India, a major player in the global automotive industry, has started focusing on transitioning to alternative fuels to curb pollution after expanding its consumer and vehicle bases and adding local manufacturing facilities over the past two decades. On this journey, 2024 will be a crucial year, as the country — the third-largest automotive market — faces challenges to offer accessible growth capital to late-stage startups while trying to lure Tesla and other foreign EV manufacturers to enter its domestic market.

How EVs fared in 2023

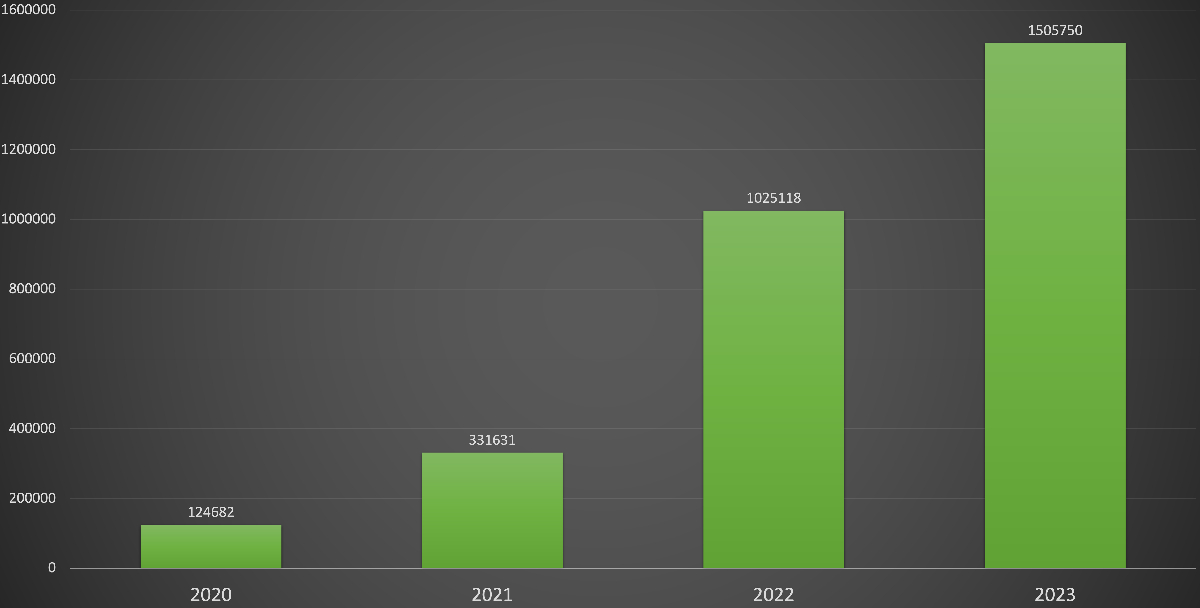

In 2023, India, the world’s largest two- and three-wheeler manufacturer, sold almost 24 million vehicles, including commercial and personal four-, three- and two-wheelers, according to the latest data on the government’s Vahan portal. Of the total number of vehicles registered, more than 1.5 million were EVs, capturing 6.35% of the total base, including 813,000 electric two-wheelers. While the overall growth was nearly 10% from about 22 million vehicles sold in 2022, EV sales grew by close to 47% from 1.03 million EVs sold last year.

This brings the total number of electric vehicle sales in the country to nearly 3.5 million. Two-wheelers accounted for more than 47% of sales, four-wheelers represented about 8% and the rest came from e-rickshaws and three-wheelers.

India’s EV sales grew from nearly 125,000 in 2020 to over 1.5 million in 2023, per the data provided by Vahan. Image Credits: Jagmeet Singh / TechCrunch

India’s annual growth in EV sales in 2023 is significant; however, it’s not as high as in the previous two years, which were over 209% in 2022 and 166% in 2021. One of the reasons for the dip in the sales of EVs is the cut in subsidies given to two-wheeler customers through the incentive scheme called Faster Adoption and Manufacturing of (Hybrid and) Electric Vehicles, commonly called FAME-II, that came into effect in June and dropped the monthly sales of electric two-wheelers in the country over 56% in that month alone. The sudden drop in electric two-wheeler sales has arguably impacted the country’s overall EV market, as India is predominantly a two-wheeler market and has limited manufacturers in the electric car segment.

Ravneet S. Phokela, chief business officer of electric two-wheeler startup Ather Energy, told TechCrunch that the market took a hit for about three months due to the FAME-II update, though it has rebounded to pre-subsidy change levels as of October.

“From the bounce back, how the rapid growth is going to be remains to be seen, but we expect it to be more gradual than exponential. However, the days of 100% quarter-on-quarter growth are gone,” he said over a call, adding that the change would help in the medium-term perspective.

“In a way, while the subsidy impacted us in the short term financially, if I just take a macro view, there has actually been a good outcome because now, the market pricing is close to non-subsidy levels, which means the market has gotten used to price levels that we can explore broadly when subsidy goes over,” Phokela noted.

