[ad_1]

Here is what happened in the Cryptoworld in the last quarter of this year:

Total crypto market capitalization in Q4

October

- We started the final quarter of the year with bitcoin (BTC) becoming a more favored investment at the expense of ethereum (ETH). Further, the flagship cryptocurrency saw an influx of USD 69m over the first week of October, which gave it enough momentum to break the USD 55,000 resistance and return to USD 1trn market capitalization. At the same time, Bitcoin Lightning Network was growing faster than the available public statistics.

- Ethereum developers came up with an abstract date for the Ethereum 2.0 update, projecting that it could happen in May or June 2022. ETH also tested a new all-time high ahead of its Altair hard fork, the first mainnet upgrade to the beacon chain.

- Polkadot (DOT) team said that parachains – blockchains that connect to the Polkadot Relay Chain – were ready to be deployed.

- A global investigation by the International Consortium of Investigative Journalists (ICIJ) – dubbed the Pandora Papers – exposed how the world elite was using offshore structures and trusts in tax havens to conceal their wealth.

- Russian president Vladimir Putin declared that bitcoin had the “right to exist”. While Moscow assured investors that it would not follow Beijing’s regulatory move, it said it could banish exchanges overseas.

- Local officials from Russia and Pakistan too were trying to come up with an appropriate framework for crypto assets.

- The International Monetary Fund (IMF) suggested that economic leaders should fight back against crypto by issuing their own central bank digital currencies (CBDCs). It also said that a peak in inflation was expected during the final months of 2021, but that central banks should not tighten monetary policy.

- Speaking of CBDCs, Nigeria’s President Muhammadu Buhari announced the launch of the country’s digital currency – eNaira.

- The Financial Stability Board (FSB) warned that countries should work to prevent ‘regulatory arbitrage’ for stablecoins, while the Bank for International Settlements (BIS) argued that the financial system was in ‘an age of disruption’.

- A leading Salvadoran engineering academic claimed that volcano-powered Bitcoin mining could be ruinous for the nation’s economy, arguing that the government spent USD 4,672 worth of public funds to mine just USD 269 in BTC.

- Meanwhile, President Nayib Bukele blasted critics as the BTC price boomed. Some citizens were resorting to “identity theft” though in a bid to obtain USD 30 worth of BTC through El Salvador’s official wallet Chivo.

- Then, El Salvador’s president announced that the government had bought the dip after overleveraged traders had caused a half a billion liquidation spree that had led to the flagship cryptocurrency dropping by 6%.

- In South Korea, the head of the Financial Intelligence Unit (FIU) Kim Jeong-Gak said that decentralized finance (DeFi) and non-fungible token (NFT) regulations were coming. Meanwhile, South Korean lawmakers were inundating parliament with crypto tax delay bills.

- Courtesy of China’s crackdown on BTC mining, the US became the largest Bitcoin mining hub, followed by Kazakhstan and Russia, researchers at Cambridge University found.

- The US Securities and Exchanges Commission (SEC) Chairman Gary Gensler ruled out the possibility of enacting a China-style crypto crackdown, saying that it “would be up to Congress.”

- The SEC eventually approved the first-ever bitcoin futures-backed exchange-traded funds (ETF), fuelling new bitcoin and ethereum highs.

- Meanwhile, US top politicians were mulling a controversial unrealized gains tax bill.

- The Australian Senate’s Select Committee released its final report which included a set of recommendations for crypto and digital asset regulation.

- In an official ruling, a US Judge wrote that the court should be allowed to hear the “meaningful perspective” of XRP holders, inviting six XRP holders to get their day in court in the Ripple-SEC battle. At the same time, the regulatory body served up Circle with a subpoena.

- Facebook took another step towards the metaverse, announcing a partnership with crypto exchange Coinbase. Then the social media giant changed its corporate name to Meta.

- The American retail behemoth Walmart started its Bitcoin ATM pilot at 200 of its stores.

- The US Federal Deposit Insurance Corporation started working on a roadmap for banks to engage with crypto assets.

