[ad_1]

With Ethereum being treated like a stone’s throw away from the psychological price of $3,000, its upward momentum continues to gain steam.

The second-largest cryptocurrency based on market capitalization was up by 22.21% in the last seven days to hit $2,911 during intraday trading.

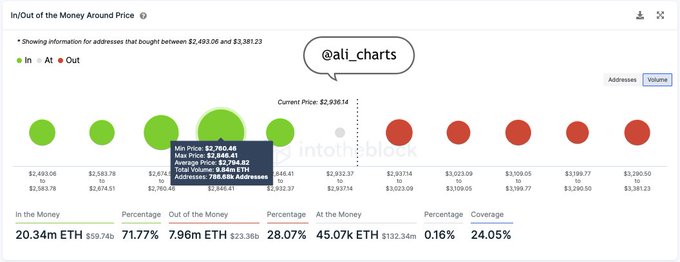

Nevertheless, Ethereum needs to continue holding the $2,800 level for a sustainable upward trend. Market analyst Ali Martinez explained:

“On-chain data from IntoTheBlock shows that as long as ETH remains trading above $2,800, ETH has a good chance of recovering and advancing further because there is no major supply barrier ahead.”

Source: IntoTheBlock

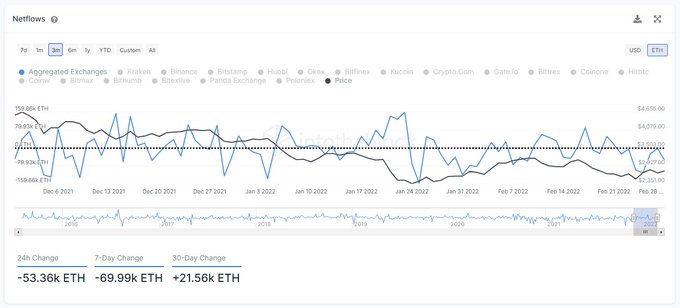

On the other hand, a bullish sign continues to pop up, given that Ethereum has been leaving crypto exchanges in droves. Data analytic firm IntoTheBlock acknowledged:

“ETH has seen 7 days of consecutive outflows from exchanges. As the price increases, the supply available to buy from exchanges has been decreasing non-stop in 2021. Over 327,000 ETH left exchanges since Feb 22nd.”

Source: IntoTheBlock

Whenever cryptocurrencies leave exchanges, a holding culture is demonstrated because they are usually transferred to cold storage and digital wallets for future purposes. Therefore, this is a bullish sign because selling pressure gets tamed.

As Ethereum continues trading above the psychological price of $2,500, whether the $3,000 level will next remain to be seen.

Meanwhile, the much-awaited Ethereum’s proof of stake (PoS) consensus mechanism is deemed a game-changer that will prompt the adoption of energy-efficient technology. A recent review by the Massachusetts Institute of Technology (MIT) ranked Ethereum’s PoS among the top 10 technological breakthroughs of 2022.

Image source: Shutterstock

[ad_2]

blockchain.news