[ad_1]

After more than 15-months of tight ranging price action, Chainlink (LINK) has shot-up +11% in a potential break-out trend, yet, as the underwater LINK army goes on parade – is it too late to buy Chainlink?

The past year of trading has seen leading Oracle Chainlink trapped between $5.50 and $9.50, in a predictable chop that has left bag-holders in purgatory.

Yet, the sudden break-high, triggered by a Chainlink blog-post suggesting the launch of a V0.2 upgrade to LINK staking is expected to come later this year – with new features including an unbonding mechanism, liquid staking rewards, and a shift of the stake slash burden from stakers to validators.

The upside move was predicted by top-tier crypto trader VikingXBT, who has withstood the wrath of many disillusioned LINK holders in recent weeks, as he shepherded the LINK army through challenging price action.

LINK Price Analysis: Is It Too Late to Buy Chainlink After +11% Pump?

With Chainlink manoeuvring towards the V0.2 upgrade, LINK is currently trading at a market price of $10.29 (representing a 24-hour change of +1.04%).

At the time of writing LINK price appears to be shifting into minor localised retracement, with price down -7.53% from a local high of $11.06 over the last 6 hours.

The sudden move, triggered by the update from the Chainlink Foundation, coincided with a crucial push back above the ascendant 20DMA over the weekend.

This comes following the emergence of a ‘golden cross’ pattern on September 29.

With price trading on a break-out, LINK could now find lower support at the $9.50 level.

Meanwhile, LINK’s indicators are reflecting the dramatic move, with the MACD showing bullish divergence at 0.281.

However, warning signs are appearing on the RSI indicator, which has overheated with serious bearish divergence to an extremely over-bought signal at 81.25.

The over-heated RSI highlights that price is due retracement – looking at the last three times the RSI moved above 70, on September 30 (before a -13.95%), on July 20 (before a -34%), and on April 18 (before a -45%).

This suggests a mean average retracement of -30%, a move that would see LINK return back to recent double-bottomed support at $7.25.

Overall, LINK seems vulnerable to a retracement here, while it has shown strength on the break-out, the screaming RSI cannot be ignored.

This leaves LINK with an upside target at the local high around $11.06 (a potential +7.18%).

While downside risk could see LINK return to double-bottomed support at $7.25 (a possible -29.6%).

This leaves Chainlink with a short-time frame risk: reward of 0.24 – a bad entry characterised by poor upside potential.

Yet, while Chainlink is fighting to hold recovery footing, a new meme coin presale is stealing the attention of markets.

$650K Raised – Could Meme Kombat Become the Hottest Meme Coin of November 2023?

Meet Meme Kombat, a trailblazing initiative that has seamlessly blended the memetic love of nostalgic gaming, and GambleFi, into a decentralized Web3 platform.

So, what makes Meme Kombat tick, and why should potential investors keep a keen eye on this presale?

The essence of Meme Kombat lies in its captivating arena where characters aiming to tap into deeply tribal crypto communities lock horns.

Players have the liberty to place their bets on these animated battles, predicting the outcomes and possibly reaping attractive rewards.

With a sturdy promise of Season 1 showcasing 11 distinct meme characters, there’s no shortage of action, and Season 2 is already on the horizon for December 2023.

The decentralized nature of the project, combined with the thrill of AI-driven battles, ensures that the outcomes are both transparent and unpredictable – every battle is a new experience, ensuring players stay engaged.

Delivering GameFi to Crypto Rivalries in Dramatic Fashion with Staking

The project isn’t just about excitement; it’s built on a foundation of trust – Meme Kombat’s commitment to transparency is evident through initiatives like the impending security audit of their smart contract.

The findings of this audit will soon be public, a move that many projects shy away from.

The founder and project lead, Matt Whiteman, isn’t an unknown entity in the crypto space.

His experience spanning two decades in process design, combined with his position as the COO of North Technologies, adds credibility to Meme Kombat.

When so many projects hide behind the veil of anonymity, Whiteman’s open profile and the project’s physical address in Amsterdam offer an extra layer of trustworthiness.

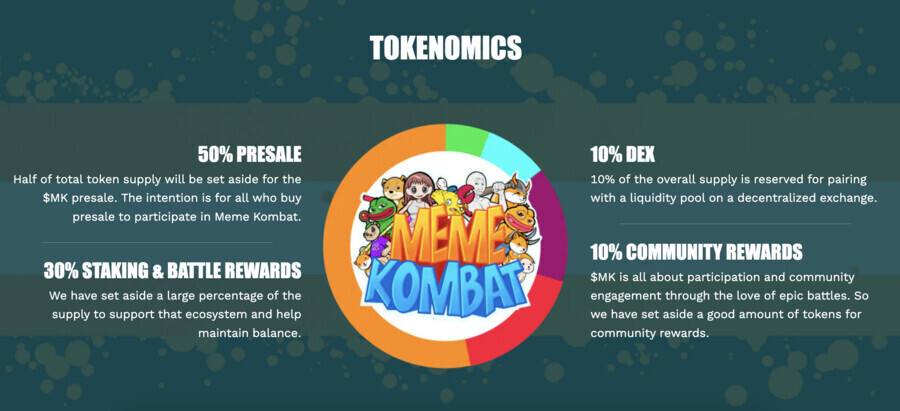

The tokenomics of Meme Kombat is also an appealing factor for potential investors – Stake the Meme Kombat ($MK) token, priced attractively at $1.667, and dive into a rewarding ecosystem.

With a generous APY of 112%, stakers not only benefit from passive income but can also use their staked tokens to place bets in the arena – this dual functionality – earning while gaming – sets Meme Kombat apart.

Intriguingly, engagement on the platform directly influences the income one can earn, so, the more you participate, the more you stand to gain.

With the GambleFi industry booming following coins like Rollbit, Meme Kombat seems poised to tap into this lucrative market with its innovative approach.

By merging memes, gaming, and blockchain, the platform is presenting something fresh to the crypto community.

For those looking to diversify their portfolio with a unique offering, Meme Kombat seems like an opportunity too good to miss – so, don’t be left behind (stay tuned with the MK Telegram).

Embrace the future of meme-based gaming and betting with Meme Kombat.

Buy Meme Kombat Here

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

[ad_2]

cryptonews.com