- Payments giant Mastercard announced a partnership with crypto platform Bakkt in a bid to integrate global bitcoin payments into its network.

- MoneyGram, an American cross-border peer-to-peer (P2P) payments and money transfer company, unveiled a new partnership with the Stellar Development Foundation, the entity behind Stellar (XLM).

- Digital asset investing firm CoinShares invested in Swiss-based online bank FlowBank, securing a stake of more than 9% in the business.

- Indian crypto exchange CoinSwitch Kuber raised over USD 260m at a valuation of USD 1.9bn. Speaking of India, blockchain analysis firm Chainalysis found that this country’s crypto market was more ‘mature’ than those of Vietnam and Pakistan.

- Major crypto exchange Binance dedicated USD 1bn towards growing the ecosystem of its Binance Smart Chain (BSC), a blockchain that runs in parallel to the Binance Chain.

- US-Irish digital payments giant Stripe was looking to hire a team of engineers for its crypto operations.

- Blockchain-powered game Axie Infinity’s governance token AXS surged to an all-time high in the market after the team announced the development of a new decentralized exchange (DEX).

- Unstoppable Domains, which offers non-fungible token (NFT) domains that run on the Ethereum blockchain, and 30 of the world’s crypto wallets formed the Wallet Alliance to establish “a new global standard” for crypto transactions.

- Decentralized finance (DeFi) protocol Compound Finance faced more trouble when USD 65m in COMP was dripped into the contract plagued by a bug.

- DeFi protocol Cream Finance (CREAM) suffered another exploit and lost USD 100m.

- The Cryptoverse pointed out the flaws of centralization after Facebook, and its family of apps, went down for hours.

- FTX US, the US arm of the crypto exchange FTX, launched a new NFT marketplace.

- Just one day later, major crypto exchange Coinbase unveiled its NFT marketplace and reported that 1.5% of its existing user number joined their NFT marketplace waitlist in the first 24 hours.

- Also, the social media platform TikTok revealed that it would expand to NFTs, while critics described the rollout as a flop.

- The anonymous developer behind NFT project Evolved Apes disappeared with USD 2.9m in investor funds, while someone conducted a fake half-billion CryptoPunk sale.

- By late October, meme coins were making headlines as shiba inu (SHIB), a so-called “dogecoin killer,” flipped dogecoin (DOGE) and became the 9th largest crypto asset by market capitalization. This ignited yet another pump of other dog and cat-themed tokens. Meanwhile, floki inu, another dog-themed coin, flooded the city of London with ads.

November

- Ethereum started November by testing its all-time highs as private notes to clients from two major investment banks revealed how different analysts view the second-largest crypto asset.

- Ethereum co-founder Vitalik Buterin proposed a new Ethereum Improvement Proposal (EIP) to tackle Ethereum’s sky-high gas fees. Meanwhile, an Ethereum developer called for the community to help test the Merge, that is, the Ethereum mainnet “merging” with the beacon chain proof-of-stake (PoS) system.

- Then bitcoin hit another ATH of around USD 68,358. Some attributed this to the fact that inflation figures in the USA had reached their highest level in 30 years and the value of paper money hit an all-time low against hard assets. For example, PayPal co-founder Peter Thiel claimed that rising BTC prices were proof that inflation had taken hold in the US economy.

- Analysts said that the bitcoin rally looked healthy and with less leverage than on previous occasions. Meanwhile, altcoins eclipsed combined bitcoin and ethereum transaction volumes on Coinbase.

- Bitcoin’s Taproot was set to be activated on November 14, and eventually went live on that day. Also, an upgrade for Ethereum’s layer two (L2) scaling solution Optimism was slated for November 11. Also, The first atomic swap between monero (XMR) and ethereum occurred on the L2 solution Arbitrum.

- The metaverse tokens extended their rally after Facebook changed its name to Meta.

