If you base your opinions on recent news, you might think that the electric vehicle industry in the U.S. is in dire straits. Headlines tout that carmakers are worried about EV growth, consumer demand is waning, and President Biden’s tax breaks haven’t helped drive consumers towards EVs.

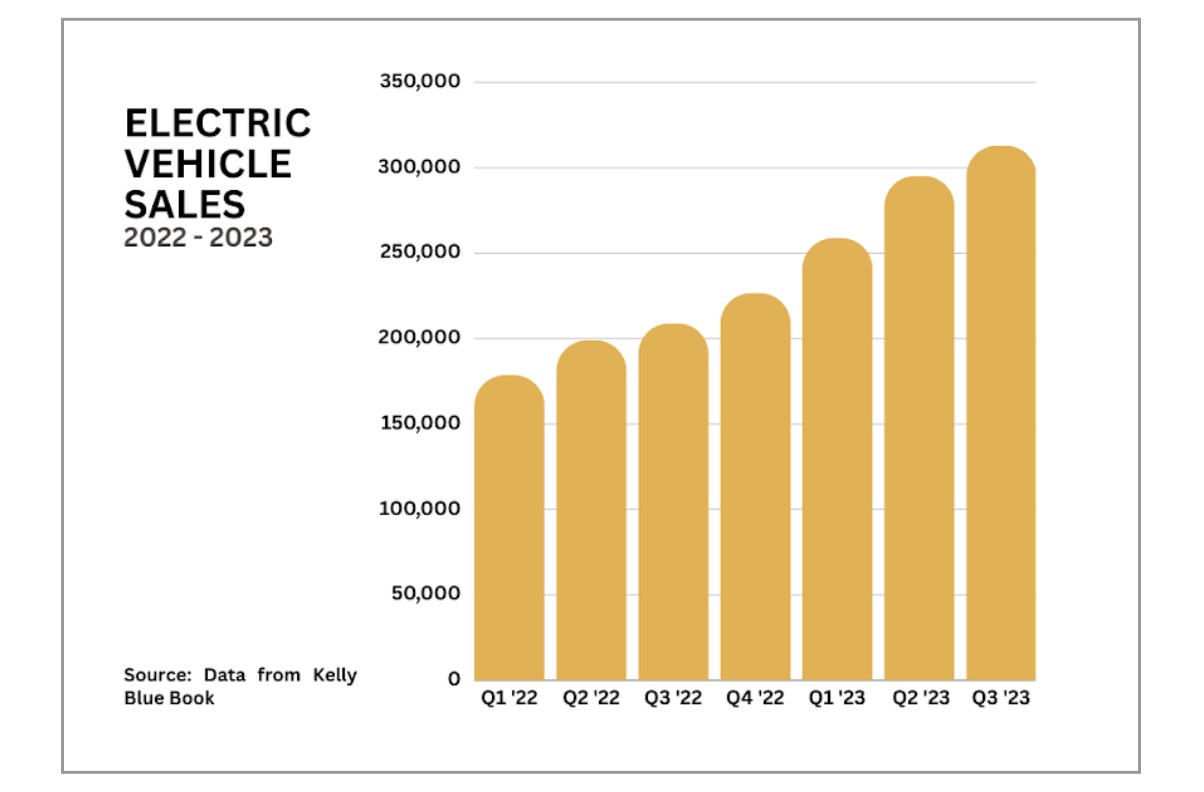

So this bit of news might come as a surprise: EV sales rose a whopping 50% in the third quarter compared to a year earlier. Electric vehicles are actually selling faster than any other automotive segment, and total sales are expected to exceed 1 million for the first time this year.

About 67% of U.S. citizens are open to buying an EV, according to S&P Global Mobility. Yes, you read that right. They recognize the value of EVs, both on a societal level (they create jobs, lower our reliance on foreign fossil fuels, and are important in the fight against climate change) and on a personal level (they require less maintenance, unlock freedom from gas prices, and are just incredibly fun to drive).

Does this look like a market with declining demand? Image Credits: DvX Ventures using Kelley Blue Book data

Bottom line: U.S. consumers want EVs.

