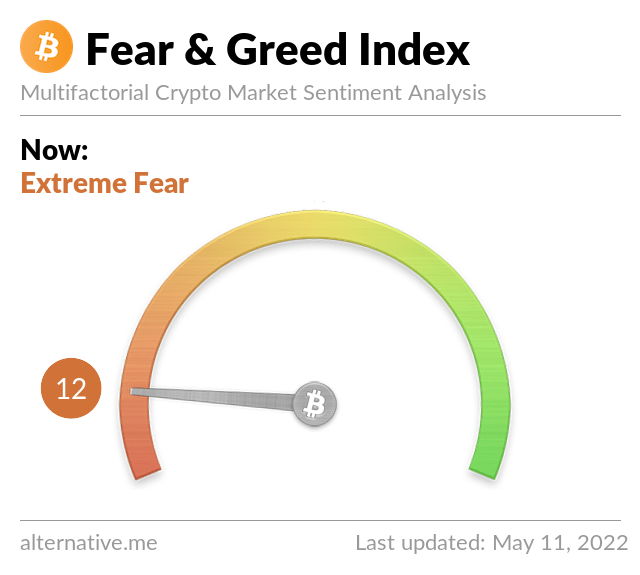

Bitcoin continues to hover in the extreme fear territory

According to the Bitcoin Fear & Greed Index, the leading cryptocurrency is in the extreme fear zone of 12.

Source: Bitcoin Fear and Greed Index

The Bitcoin Fear and Greed Index ranges from 0 to 100 and shows the extent of fear and greed in the BTC market. Time will tell how BTC will play out in the short term because events of extreme fear are usually followed by bullish momentum.

The price drop in the BTC market might be caused by a risk-off approach triggered by Fed’s interest rate hike, according to Darshan Bathija, the CEO of Singapore-based crypto exchange Vauld. The increase in interest rate by 0.5% was the largest in twenty-two years.

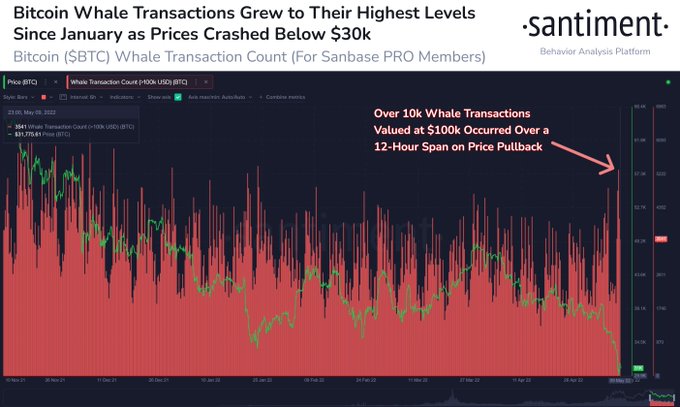

BTC Whales accumulation goes a notch higher

Bitcoin whales took advantage of the slip below $30K by increasing their holdings.

Santiment pointed out:

“There is clear evidence that Bitcoin whale addresses are viewing yesterday’s drop below $30k as an event to accumulate. Santiment feed saw the highest amount of transactions exceeding $100k since January, and their supply of BTC held is rising again.”

Source: Santiment

Bitcoin was down by 3.32% in the last 24 hours to hit $30,797 during intraday trading, according to CoinMarketCap.

Image source: Shutterstock

[ad_2]

blockchain.news