- Crypto.com‘s native token CRO jumped following the news that Crypto.com had secured the naming rights for the famous Staples Center. Crypto.com soon announced that it would acquire the North American Derivatives Exchange (Nadex) and the Small Exchange futures exchange, for USD 216m.

- Ethereum Name Service announced the launch of the ENS governance token that would be used to create a decentralized autonomous organization (DAO). The token soared on the first day of trading, delivering triple-digit gains to investors.

- EOS dropped when a new foundation was formed to ‘fork out’ Block.One, the project’s developer.

- The SQUID token, based on an alleged play-to-earn game with the same name as a popular series on Netflix, moved up again despite its prior massive collapse.

- A joint call from the US Treasury Department, the Federal Reserve, and financial regulators to get power over stablecoins and their issuers drew a mixed reaction from the crypto community. The US Senate demanded answers from stablecoin issuers while expressing concern about this type of asset. Further, several crypto CEOs were summoned to speak at a parliamentary hearing in the US.

- Meanwhile, former New York City police captain Eric Adams, who had previously promised to turn MY into a “Bitcoin Center,” was elected the city’s mayor.

- Then, the US President Joe Biden signed the controversial Infrastructure act into law.

- South Korean political parties were targeting millennials and zoomers with pro-crypto policies, while the main presidential candidates said they were in favor of delaying or amending the crypto tax.

- But a man ‘tried to set himself on fire’ at crypto exchange Upbit’s customer center. Later, the police revealed that the man who had attempted arson had made a disastrous crypto-asset investment.

- A draft law in that country called for life sentences for certain crypto market manipulators.

- Meanwhile, one of South Korea’s biggest crypto exchanges Bithumb received an operating license from the nation’s financial regulator.

- South Korean top financial regulator said NFTs were not crypto assets, but Seoul said that it would become the first local government in South Korea to launch a metaverse public service platform.

- In India, lawmakers concluded that the crypto sector’s growth can’t be stopped, but must be regulated. Prime Minister Narendra Modi warned that BTC could spoil the country’s youth if it ended up in the wrong hands. Meanwhile, a report from the country stated that India was set to define crypto as an asset but ban payments and ads.

- Taiwanese MPs were calling for a crypto ban, but the country’s regulators said they prefer a progressive approach.

- Reports revealed that Kazakhstan’s economy could benefit more than USD 1.5bn in revenue from legal mining operations in five years. However, the country’s regulators moved to limit the amount of money retail investors could spend on crypto purchases on domestic exchanges.

- The Russian Ministry of Economic Development expressed a willingness to legalize BTC and crypto mining but the central bank contradicted. Russian lawmakers and regulators were pressing for crypto change but kept on facing the anti-crypto Central Bank.

- Sweden’s state-owned power company defended a Bitcoin mining bill proposed by the directors-general of the Swedish Financial Supervisory Authority and the Swedish Environmental Protection Agency.

- The Argentine government’s new decree imposed a tax on credits and debts on crypto transactions.

- Israel’s Money Laundering and Terror Financing Prohibition Authority (IMPA) announced that new and tightened regulations would apply to cryptoassets.

- A group of China’s tech giants signed a pact that involved a commitment to “fighting” or “eliminating” crypto assets. Meanwhile, a top official was expelled from the Chinese Communist Party for allegedly “supporting” crypto mining in exchange for bribes and sex. Later, he was expelled from the party and was also arrested.

- The Chinese central bank said that NFT and metaverse projects ‘could become money-laundering tools’.

- The CEO of the Japanese financial heavyweight and crypto player SBI Holdings Yoshitaka Kitao said that China was leading the CBDC race ahead of the US and Europe. However, a report found that Asia had for the first time fallen behind the US by the number of crypto startups that raised capital.

- El Salvador announced it would build a bitcoin-themed city at the base of a volcano and would use a new USD 500m bitcoin bond plan to fund it. However, mainstream analysts criticized the 2022 budget plans and the bitcoin bond ambitions.

- Crypto exchanges in the UK would be forced to pay a tech tax.