The subsidy update has also caused consolidation and sudden exits of many small-scale electric two-wheeler brands, including the ones selling rebranded Chinese vehicles. Phokela said that the top four market players, namely Ola, TVS Motor, Ather Energy and Bajaj, currently capture about 80% of the total electric two-wheeler market. These players combined had about 26% to 27% of the market about nine months ago (before the government updated FAME-II in May).

Ather Energy sold an average of about 80,000 to 85,000 units this year and expects a similar sales figure for 2024, Phokela said.

Apart from electric two-wheelers, the $1.38 billion FAME-II scheme applies to three- and four-wheeler sales to boost EV consumption in the country.

New Delhi has given more than $628 million in subsidies through December 1 under FAME-II on the sale of 1.15 million, according to the government data shared in the parliament.

EV manufacturers have demanded that the government continue offering subsidies to let the market sustain its growth and expand further to meet the country’s electrification target to have 30% EV penetration by 2030.

“Given that the costs are still not optimized yet for the supply chain, it is important for the government to continue the subsidy for two to three years and taper it down,” Phokela said.

Sources familiar with the development told TechCrunch that industry players have requested the government provide predictability in its policies and avoid bringing abrupt changes, such as the case of FAME-II updates, to let them make assumptions and base financial and business planning accordingly.

“A lack of predictability is the biggest killer point for the industry,” one source said. “Even if you are saying six months, please tell us that it will be for six months and then turnaround, but don’t say two years and end in one year.”

In addition to FAME-II, the Indian government has offered a $3.11 billion production-linked incentive scheme to attract investments and push domestic manufacturing of automobile and auto components in the country. Indian car manufacturers Tata Motors and Mahindra & Mahindra have emerged as the early beneficiaries of the incentive scheme. The government reported more than $1.43 billion of investments came until the second quarter of the financial year 2023-24 as a result of the scheme.

Tata Motors saw a growth of 63% in EVs and increased EV penetration in its portfolio to 12% this year, a company spokesperson said in a statement to TechCrunch.

Automobile manufacturers, including Ather Energy and Tata Motors, introduced their new EV models in the country to expand their presence and attract new customers.

Phokela underlined that “premiumization” emerged as a notable consumer trend this year, particularly in the Indian electric two-wheeler market. The trend of premium models coming to the market will continue in 2024, he predicted.

All four top electric two-wheeler brands have vehicles between the price range of $1,400 to $1,800, while the traditional internal combustion engine two-wheelers are available at an average price of $1,000.

In the last 12 to 18 months, the electric two-wheeler market also saw growing sales from the tier two and tier three towns. For Ather Energy, Phokela said only 43% of its sales came from tier one cities, while 57% was from tier two and tier three towns — despite its limited distribution in those regions. The startup is now expanding its distribution to get even higher sales.

Some market observers believe that the growth of electric two-wheeler sales in the developing parts of India is due to hefty electricity subsidies. However, Phokela argued that if that were the reason, there would be a significant growth in the demand for low-end vehicles, not the premium models. People in non-metro cities consider EVs as status validation and a way to show off, he said.

Commercial use cases as a major investor attraction

Although top electric two-wheeler manufacturers have so far targeted the personal mobility segment in the Indian market, investors are bullish on the growth of commercial use cases.

“In the next two to three years, the majority of the traction will come from B2B use cases — whether it is three-wheeler cargo, three-wheeler passenger, eco-mobility, food delivery, hyperlocal delivery, fast/quick commerce, the use of EVs there is the one that’s accelerating much faster,” Kunal Khattar, founder and general partner at Indian VC fund AdvantEdge Founders, told TechCrunch.

He said while the share of commercial vehicles is about 30 million, or 10% of the total number of vehicles on the road in India, they consume almost 70% of the energy of all the vehicles.

Commercial electric vehicles consume a large percentage of energy in India. Image Credits: Sanchit Khanna/Hindustan Times

“If you’re in the business of energy, whether it is battery manufacturing or swapping, energy storage or building charging infrastructure, your entire focus should be on B2B,” he noted.

Sandiip Bhammer, founder and co-managing partner at New York-based climate tech VC fund Green Frontier Capital, told TechCrunch that the opportunity to gain faster and more rapid growth in the commercial segment is significantly higher than in the consumer segment.

“The economic viability of two-wheeler and three-wheeler segments on the commercial side is much clearer than on the passenger car segment,” he said.

Investors believe that compared to the consumer segment, the commercial segment is less prone to be impacted by subsidy changes. This is because businesses consider the total cost of ownership rather than the face value of the vehicle they purchase.

Khattar said the B2B segment will be 100% electric in India in the next two to three years, irrespective of whether subsidies and other incentives would be available.

The country plans to add thousands of battery-operated auto-rickshaws and e-buses to electrify public transportation across states in the coming months. Likewise, it looks to offer EV charging stations at various local gas stations.

