[ad_1]

Ethereum (ETH) wannabe competitor kadena (KDA) has continued to soar higher in the market over Christmas on hopes that the protocol will bring improvements to everything from smart contract creation to non-fungible token (NFT) trading.

As of 10:37 UTC, KDA traded at USD 15.31, up 12% for the past 24 hours. The token is currently ranked as the 70th most valuable cryptoasset by market capitalization (USD 2.47bn).

Over the past week, KDA has now rallied by more than 43%, making it the 5th best performer on a 7-day basis among the top 100 coins by market capitalization. At the time of writing, the only coins that performed better than it for the week were NEAR, FTM, AAVE, and SUSHI which rose by 70%, 65%, 56%, and 45%, respectively.

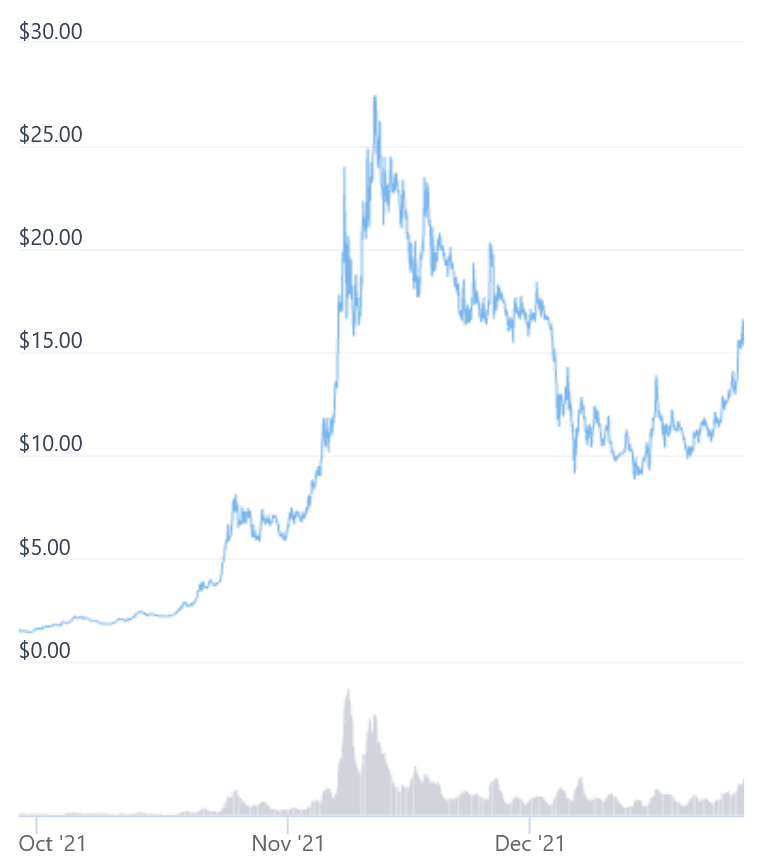

90-day price of KDA:

The Christmas rally for KDA comes as the team behind the protocol has announced a number of new features. Among the most interesting for holders is the ability to wrap KDA tokens for yield farming on Ethereum-based decentralized exchanges (DEXes) like SushiSwap, and a new web browser extension wallet for Kadena known as X-Wallet.

Created by Stuart Popejoy and Will Martino, two former blockchain developers at investment banking giant JPMorgan, Kadena is described as a smart contract platform that aims to compete with Ethereum by simplifying the way smart contracts are written.

The protocol has also made use of certain aspects of Bitcoin (BTC)’s design, such as the proof-of-work (PoW) consensus model. According to Kadena’s website, the network offers “the security of Bitcoin, virtually free gas, unparalleled throughput, and smarter contracts.”

Among other things, the project has received attention for plans to launch Marmalade, its own standard for the buying and selling of NFTs that will bring requirements on the sale of an NFT into the standard.

Often touted as one of Kadena’s major merits is its own Pact programming language for smart contracts, which is described in its documentation as “the first truly human-readable smart contract language.”

However, the project is being criticized by some analysts for an alleged high level of centralization in hashing power supporting the network.

In either case, the rally for kadena over the past week follows a strong period for the token in early November, with KDA rising by more than 300% between November 1 and 13. As often happens after parabolic rallies, however, the price later turned lower, falling by about 70% from its November 13 peak of over USD 28 to a bottom on December 13 of USD 8.57.

For now, KDA is mainly traded on the exchanges KuCoin and Gate.io, which combined made up 89% of the trading volume over the past 24 hours. The token is not yet listed on some of the world’s largest exchanges such as Binance and Coinbase.

____

Learn more:

– BitMEX to Launch BMEX Token in 2022, Announces Airdrop

– OpenDAO’s SOS Token Falls Over 20% After Its Initial Near-500% Leap

– SUSHI Jumps 10% as New Takeover Proposal is Met with Mixed Reactions

– Gaming Token Gala Jumps Amid Increased Gaming Sector Bullishness

[ad_2]

cryptonews.com