- Brad Garlinghouse, CEO of US-based fintech company Ripple, claimed that the company was making ‘good progress’ in the legal row with the SEC.

- Google’s parent company Alphabet took another step into the world of crypto by joining a funding round for Digital Currency Group (DCG), the owner of Grayscale Investments, which increased DCGs market valuation to USD 10bn.

- The Commonwealth Bank said that it would become Australia’s first mainstream financial provider to allow customers to buy, sell and hold crypto assets.

- Grayscale launched a new solana (SOL)-backed regulated investment product in the US.

- Technology firm MicroStrategy made its fourth-largest investment in BTC and increased its stash to BTC 121,044

- US financial institutions could be able to get exposure to ETH through a futures-backed ETF in Q1 2022, an analyst at Bloomberg Intelligence estimated.

- The Adidas brand Adidas Originals announced an obscure partnership with Coinbase. In another deal, Coinbase acquired the crypto wallet startup BRD.

- Elon Musk and Binance CEO Changpeng Zhao (CZ) exchanged words over dogecoin withdrawals on Binance, which were suspended for two weeks due to some technical issues that emerged as a result of an update. Binance resumed DOGE withdrawals stating that ‘no shade was intended’. Also, Binance boss CZ, worth USD 90bn, was reportedly the richest ethnic Chinese person alive.

- Trading platform eToro restricted access to cardano (ADA) and tron (TRX) for US users.

- Brokerage firm Robinhood claimed that it had some 1.6m people on the waitlist for their crypto wallet.

- The popular messaging platform Discord seemed to be working on a link to Ethereum as hinted by CEO and founder Jason Citron.

- The newly renamed Meta lost its crypto chief as the head of the Novi wallet David Marcus decided to step aside. Speaking of Facebook, no, it did not reverse its crypto ad ban, rather it simply updated its eligibility criteria.

- Jack Dorsey confirmed he was stepping down from his role as Twitter CEO. Furthermore, he announced that the payments company Square had rebranded to Block and Square Crypto to Spiral.

- KuCoin Labs, the investment and research arm of KuCoin exchange, launched a USD 100m fund to support metaverse-related projects and education.

- Also in the metaverse, SAND rallied as the The Sandbox unveiled its upcoming metaverse event that included earning rewards.

- Tokens.com, a publicly-traded company that invests in revenue-generating digital assets, bought 116 parcels of virtual land within Decentraland‘s metaverse for USD 2.8m.

- Warner Bros teamed up with NFT platform Nifty to release digital collectibles tied to The Matrix Resurrections. Meanwhile, prominent film producer Quentin Tarantino offered seven deleted scenes of Pulp Fiction in the form of NFTs.

- We also reported that NFTs were increasingly being used as collateral against loans. Meanwhile, CryptoPunk 7557, which had been traded at ETH 196.69 earlier, was sold at more than 99% discount for ETH 4.444.

- AMC, an American movie theatre chain, mulled launching its own cryptocurrency and partnering with Hollywood studios to release NFTs.

- Meanwhile, in the UK, major auction house Christie’s sold a Beeple piece for USD 28.9m.

- The Silk Road darknet market founder Ross Ulbricht launched his NFT auction, and fetched a bid of nearly USD 1.2m within the first few days.

- 72% of game developers surveyed by the blockchain platform Stratis (STRAT) said they were interested in using blockchain and NFT’s. Similarly, Activate Consulting, a management consulting firm for technology and entertainment industries, predicted that NFTs would become mainstream by 2022.

- Around USD 31m was stolen from DeFi platform MonoX.

- A new DAO dubbed ConstitutionDAO, raised millions with a goal to acquire a rare print of the US Constitution. It failed, but with silver linings abound. It soon said that it would close.

- Meanwhile, retail condos in New York City were being sold for USD 29m exclusively in bitcoin.

- Binance published a bill of rights for crypto users.

- The long-expected Faketoshi trial began.

December

- We started the last month of the year with a DeFi hack as Badger DAO was exploited for over USD 100m. This trend continued till the end of the month, as a total of seven hacks took place.

