In an unexpected move, Miles Grimshaw announced today that he is rejoining Thrive Capital after working as a general partner at Benchmark for the past three years.

Grimshaw first joined Thrive, a New York-based venture firm that Joshua Kushner founded, in 2013. He is returning as a general partner.

In a post on X, Grimshaw said that was “elated to re-join the team at Thrive” but that he also “looked forward to continuing to partner with Benchmark, as Thrive has for many years.”

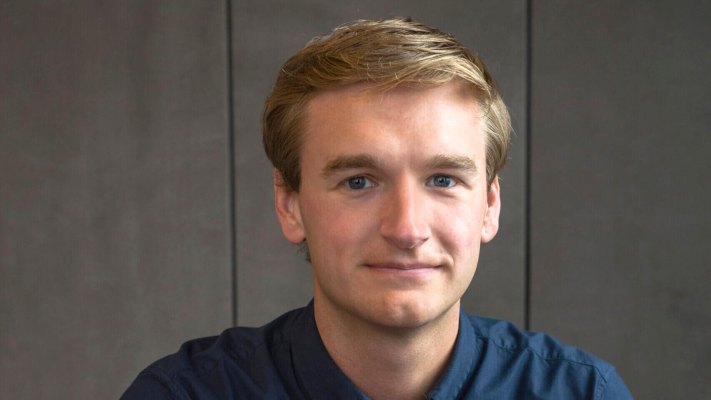

Image Credits: Thrive Capital

Kushner also shared the news on X, pointing out that during his previous time at Thrive, Grimshaw led investments in companies such as Airtable, Monzo (which raised another $430 million today), Lattice and Benchling.

He also wrote: “As we look ahead to the next chapter of the firm, and the extraordinary wave of innovation that lies ahead, Miles has a rare set of characteristics that make him a formidable partner to our founders.”

TechCrunch has reached out to both Grimshaw and Thrive for comment.

When joining storied venture firm Benchmark in December of 2020, then-29-year-old Miles Grimshaw became its fifth general partner. He had similarly joined a team of four other partners at Thrive back in 2013.

The Financial Times reported in January that Thrive Capital was “preparing to ask investors for at least $3bn in fresh capital after the New York venture fund made mammoth bets on technology start-ups last year.” For example, Thrive in 2023 put more money into payments giant Stripe in that company’s $6.5 billion raise, co-led a $300 million investment into fintech Ramp (at a lower valuation) and led a $25 million round into fintech Clair.

In February 2022, Thrive Capital, which was founded in 2009 by a then 25-year-old Kushner, announced it had closed its eighth fund with approximately $3 billion in capital commitments, $500 million of which it planned to invest in early-stage startups and another $2.5 billion that it had earmarked for later-stage companies.

techcrunch.com