[ad_1]

Sentiment among traders and investors in the crypto market saw a slight drop this week, with volatile and ‘choppy’ markets in recent days and weeks frustrating traders who are looking for clear trends.

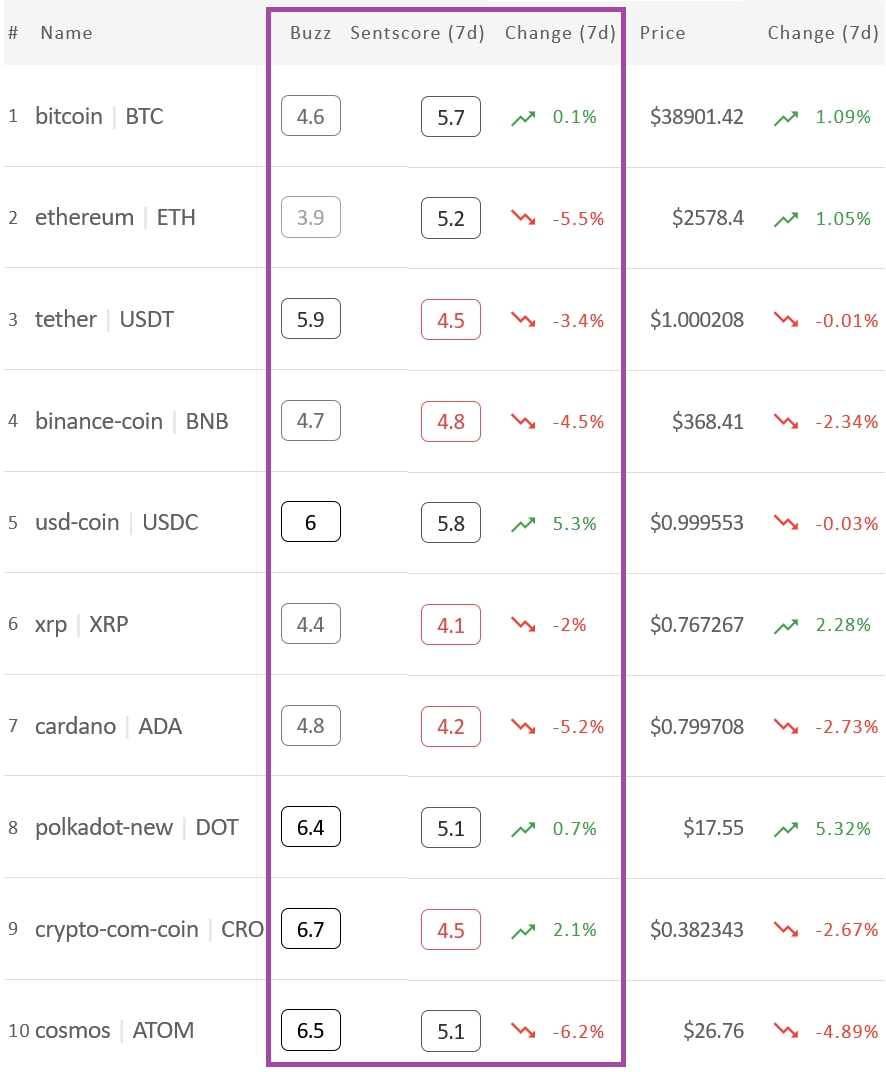

According to data from the market sentiment analysis service Omenics, the average 7-day sentscore for 10 major cryptos dropped to 4.9 this week, down from 5.02 last week, but still up from the 4.7 seen two weeks ago.

The stablecoin USD coin (USDC) came in on top this week with a sentscore of 5.8, just above bitcoin (BTC) with its sentscore of 5.7, and ethereum (ETH) with a score of 5.2.

The strong sentiment for USDC this week marks a further increase from 5.6 last week when USDC had the second-strongest sentiment after BTC. The sentiment around the number one crypto, meanwhile, was unchanged from last week.

Like last week, all of the top 10 coins tracked by Omenics this week had sentscores that the company considers neither positive nor negative.