The problem is that the U.S. is already behind in the global EV race, and some are advocating for us to slow down even further. If we ease up on EV adoption now, it won’t mean fewer EVs; it will just mean fewer U.S.-made EVs, which in turn will mean fewer jobs in the country. Those politicizing EVs might want to consider the economic impact of their words.

We are behind on the factors that will tip the scales: Competitive prices, charging infrastructure, consumer choice and the domestic supply chain. That’s why focusing only on consumer demand misses the bigger point about the ecosystem for EVs: Whether we want to or not, the U.S. must adopt EVs, and we must foster a better environment for that to happen.

The global market has already made up its mind on EVs. The best-selling car in the world, not just the best-selling electric car, is the Tesla Model Y. In Europe, 21.6% of all new vehicle registrations in 2022 were EVs. In China, 50% of people said they were likely to buy an EV as their next vehicle. In the U.S., January 2023 was the first time EVs accounted for 5% of new car sales, and that number had risen to 7% by September.

The auto industry is undergoing one of the biggest technical transitions in its history. Europe and China saw this coming before we did and invested heavily in EVs over a decade ago. That’s why the U.S. finds itself behind in battery technology and charging locations today, and is reliant on Korean and Chinese battery manufacturers.

As the U.S.’ largest manufacturing sector, the automotive industry is an about $2 trillion annual market, and it’s responsible for 3% of our GDP. It is also responsible for more jobs than any other manufacturing sector. For all the talk of making sure we don’t lose our lead in chips and AI, the fact is, we cannot afford to lose our lead in automotive manufacturing technology.

There is reason for angst, but it’s not nearly as dire as the news would suggest.

The reality is, we won’t see a seamless shift from gas cars to EVs. Demand for EVs has increased, but it hasn’t risen as quickly as U.S. automakers had hoped. And it’s true that automakers across the board had bet big on EVs and many have had to delay investments and change plans for manufacturing.

That’s because there are some real roadblocks (pun intended) to making the switch.

EV infrastructure in the U.S. is still lacking. Consumers have valid concerns about charging their car, and less than half of U.S. mayors said they feel prepared to support widespread EV adoption. Our cities need more charging stations, more power sources, more electricians… the list goes on.

While prices have come down, they are still too high for some buyers. Today you can buy an EV for $30,000 (before tax credits), but choices are still limited compared to gas cars: You can now choose from over 40 different EV models, but if you buy a gas car, you have hundreds to choose from. Plus, car dealers are often much more comfortable helping a buyer understand those options.

There’s no denying that these factors impact demand, but I don’t believe any of these issues undermine the ultimate promise and potential of EVs.

Sometimes, big problems are exposed when things scale. That’s not what’s happening here. The barriers to adoption are solvable. These problems are already being addressed through myriad public and private partnerships, industry deals and new companies. Through tax policies and CHIPS legislation, some of these barriers to entry are being broken down.

In 2018, when I was President of Tesla, Piero Ferrari (yes, that Ferrari) came to visit the Tesla factory and raved about our electric sedan, which was faster than his supercars. He wanted to see what we were doing with his own eyes.

Fast-forward to 2021, Ferrari introduced its first hybrid car on the market, and in 2025, Ferrari plans to sell its first fully electric car. Even a heritage, luxury sports car manufacturer with the oldest and most successful F1 team recognizes consumers’ demand for EVs.

But it may be too little, too late for the Italian auto manufacturing industry. Italy once produced some of the most admired and coveted cars in the world, but Italian companies and policymakers didn’t invest in advancing the industry. In 1997, Italy manufactured 1.8 million vehicles; last year, just under 800,000k cars were produced in the country.

We have to solve these problems.

As we head into a new year, we’re about to see a new round of EV sales figures. Sales may be better than we expected, or demand may have risen by a percentage point or two less than we hoped. Whatever those numbers are, I expect the skepticism to persist.

Still, we can’t lose sight of the big picture. We have to stay the course if we want to remain a leader of this multi-trillion-dollar industry, or hold on to manufacturing jobs, or stop relying on other countries for our cars. We have to be aggressive about addressing the roadblocks in front of us and keep pushing for adoption. To do that, we need leadership, both in the public and private domains, and determination.

Before it’s too late.

techcrunch.com