[ad_1]

As the week began, Bitcoin broke above the USD 40,000 mark again, with the war in Ukraine possibly becoming the first “great test case” for BTC. Traditional markets and crypto trimmed losses while the Moscow Exchange decided not to open. We looked back at the market’s performance over February, and we looked into the list of coins that have moved the highest and the lowest since the war in Ukraine began. Meanwhile, GRIID claimed that Intel’s BMZ2 Bitcoin miners will improve gross profits by 130% compared to the rival Antminer S19 Pro.

And the war rages on. The US and Europe vowed to target Russians’ attempts at using crypto to avoid sanctions, selected Russian banks were excluded from SWIFT and the Central Bank could be targeted next, which could make rubles “close to worthless,” but the Central Bank claims that its SWIFT alternative is ready. While Anonymous pledged USD 44K in BTC for every surrendered Russian tank, crypto companies increased their efforts to help Ukraine, crypto donations neared USD 20m with the start of the week, then USD 54m by mid-week, and after Polkadot’s chief got criticized over his Ukrainian DOT donation proposal, Ukraine added more crypto options for donations, while the government confirmed an airdrop as well, but soon canceled it, saying they’d issue NFTs instead. Meanhwile, El Salvador’s President Nayib Bukele and his government remained silent on Russia’s invasion of Ukraine. Also, ordinary Russians were increasingly starting to feel the bite of Western-led sanctions, they were spending their falling ruble in a bid to dump it, and crypto buyers were facing whopping premiums amid the economic crash in that country. Industry observers argued that a potential fallout from the war may be priced into crypto market, and that there have been massive increases in crypto trading volumes using the Ukrainian fiat currency. Kraken CEO said that crypto exchanges could be required to freeze their Russian customers’ accounts, while Coinbase CEO said that Russian oligarchs are unlikely to use crypto to dodge sanctions.

Animoca banned Russian users while Revolut’s CEO condemned the war and announced that the donations would be matched. As all this was happening, some speculators were betting on the outcome of the war.

Eyes also turned to the US Congress as the Fed chair prepared for his first comments since the war began, saying they’ll “proceed carefully” with plans to hike interest rates despite the war, South Korea’s Constitutional Court upheld a law that blocks gamers from buying and selling crypto and NFTs, and the UK advertising watchdog banned the Floki Inu London ad campaign. Meanwhile, Heather Morgan who allegedly attempted to launder the BTC stolen from Bitfinex is talking to the authorities about a possible “plea deal”.

Let’s get to joking.

_________

Good morning, Crypto Twitter. A sat for your thoughts.

__

Let’s check out the Putin-regulation-sanctions combination.

__

Traditional problems in traditional finance.

__

Ouch.

__

Say what you will, but they’re thinking about everything over there.

__

Wrong priorities, Putin.

__

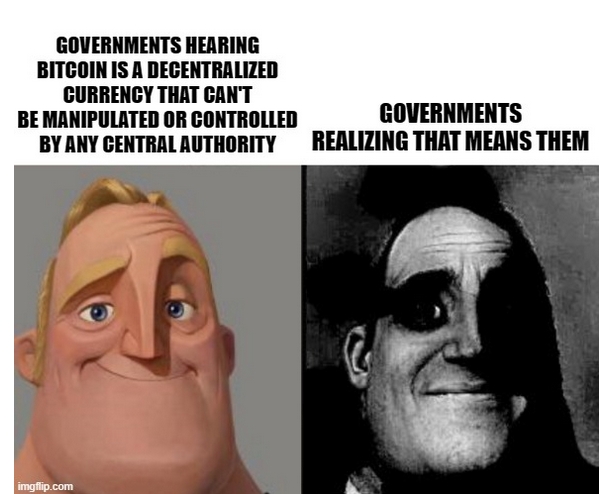

‘Wait a minute…I am a centralized authority!’

__

Confused by all the talk about inflation. No worries, here’s an explanation.

__

‘And she said ‘sure you did, babe’ and patted me on the head.’

__

Bad day?

__

Helpful indeed.

__

Bitcoiners said they’ve got a new hobby.

__

Yup, hodling’s nice.

__

Look at that smile. That’s the facial expression of one that knows and invests.

__

The face of one that has absolutely no clue – like, they’re certifiably oblivious – and invests.

__

Gotta hustle.

__

Maybe today’s the lucky trading day.

__

That’s what happens when you stare at the charts all day.

__

How dare she?! He makes sarcastic, passive-aggressive comments too!

__

When you make it big. No worries, you’ll be there soon too.

[ad_2]

cryptonews.com