[ad_1]

As the new week began, crypto market sentiment dropped, the bitcoin options key metric suggested that more traders were taking bullish bets, BTC then consolidated as the US Fed started a two-day meeting, and went up following the Fed rate hike. ETH outperformed BTC following news that a final testnet went through the steps necessary for Ethereum transitioning to PoS, XRP pumped and dropped after what the CEO saw as a ‘huge win’ for Ripple, and the NFT market outperformed the broader crypto market this year. As this was happening, the market capitalization of gold-backed tokens crossed USD 1bn following the start of the Ukraine war. Elon Musk said that he won’t be selling his BTC, ETH, and DOGE, and Terra CEO agreed to a large bet with a Twitter user that the price of LUNA will stay above USD 88 in a year. Bored Ape Yacht Club and MetaMask confirmed plans for tokens and DAOs.

Binance and FTX expanded to the Arab Gulf States with new licenses, HSBC became the first global financial services provider to enter the virtual world The Sandbox, Instagram might start supporting “some” NFTs “over the next several months”, and speaking of NFTs, three winners solved Larva Lab’s puzzle and got a Meebit and ETH 0.025. South Korean gaming firms are looking to emulate Axie Infinity P2E gaming success with heavyweight Neowiz set to drop a new crypto golf gaming title, while a DAO bought a South Korean national treasure – in what represents a remarkable first for the nation’s culture and crypto sectors.

Amid the invasion by Russia, Ukraine’s President Volodymyr Zelenskyy signed off on a new law that will bring cryptoassets under a legal umbrella. The Ukrainian government is set to launch an NFT collection as a ‘war museum’, and the Ministry of Digital Transformation with FTX and Everstake launched a crypto fundraising site. The FSA and Japanese Ministry of Finance told domestic crypto exchanges to suspend all transactions with Russians and Belarusians who have been hit with international sanctions, Elliptic claimed they made a breakthrough in the search for the Russian crypto sanctions evaders, while an MP claimed that Russia has ‘all the resources’ it needs to create its own crypto infrastructure, and an ex-central bank exec said that sanctions imposed on Russia may lead more countries to consider CBDCs. Meanwhile, the war in Ukraine may cause disruption to El Salvador’s bitcoin-bond-related plans, Arthur Hayes said that the world’s monetary regime ended with the freezing of Russian foreign reserves by Western governments, and the Internet Computer founder had a proposal to ‘hasten the end’ of the Ukraine War.

In regulation news, the UK’s NCA called on the country’s authorities to regulate decentralized crypto mixers, but Samourai Wallet defended the need for CoinJoin while Wasabi already moved to bar some bitcoin transactions. The ECON rejected a suggestion that could ban PoW consensus protocols such as Bitcoin and Ethereum in the EU, but the European Union still has its sights set on the miners. People’s Bank of China updated its pilot digital yuan app while the police dealt with their first-ever CBDC ‘fraud’ case. Meanwhile, the Fed raised interest rates by 25 basis points in its first rate hike since 2018, and a person in the case involving the IRS’s alleged attempt to refund a tezos staking tax bill pushed for a “definitive ruling” that may change the way staking is taxed in the US. Also, the Argentinian Senate passed a USD 45bn IMF debt deal that discourages crypto use in this country.

Here’s your very carefully and much manually selected assortment of crypto jokes.

__________

First, the memeing intro.

__

Hey, CT, all good? What’s on your mind?

__

On baning stuff. And things.

__

Any thoughts on stablecoins this week, CT?

__

Time to check up on BTC too.

__

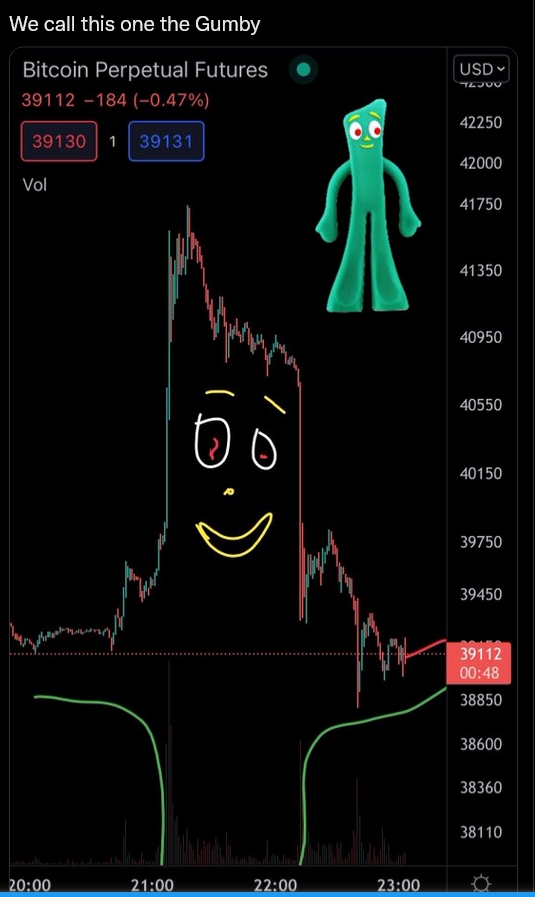

Could we have a technical analysis on this, please? Ta.

__

Here’s a question…

__

A theoretical approach to Bitcoin with practical examples.

__

Good job, Jery.

__

The vast power of signs.

__

‘Who are you calling delulu?’

__

Someone’s always watching. And that someone’s usually the bear.

__

Contemporary flexing.

__

At least it’s a famous meme…

__

The man was never the same again. Nothing was.

__

And you thought last year was weird.

__

Excellent time to come back from the future.

__

Another tax conundrum.

__

Goddamnit, Karen! You’re missing the whole point, Karen!

__

An expert commentary on the recent BTC price moves.

[ad_2]

cryptonews.com