[ad_1]

Despite overall declining usage since Elon Musk’s acquisition, X’s hold on the microblogging market may be stickier than first thought. The app formerly known as Twitter saw its daily active users drop 16% in September, according to The Wall Street Journal, citing data from research firm Sensor Tower. The firm also said that the average time spent daily per user also fell 2% year-over-year in the third quarter. However, another firm has a slightly different view on X’s metrics, finding that the time U.S. daily active users are spending on X has actually been growing, and the usage by X’s U.S. power users remains largely unchanged.

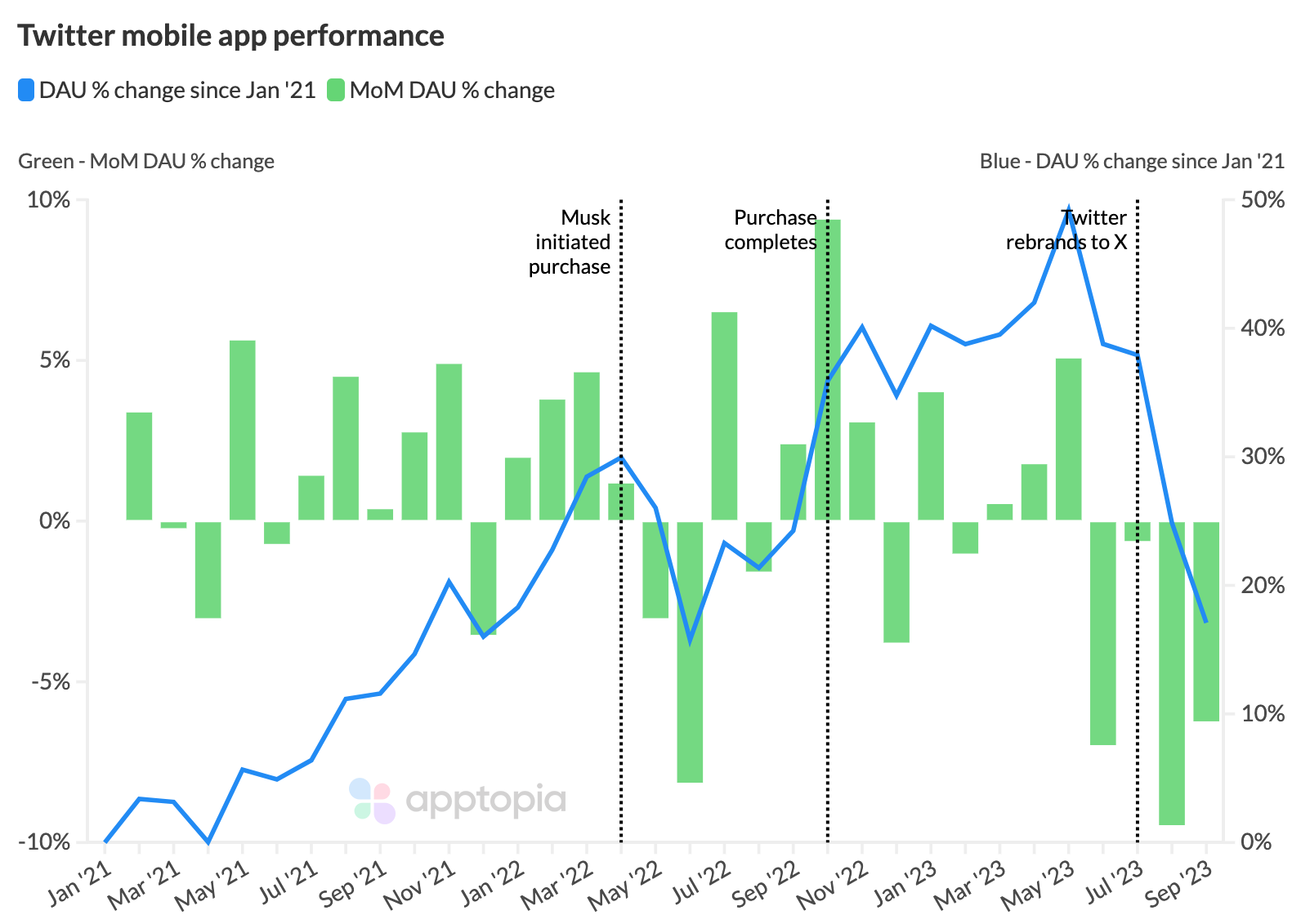

Image Credits: Apptopia

Sensor Tower isn’t the only firm to point to declining usage. Another research firm, Similarweb, recently said X traffic and monthly active users were in decline.

Though app intelligence provider Apptopia largely agrees with Sensor Tower and others that X’s daily active users have been falling, it sees that drop-off starting in May of this year. Downloads also started dropping when the app rebranded to X in July. But that could mean, the firm suggests, that the declining daily active user numbers are not necessarily related to the reduced retention of longtime Twitter/X users, but due to a lack of new users coming on board because the Twitter brand name disappeared from the app stores. (Plus, when Instagram Threads launched this summer, it immediately started advertising on the term “Twitter,” further complicating matters.)

In other words, it’s not a “users fleeing” situation so much as it is a problem with new users backfilling the losses, post-rebrand.

