[ad_1]

Get your daily, bite-sized digest of cryptoasset and blockchain-related news – investigating the stories flying under the radar of today’s crypto news.

__________

Investments news

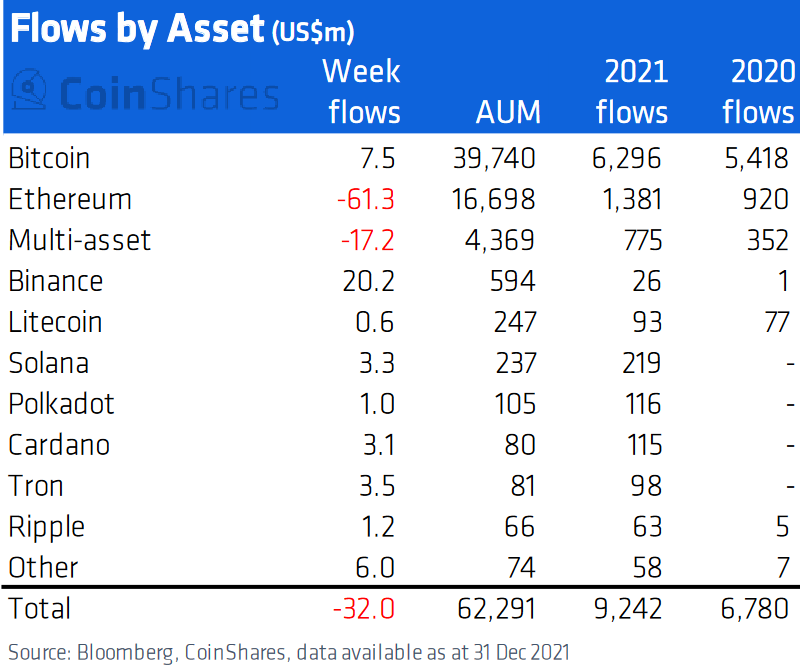

- In the final week of 2021, digital asset investment products saw a third week outflows totaling USD 32m, with the trend suggesting diminishing outflows following the record weekly outflows mid-December, per CoinShares data. Total outflows for the 3 weeks now total USD 260m 0.4% of assets under management (AuM). Meanwhile, total flows reached USD 9.3bn in 2021, a 36% increase from 2020. “While the increase from 2019 to 2020 was significantly higher at 806%, we believe this represents a maturing industry, with total AuM ending the year at USD 62.5m in 2021 versus just USD 2.8bn at the end of 2019,” CoinShares said.

- Binance Labs, the investment arm of crypto exchange Binance, announced it has led a USD 12m Series A investment round in liquidity provider WOO Network. The investment should be used for their expansion through talent acquisition, research and development, and the development of new decentralized products.

- Asset manager Grayscale Investments announced the updated Fund Component weightings for each product in connection with their respective quarterly reviews, which they adjusted by selling certain amounts of the existing Fund Components in proportion to their respective weightings and using the cash proceeds to purchase Amp (AMP). As a result of the rebalancing, Bancor (BNT) and Universal Market Access (UMA) have been removed from the CoinDesk DeFi Index and the DeFi Fund.

- Software company WonderFi Technologies announced it has entered into a definitive agreement to acquire First Ledger Corp., the parent company of crypto exchange Bitbuy. The acquisition and integration will establish WonderFi as an end-to-end consumer platform for people seeking access to crypto and DeFi, they said.

Regulation news

- The US Commodity Futures Trading Commission (CFTC) fined crypto predictions service Polymarket USD 1.4m, ordered it to shut down its various markets, and offer users full refunds. The crypto project did not seek a Designated Contract Market (DCM) or Swap Execution Facility (SEF) registration, two requirements under the Commodity Exchange Act for companies offering binary options in the US, the CFTC said.

- The European Securities and Markets Authority (ESMA) is seeking submissions from stakeholders on the use of blockchain technology in the settlement and trading of tokenized securities, and whether existing rules need to be amended to be effective for securities traded using distributed ledger technology (DLT). The agency’s “DLT Pilot”, expected to commence early 2023, will explore how data stored on a blockchain could enable more efficient, secure, and cost-effective trading and settlement of securities.

DEXes news

- The Uniswap (UNI) protocol will cross USD 1trn in cumulative volume during 2022 with its current 1-2m users, Hayden Adams, inventor of the protocol, said. According to him, as centralized exchanges currently have a hundredfold bigger user base, there is “plenty of room to grow”.

Career news

- The Federal Reserve Bank of Boston is on the hunt for a new director of product management for Project Hamilton, its ongoing central bank digital currency (CBDC) pilot program, according to an online job posting. The new director will work to help build, manage, and test software to further the bank’s understanding of digital currency and continue their efforts to build a “hypothetical general purpose digital currency.”

Mining news

- The Kosovan Ministry of Economy said it has decided to ban crypto mining in the country as part of a set of emergency measures to handle an ongoing energy crisis. The statement further adds that all “relevant institutions” will have to identify physical locations of cryptocurrency mining operations and prohibit the activities.

- Two of the largest publicly-traded Bitcoin (BTC) miners, Bitfarms and Marathon Digital, have produced BTC 3,452 and BTC 3,197 respectively in the past year. Bitfarms’ total holdings grew to over BTC 3,300 as of the end of the year, worth USD 151.8m at current prices, while Marathon’s holdings increased to BTC 8,133, worth roughly USD 375.8m.

- Mining solutions provider Canaan announced the deployment of another 8,000 Avalon Miner units in Kazakhstan, as part of its joint mining operations in the country. They add that a total of 10,300 units of the Avalon Miners are fully operational and have begun mining bitcoin.

Security news

- Decentralized trading platform Tinyman was hit by a smart contract exploit on January 1, which has cost them more than USD 3m in funds. “Due to the permissionless nature of the project,” they mentioned that they could not obstruct any kind of transaction on the blockchain, and that any funds lost after January 4, 9am UTC, would be the responsibility of the users who have not removed their liquidity.

DeFi News

- Decentralized finance (DeFi) platform Dot Finance announced its migration to smart contract platform Moonbeam’s parachain and its immediate integration on Moonriver, Moonbeam’s canary network on Kusama (KSM). The first part of the migration process will involve taking Dot Finance’s yield aggregation contracts and adapting them for Moonriver, they added.

NFTs news

- Crypto data aggregator CoinGecko has released a book titled “How to NFT”, providing an overview of the non-fungible token (NFT) asset class. The book covers topics such as the history of NFTs, how to create, buy and sell them, how to avoid common scams, and of which segments the NFT industry consists.

[ad_2]

cryptonews.com