[ad_1]

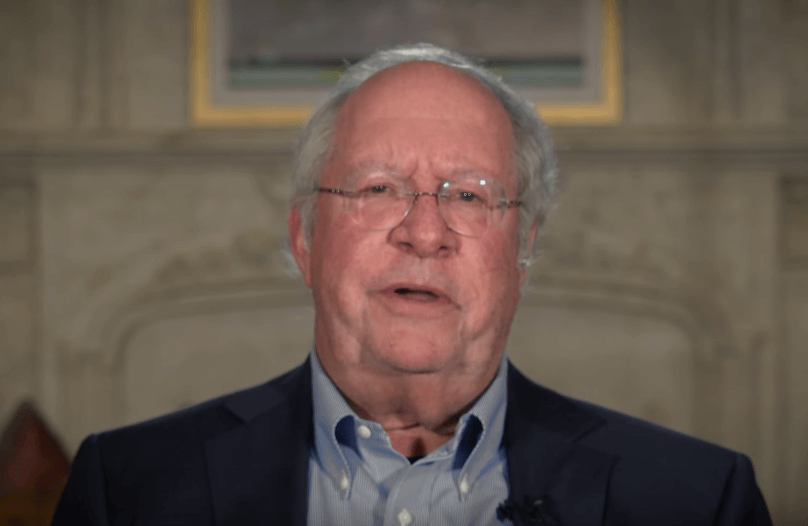

Famous value investor Bill Miller has disclosed he invested 50% of his personal funds into bitcoin (BTC) and several other cryptoassets, leveraging his crypto investments.

Miller, Founder and Chief Investment Officer of Miller Value Partners, initially invested in the top cryptocurrency in 2014, and then started buying it up again last spring amid a surge in interest by venture capital firms.

In a recent interview with WealthRack’s Consuelo Mack, Miller said:

“I think the average investor should ask himself or herself what do you have in your portfolio that has that kind of track record — number one; is very, very underpenetrated; can provide a service of insurance against financial catastrophe that no one else can provide; and can go up ten times or fifty times. The answer is: nothing.”

Miller, who holds the record for beating the S&P 500 index for 15 consecutive years in the years 1991 to 2005 with Legg Mason Capital Management Value Trust Fund, admitted that his crypto investments go “against many of the tenets of financial discipline” but added that some of the richest people in the USA – such as Amazon’s Jeff Bezos, Meta’s Mark Zuckerberg and Berkshire Hathaway’s Warren Buffet – are also “highly concentrated” in their investments.

Explaining his decision to invest so heavily in cryptocurrencies, Miller referred to a conference at which he listened to a speech by Wences Casares, CEO of crypto wallet Xapo. Casares said investors in unstable economies considered bitcoin means of safeguarding their wealth against hyperinflation, nationalization of banks, and governments seizing their assets, according to Miller.

“I bought some [in 2014], and bought a little bit more over time, and it became USD 500. Then I stopped buying it. And I didn’t buy it for years until just the spring of [2021]. It hit up USD 66,000 high price, and then in four weeks it was in half,” he said.

Per Miller, he started buying BTC again at USD 30,000, his reasoning being that “there’s a lot more people using it, there’s a lot more money coming in from the venture capital world.”

____

Learn more:

– Current ‘Trickle Into Bitcoin’ Could Become ‘A Torrent’ – Bill Miller

– 5 Key Trends to Watch in 2022 According to Grayscale CEO

– How Investors Should Approach Bitcoin, According to Ark Invest

– Bitcoin ETFs in Europe & Canada Remain Popular Even With US ETFs Widely Available

– MicroStrategy Spends Another USD 82m on Bitcoin

– Rising Number Of Investors Sell Stocks, Bonds To Buy Crypto – Survey

[ad_2]

cryptonews.com