- Ethereum co-founder Vitalik Buterin discussed a “plausible roadmap” for obtaining a scalable blockchain but said it would probably take years before it “plays out”.

- Another step was taken towards Ethereum 2.0 as the developers asked the community to start testing on the Kintsugi testnet.

- Polkadot launched its first set of parachains.

- Polygon (MATIC) justified its silent hard fork by citing ‘critical vulnerability’.

- The file sharing token bittorrent (BTT) surged following the news of the BitTorrent Chain mainnet launchh.

- The EOS community voted to stop token vesting to Block.one.

- Dogecoin saw a sharp rally after Elon Musk said Tesla would “make some merch buyable” with it.

- Myanmar’s shadow government recognized tether (USDT) as its official currency to use it to combat the military regime.

- Six crypto CEOs testified before the US Congress about threshold issues and Bitcoin mining among other topics.

- BTC and ETH jumped following the Federal Reserve meeting that heard talks of crypto, doubled tapering, and 2022 interest rate hikes.

- America’s credit regulator, the National Credit Union Administration (NCUA), told domestic credit unions that they could partner with third-party crypto service providers to give their members access to crypto markets.

- The Central Intelligence Agency (CIA) Director William Burns admitted that the US agency had “a number of different projects focused on cryptocurrency” in progress.

- A US court hinted that the Internal Revenue Service (IRS) could have violated a Coinbase user’s privacy rights in a tax audit.

- Meanwhile, the human rights organization Cristosal claimed that the US could impose sanctions on El Salvador’s Chivo wallet.

- Russia was set to create a crypto working group to “develop the further regulation” of crypto. The Russian Central Bank moved to ban funds from crypto investments, despite experts complaining of a ‘blurry’ legal status. By the end of the month, the country was still no closer to regulating crypto despite the central bank’s ‘concession’.

- The Financial Services Agency (FSA), a Japanese financial regulator, eyed stablecoin and wallet provider regulations for 2022.

- An Australian joint regulatory body backed the government’s plans to regulate crypto.

- An IMF official admitted that it would be difficult to regulate crypto without global consensus.

- Meanwhile, crypto advocates secured a remarkable victory in Paraguay with a mining bill passing in the country’s Senate.

- The Bank for International Settlements (BIS) said that multiple settlement platforms could emerge in the future with multiple assets and currencies. The financial body also said that DeFi could play “an important role” in the traditional financial system while pushing for increased regulation.

- It was also reported that 20% of the total Bitcoin mining hashrate was still in China, despite the crackdown. Crypto users in Mainland China were still finding ways to trade while major exchanges were preparing to disable service for users by the end of the year.

- In South Korea, there were 24 licenced crypto exchanges by the end of December, but most are stuck in crypto-to-crypto purgatory. Crypto exchange Coinone told its customers that they would no longer be able to make withdrawals to “unregistered” wallet addresses starting 2022.

- South Korean tax body the National Tax Service (NTS) announced plans to start taxing crypto gifts and inherited tokens, while the gaming regulator Game Rating and Administration Committee (GRAC) told crypto and blockchain gaming developers to remove play-to-earn titles from the Google Play and the Apple App Store.

- Lee Jae Myung, South Korea’s presidential candidate, called crypto “a means of trading and investment.”

- Bitcoin mining industry saw didn’t have a good last week of the month, as Kazakhstan experiences power interruptions, but the government was thinking of building a nuclear power plant that could help to strengthen the country’s Bitcoin and crypto mining sector.

- London-based football club Arsenal FC drew the ire of the UK advertising watchdog for “taking advantage of consumers’ inexperience in cryptoassets”.

- Nearly 90% of surveyed Aussie crypto owners profited from trading or broke even in 2021. In another survey, Grayscale found a rising interest in BTC as the company was pushing for the first bitcoin spot-based ETF in the US.

- We found that Bitcoin ETFs in Europe and Canada remained popular even with the US ETFs entering the market.

