[ad_1]

The trading volume across the major non-fungible token (NFT) marketplace OpenSea has been in a downtrend over the past week, possibly largely due to several incidents which led to users losing millions of dollars worth of digital assets.

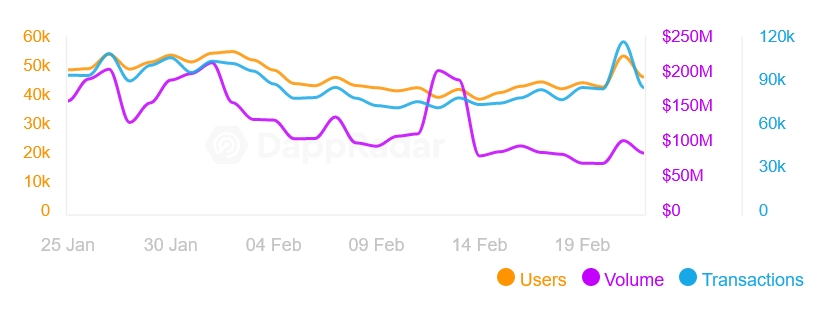

OpenSea’s trading volume is down more than 11% over the past day and more than 27% over the past week, according to data by DappRadar. Over the past 30 days, it is up 29%.

The platform processed around USD 87m worth of transactions on Tuesday, down from USD 161.7m seen 30 days ago, on January 25. Comparing Tuesday’s volume to that of January 25, it is down by more than 46%.

Interestingly, the number of transactions and users interacting with the platform has largely remained flat. On Tuesday, the marketplace processed 86,800 transactions from 47,030 users, compared to 95,300 transactions from 49,540 users on January 25.

The decrease in OpenSea’s volume may, at least in part, be attributed to the recent incidents.

In late January, due to an issue with the marketplace’s user interface (UI) design, some opportunists were able to purchase NFTs below their actual price. In a statement to Cryptonews.com, the marketplace detailed that the issue would arise when users create listings for their NFTs and then transfer the listed NFTs to a different wallet without canceling the listing.

“OpenSea cannot cancel listings on behalf of users. Instead, users must cancel their own listings,” OpenSea said at the time.

To tackle this issue, OpenSea released a smart contract update on Friday, requiring all users to move their listings on Ethereum (ETH) to the new smart contract.

Subsequently, however, it fell victim to a phishing attack, with some arguing that the issue might have been with the migration.

However, on Tuesday, the platform said that their contract migration tool has been ruled out as a vector for the attack, adding that it’s “safe to migrate your listings.”

Meanwhile, the daily trading volume across LooksRare, a rival to OpenSea, has declined sharply. On Tuesday, the platform processed USD 90.3m worth of transactions (compared to OpenSea’s USD 133.6m per this source) — down by 89% compared to its peak of USD 842.8m recorded on January 19, according to Dune Analytics.

As reported, NFT data aggregator CryptoSlam argued in late January that wash-trades constitute a huge portion of LooksRare’s volume.

____

Learn more:

– OpenSea Narrows Down List of Impacted Users, Still Looking for the Cause

– Texas Man Sues OpenSea Over Stolen NFT, Asks for Over USD 1M in Damages

– OpenSea Boosts Valuation 9X as This NFT Giant Sets Four Strategic Goals

– NFT Market Cools Down Once Again as Crypto Prices Heat Up

– ETHDenver Hackathon Finalists Aim at These Pain Points Across DeFi, NFTs, DAOs, and Metaverse

– What’s Still Holding NFTs Back & How to Fix It

[ad_2]

cryptonews.com