Sentiment change among the top 10 coins*:

Interpreting the sentscore’s scale:

– 0 to 2.5: very negative

– 2 to 3.9: somewhat negative zone

– 4 to 5.9: neutral zone

– 6 to 7.49: somewhat positive zone

– 7.5 to 10: very positive zone

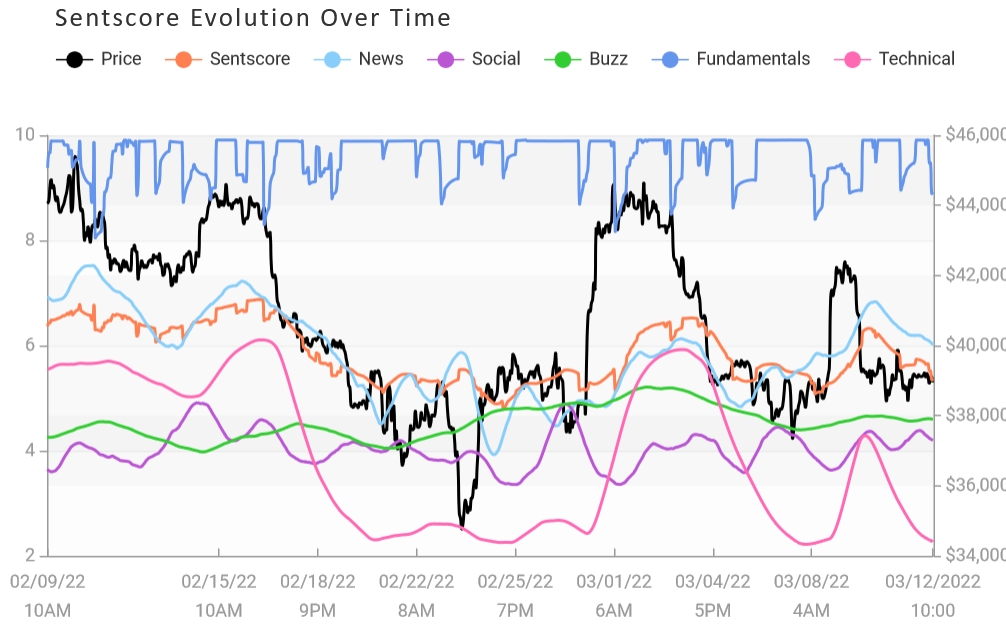

Looking more closely at what has changed in terms of sentiment over the past 24 hours, we see that the top spot has been taken by the Ethereum-alternative polkadot (DOT), which came in with a sentscore of 5.7.

Bitcoin, which came in second on the weekly overview, is down to a sentscore of 5.4 on the daily overview. The coin came in after USDC as the coin with the third-strongest sentiment.

The coin with the weakest sentiment today was crypto.com coin (CRO) with a 24-hour sentscore of 4.1.

As in the weekly ranking, all coins in the top 10 had a sentscore in the neutral zone.

Daily Bitcoin sentscore change in the past month:

Broadening the scope to include all 35 coins tracked by Omenics on a weekly basis, a similar picture can be seen, with USDC still ranked on top followed by BTC.

Following the two coins, the next three places on the list were taken by coins from outside the top 10, with synthetix (SNX), REN, and zcash (ZEC) coming in with sentscores of 5.6, 5.5, and 5.4, respectively.

WAVES, the blockchain platform dubbed by some as the ‘Russian Ethereum’, saw the strongest increase in sentiment this week with a rise to 5.3 following a price rally that started in February after the project unveiled a new roadmap.

Among the coins with the weakest sentiment, nem (XEM), ontology (ONT), and chainlink (LINK) came in with the lowest sentscores of 3.6, 3.7, and 4, respectively. The low scores for these coins followed the same pattern as last week when all three were also found among the five coins with the weakest sentiment.

Out of all 35 coins tracked by Omenics, only XEM and ONT had a sentscore in the negative zone with sentscores below 3.9. No coins were in the positive zone, which Omenics defines as having a sentscore of 6 or more.

____

* – Methodology:

Omenics measures the market sentiment by calculating the sentscore, which aggregates the sentiment from news, social media, technical analysis, viral trends, and coin fundamentals-based upon their proprietary algorithms.

As their website explains, “Omenics aggregates trending news articles and viral social media posts into an all-in-one data platform, where you can also analyze content sentiment,” later adding, “Omenics combines the 2 sentiment indicators from news and social media with 3 additional verticals for technical analysis, coin fundamentals, and buzz, resulting in the sentscore which reports a general outlook for each coin.” For now, they are rating 35 cryptoassets.

[ad_2]

cryptonews.com