- Visa launched crypto advisory services to help clients understand various segments of the crypto industry.

- Abu Dhabi state-owned investment giant Mubadala started to invest its assets in crypto and the surrounding blockchain-based ecosystem.

- Jack Dorsey’s Spiral unveiled their Bitcoin Lightning Development Kit, a tool that would allow developers to integrate instant Bitcoin payments into their applications.

- Meanwhile, Dorsey’s payment firm Cash App unveiled a new feature that would allow users to gift crypto and stock over the holiday season.

- Binance said it would shut its Singapore exchange and “refocus” those operations into a “blockchain innovation hub.”

- Binance and FTX were reportedly preparing to go head-to-head in a battle to become the main shirt sponsor of the football giant FC Barcelona.

- Major crypto derivatives exchange BitMEX said it would launch its token BMEX in 2022 in two phases.

- Robinhood was working on enabling its customers to send crypto as a gift.

- Tron (TRX) founder Justin Sun stepped away from the day-to-day operations at the Tron Foundation as he was appointed as the Ambassador, Permanent Representative of Grenada to the World Trade Organization (WTO).

- Meta decided to spend USD 60m to acquire the naming rights owned by the US bank Meta Financial Group.

- Sportswear giant Nike acquired virtual sneakers and collectibles creator RTFKT, in a bid to push deeper into the metaverse.

- Nexon America, an online gaming company and a subsidiary of the South Korean gaming giant Nexon, started accepting BTC and ETH among other coins for in-game purchases.

- Binance Smart Chain unveiled a USD 200m investment program developed in partnership with Animoca Brands, a company focused on NFT and gaming digital property rights, to finance early-stage blockchain-based gaming startups.

- Major hardware maker Ledger announced a crypto debit card, support for NFTs, and partnership with Coinbase and FTX.

- Blockchain analysis firm Chainalysis found that only 1 in 4 NFTs bought during minting result in profit.

- South Korean banking giant KB said it created crypto, NFT, and CBDC-compatible wallets.

- In a surprise move, the Chinese communist party mouthpiece Xinhua endorsed NFTs.

- MetaMask, a popular cryptocurrency wallet designed in the form of a browser extension, unveiled its upcoming in-app NFT extension.

- The massive photo and video sharing social networking service Instagram was reportedly exploring ways to integrate NFTs within its social media platform.

- An investor managed to purchase 330 Adidas NFTs by using a smart contract, while the limit was only two items per person.

- Solana-based NFT project Monkey Kingdom saw its Discord server hacked, resulting in nearly USD 1.3m worth of digital assets stolen.