Capital flow in the market

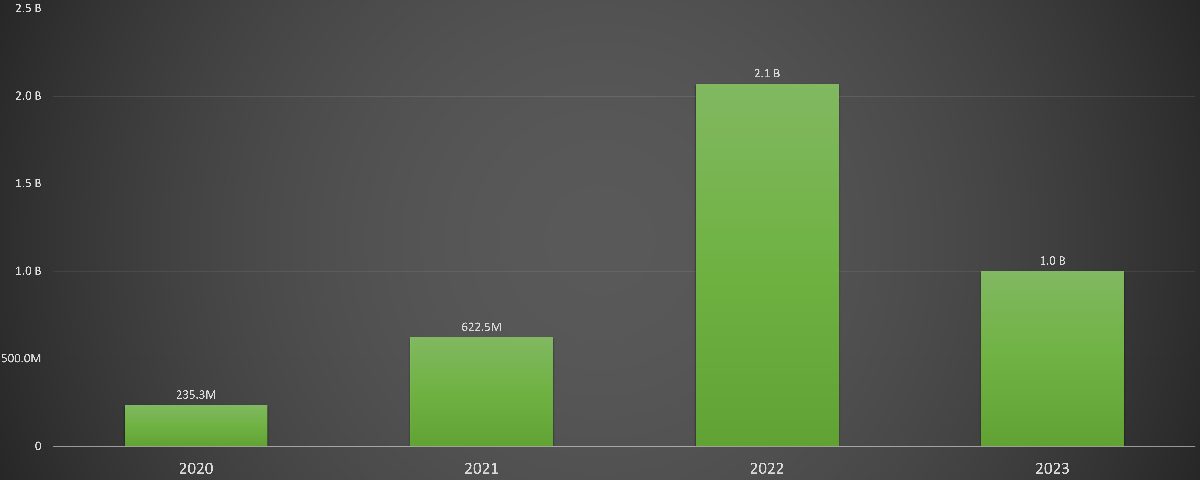

Equity investments in India’s electric vehicle (EV) market decreased by 52%, from $2.1 billion in 2022 to $1 billion in 2023, according to the data shared by VC analyst firm Tracxn earlier this month. The number of funding rounds also dropped 62%, from 135 in the previous year to 51. However, EV funding was not as dire as in some top-performing sectors, such as tech, SaaS, agritech and health tech, where equity investments dropped by over 80%.

Bhammer of Green Frontier Capital said the drop in EV funding this year was mainly due to valuations that were too high in many of the existing startups.

“If you look at new companies that are raising capital, they are actually raising capital at a much more reasonable valuation than the older companies doing extension rounds,” he said.

India’s EV funding declined to $1.5 billion in 2023, per the data provided by Tracxn. Image Credits: Jagmeet Singh / TechCrunch

Investors are optimistic about the capital flow growth in 2024 but cautious about muted numbers, particularly in the consumer segment, due to FAME-II changes and lack of clarity on subsidy extension.

“We need the support of the government, in terms of subsidies and taxes and all of that, because of the fact that we are not mainstream yet,” Khattar of AdvantEdge Founders said.

One key reason for being hopeful is India’s growing global presence and becoming a part of the China+1 strategy for most global companies.

“China has now started de-growing. So, India is the beacon of hope in an otherwise pretty dull emerging markets scenario,” Bhammer said.

What’s coming up next?

While India is still a nascent market for EVs, global EV companies including Tesla and VinFast are also looking to enter the Indian market in the coming months to leverage the size of the world’s most populous nation. The Indian government is developing a new EV policy to attract foreign carmakers to foray into the market alongside supporting domestic players to expand the country’s electric car base. Incumbents including India’s top carmaker Maruti Suzuki are also closely observing the ongoing moves by international players to look for the right time to enter the market.

“Legacy carmakers are in no hurry. When they launch, they will distribute, and through their distribution, they will be able to start selling numbers as much as, if not more than, existing players,” a source told TechCrunch.

Companies including Tata Motors, which are already in the EV market with their vehicles, are working to address the current adoption challenges.

“Charging infrastructure growth remains the residual barrier for mass adoption of EVs. Tata Motors has initiated open collaboration with key charging players to accelerate the growth of chargers, which will deliver a better experience to the EV buyers,” the Tata Motors spokesperson said.

Ravi Pandit, co-founder and group chairman of automobile tech company KPIT Technologies, told TechCrunch that software and hardware have become the vehicle’s core and that trend will continue to grow over time.

“Now, the model is changing where instead of there being a lot of computers in a car, there will be a computer and around which there will be a car. That’s a fundamental shift,” he said.

Similarly, electric two-wheeler manufacturers and infrastructure providers are working on standardized charging solutions. Ather Energy has already collaborated with Hero to offer interoperability on charging.

“We have about 1,400 fast chargers, and Hero Vida has about 500, and we are growing on a monthly basis,” said Phokela. “We are in conversations with many other OEMs, and these discussions are at different levels of maturity.”

In addition to standardization and interoperability on the charging side, some companies are exploring alternatives to lithium, including sodium-ion-driven technologies and silicon anode.

“What is clear is that you cannot drive revolution in any sector unless you have access to the raw materials that power the industry. So, if China controls the refining capacity of lithium, how would India drive the EV revolution if it has to keep going to China for its batteries,” Bhammer said.

He mentioned that other incoming updates in the market include vehicle-to-grid and clip-on devices that will be available on a subscription-based model to help users convert an existing two-wheeler from a non-EV to an EV without charging the motor or battery permanently.

techcrunch.com