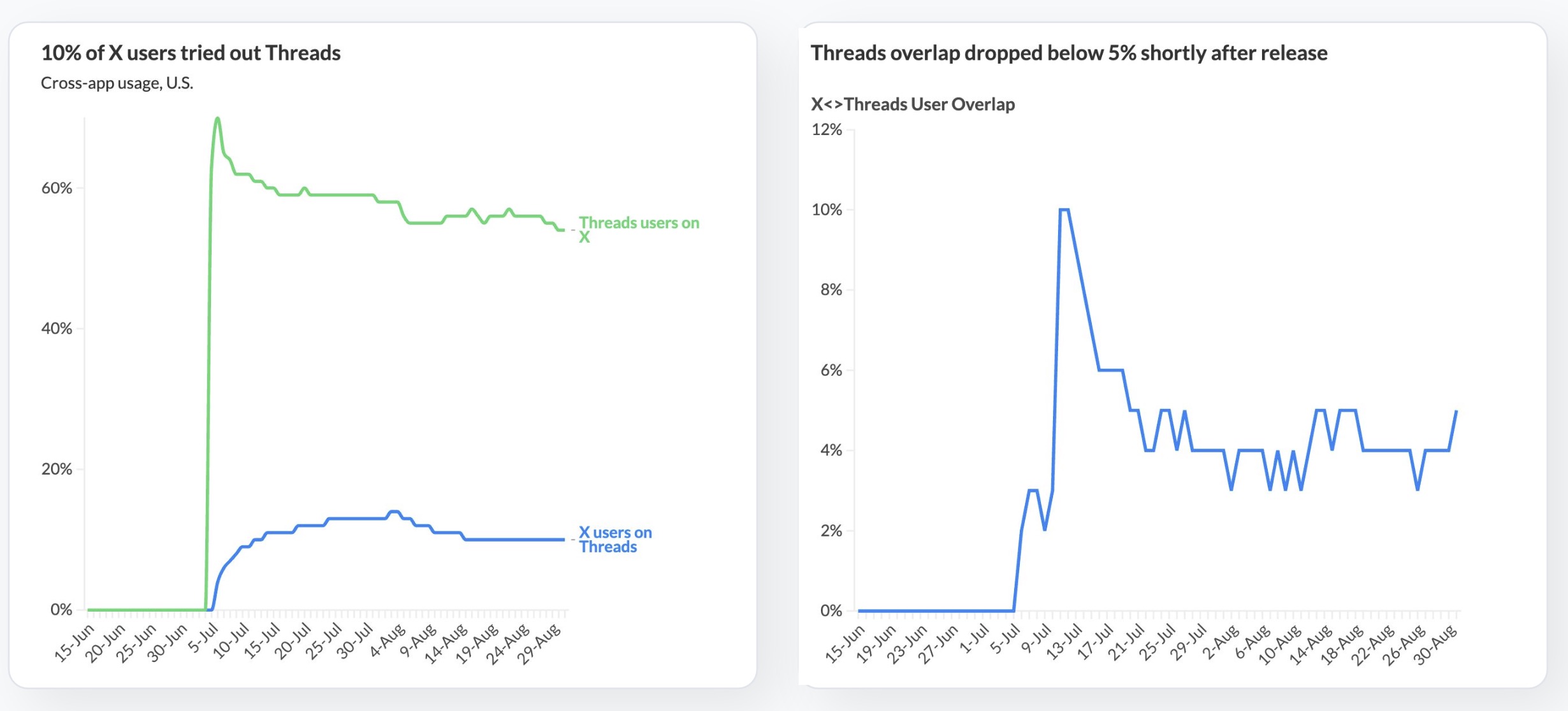

Estimates from Apptopia also found that new rivals to X, like Threads, aren’t necessarily wooing users away from one app to the other. In fact, the overlap between the two apps is lower than you might think. Over a month after Threads’ launch, only 10% of X users had tried out Instagram’s new Twitter competitor, and that figure dropped to 5% shortly after the app’s release.

Image Credits: Apptopia

But what’s interesting here is that even when Threads was able to get X users to try it, X’s daily active users would spend more time on X than on Threads.

At launch, Threads was initially competing fairly well against X, as Threads users who also used X were spending 23.8 minutes on the Instagram Threads app, compared with 31.1 minutes on X. However, as of September, those numbers have shifted. Now, users of both apps spend 3.7 minutes on Threads versus 16.9 minutes on X. That indicates X is retaining some of its pull, even as Meta announces that Threads is nearing 100 million monthly active users.

Meanwhile, X’s U.S. power users — or those who are in the top decile of usage in the given time period — are still heavily engaged with X, Appotopia’s data found. This group now accounts for 72.4% of the total time spent among X users in the U.S., only slightly down from 73.1% in January 2022.

In other words, the percentage of total time spent that U.S. power users are responsible for hasn’t significantly changed since either Musk taking over Twitter or its subsequent rebranding to X.

In addition, X’s U.S. daily active users were spending, on average, 18.8 minutes per day on Twitter/X as of January 2022. When Threads launched in July, they continued to spend 19.8 minutes on X. And as of September 2023, that number grew once again to 20.6 minutes.

Though overall, X may be seeing some declines, this “stickiness” factor around X usage has already caused its first casualty among would-be rivals. A startup called Pebble (formerly T2) that tried to take on X by copying Twitter features announced this week that it would shut down, citing the competitive environment.

“The durability of the network effect of Twitter is stronger than anticipated,” noted Pebble CTO Michael Greer at the time. The founders also pointed to a landscape littered with Twitter clones angling for attention.

Given these new findings, Threads may still have a shot at competing with X because of its tight integration with Instagram and the resources of Meta behind it to grow an independent user base, but other X rivals like Spill, Spoutible, Bluesky, Mastodon and others may find it hard to convince X users to fully disengage to join their app instead.

[ad_2]

techcrunch.com