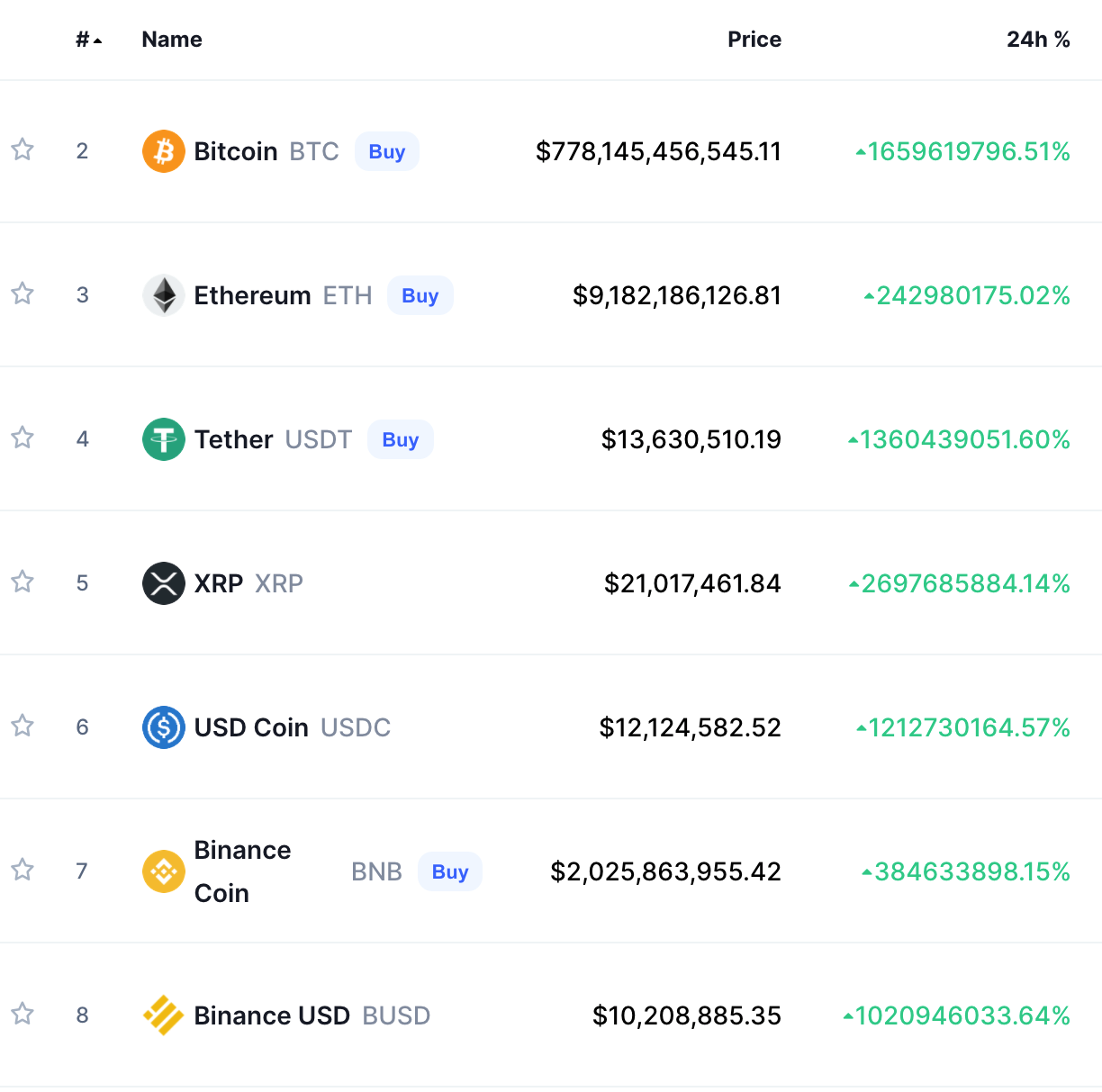

- Major crypto data aggregator CoinMarketCap (CMC) displayed eye-popping prices for almost all digital assets due to a glitch.

And thus ended the year. Happy 2022.

____

Learn more:

– Crypto News Rewind 2021: Q1 – Rallies, Tesla & MicroStrategy & PayPal Bitcoin Moves, Historic NFT Moments

– Crypto News Rewind 2021: Q2 – Bitcoin Crash, China’s Crypto Crackdown, El Salvador’s BTC Move, Musk vs BTC

– Crypto News Rewind 2021: Q3 – Bitcoin Becomes Legal Tender & Gets Taproot, Improved Ethereum, NFTzation

– Bitcoin and Ethereum Price Predictions for 2022

– Crypto Adoption in 2022: What to Expect?

– 2022 Crypto Regulation Trends: Focus on DeFi, Stablecoins, NFTs, and More

– DeFi Trends in 2022: Growing Interest, Regulation & New Roles for DAOs, DEXes, NFTs, and Gaming

– Crypto Security in 2022: Prepare for More DeFi Hacks, Exchange Outages, and Noob Mistakes

– How Global Economy Might Affect Bitcoin, Ethereum, and Crypto in 2022

– Crypto Exchanges in 2022: More Services, More Compliance, and Competition

– Crypto Investment Trends in 2022: Brace for More Institutions and Meme Manias

[ad_2]

cryptonews.com