Textiles and garments contribute 16% of Vietnam’s total GPD, but it’s challenging for small garment brands to take advantage of the country’s manufacturing prowess. Inflow is stepping into the gap, with a platform that gives small brands visibility into manufacturers’ supply chains and the design-to-production cycle. It also helps them meet manufacturers who are willing to produce smaller quality of garments.

Inflow announced today it has raised $2 million in seed funding. Investors included AppWorks, 500 Global, January Capital, Spiral Ventures and Saison Capital. The company says that over the last year, its revenue has grown by more than 15x, and it’s now used by more than 80 fashion brands across Southeast Asia.

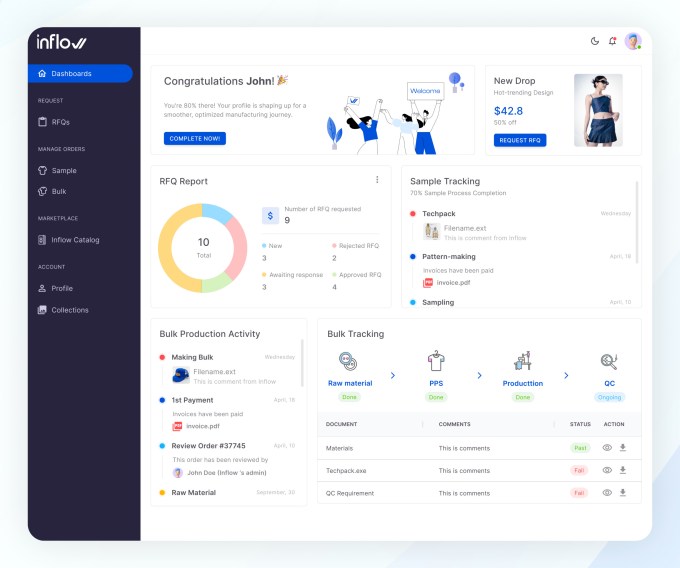

The startup’s production network currently includes over 150 manufacturers and suppliers. It typically works with brands that have a yearly revenue of $200,000 and above. Small brands get the benefit of Inflow’s platform, showing them inventory forecasts, data-driven factory matching and merchandise management. This meant to help them compete against larger brands.

The company says that its platform and factory matching services can reduce sample production to 7 days, with a 45-day turnaround. It supports small-batch orders with minimum order quantities starting from 50 units. This means that brands can scale their production based on how well products do.

Inflow’s platform

Before starting Inflow, founder Khanh Le spent 15 years working in the fashion industry, including owning her own fashion brands in Vietnam. A couple jobs later, she decided she wanted to get back to her B2C brand again. But she ran into several challenges.

“Finding a factory within Vietnam, I realized it was really traditional and this was no different from 15 years ago,” she said. “It’s still very difficult for a small brand to find a trusted partner and take advantage of production in Vietnam.”

This was a contrast to Vietnam’s high-rank among clothing and textile exporters in the world. “I was like, how come this has such a huge potential, but it’s only for big brands, like Nike, Adidas, Uniqlo.”

That’s when Le decided to start using data-driven matching to help smaller fashion brands tap into the network of factories in Vietnam.

Inflow is solving several problems for small brands that want to manufacturer in Vietnam. The first is finding a trusted partner, a process that usually takes two or three months, Le said. Inflow solves that by assembling a network of pre-screened partners. Since many brands are based in the United States or Europe, it uses its platform to provide real-time updates into the manufacturing process.

Khanh Le, founder and CEO of Inflow

The platform also gives information like inventory forecast, based on historical data from customers and sales data. This helps them decided the right quantity of items to produce.

Inflow says the manufacturers and suppliers on its platform are ethical and it ensures that through a vetting process, and frequent factory audits. Le says Inflow ensures factories meet global standards in terms of workers’ benefits, working environment and how they process materials. They also encourage clients to choose sustainable materials, or know the impact of the materials they use.

Inflow’s seed funding will be used for its design R&D and developing its supply chain and manufacturing tech. It plans to enable brands to bring new designs to market within 30 days at minimum order quantities of 50. The startup will also set up sales channels in developed markets and plan to partner with fashion exports companies in places like the U.S. or Europe.

In a statement, 500 Global managing partner Vishal Harnal said, “The global garment industry, like many others, is diversifying its reliance on China for manufacturing. Inflow’s fashion supply chain technology could capture this huge onshoring opportunity for Vietnam through a connected, convenient and scalable platform.

techcrunch.com