[ad_1]

Conditions appear to be shifting favorably for India’s Swiggy. The food delivery startup — backed by SoftBank, Prosus and Accel — saw its paper valuation slashed by more than a half this year as investors marked their holdings largely in response to the dwindling market conditions. The startup, valued at $10.7 billion in a funding round early 2022, also lost some market share to Zomato, its arch publicly-listed rival, according to Prosus.

Now, not so much.

Invesco, which led Swiggy’s previous round and cut its valuation to under $5.5 billion, marked up the startup’s valuation to $7.85 billion at July’s closure, according to a newly published disclosure.

Share price of Zomato. (Chart: S&P Global Market Intelligence)

The U.S. asset manager says it considers the valuation of similar public companies as a factor when reassessing the value of its private investments. Given that shares of Zomato have risen by 33% since the end of July, this could imply that the current $7.85 billion valuation for privately-held Swiggy may be conservative.

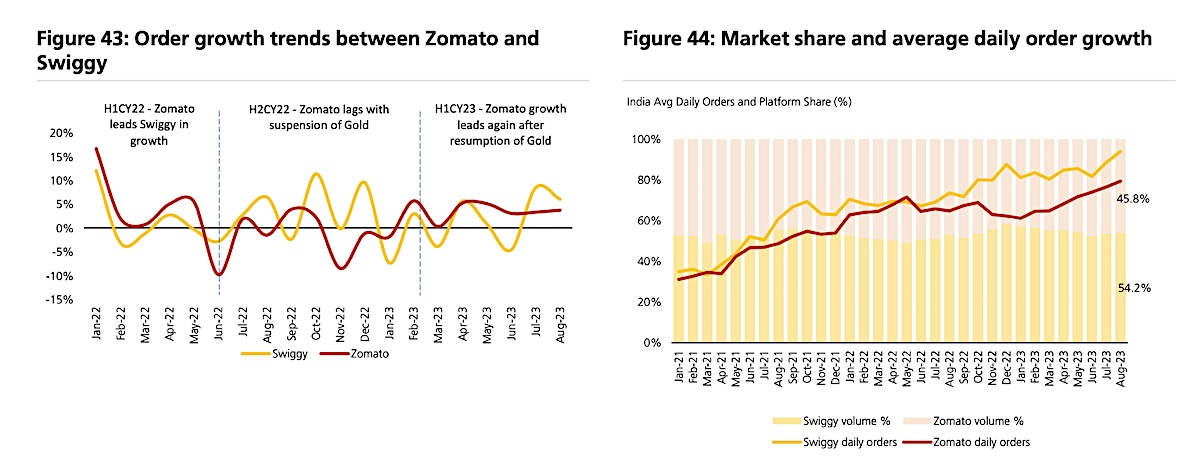

Separately, Swiggy, which is eyeing to make an initial public offering next year, appears to be closing in on some of the market share it lost to Zomato this year. Swiggy’s month-on-month volume grew 7% this July and 6% in August, beating Zomato in both months, UBS said in a report last week.

Data and image: UBS

[ad_2]

techcrunch.com