Identification requirements, high fees and a language gap have long been barriers to preventing some Latino immigrants from opening a banking account in the United States. Comun wants to change that.

The New York-based neobank is the latest to provide banking services customized to the needs of immigrants. While most traditional banks require customers to have a U.S. Social Security card or proof of address, for example a mortgage or utility bill, Comun enables its customers to apply for an account using 100 different identification types from Latin America, including foreign country passports.

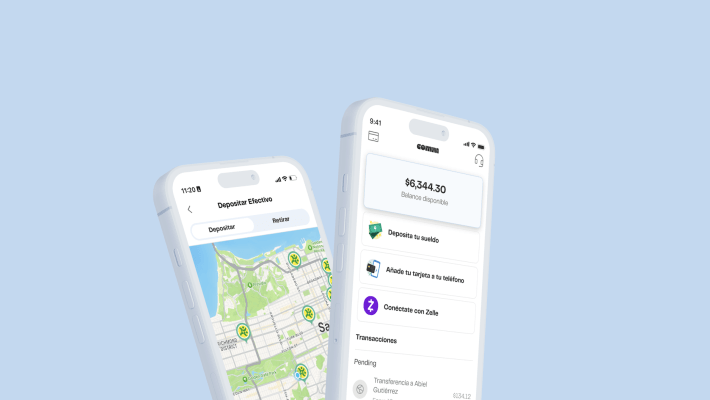

Andres Santos and Abiel Gutierrez started Comun in early 2022 to offer digital banking services, including instant payments, check deposits and early paychecks. They also wanted to provide customers with access to native Spanish-speaking reps seven days a week.

“Our mission is to bring back local banking to immigrants in the U.S.,” Santos told TechCrunch. “We think that is a model that has been dying at alarming rates over the last 30 years. You’ve basically seen ‘too big to fail banks’ taking most of the share and going from 20,000 banks to less than 5,000 banks.”

Abiel Gutierrez and Andres Santos, co-founders of Comun. Image Credits: Comun

Santos also explained that during that time, some banks have thought about immigrants. However, that group typically doesn’t fit the model of a potential customer to go after, so they get left behind.

Comun wants to “reimagine what local banking looks like in the digital arena, and that means community and the unique needs of our community to better serve them with winning products,” he added.

The bank makes money from interest on deposits and also convenience fees for facilitating instant transactions, similar to peer-to-peer transactions. It also launched a direct banking integration in the past month that Santos said is growing fast and “already driving around 25% of our revenue and volume.” Comun will also collect fees from transactions once it opens up a remittance program it is piloting that enables immigrants to send money from the U.S. to Latin America.

Comun isn’t alone in targeting immigrants. It joins companies like Tanda, Bloom Money, Majority, Welcome Tech and Pillar in solving the bank accessibility problem.

It also joins them in attracting venture capital for its approach. Today, Comun announced another $4.5 million in funding to give it $9 million raised in total. The latest investment was led by Costanoa Ventures with participation from a group of existing investors, including Animo Ventures, South Park Commons and FJ Labs.

In addition to offering the various identification methods for opening accounts, the company differentiates itself from its competitors through its partnership with Community Federal Savings Bank. By having a direct relationship with the bank, Comun is able to add new services quickly and in compliance, Santos said.

Comun is also developing a large network of partners to support cash deposits and withdrawals with more than 90,000 physical locations.

The concept has caught on. Not only has the bank achieved a net promoter score (NPS) of 86, which is over four times the industry average in terms of customer satisfaction, but Comun is experiencing 60% month over month revenue growth. It has processed over $75 million through its platform.

Santos and Gutierrez plan to use the new funds to hire additional employees to scale Comun’s banking services and launch new products, including insurance and eventually going into credit and underwriting.

techcrunch.com