[ad_1]

If you’ve ever had to plan a large infrastructure project — like building a new section of a city or trying to figure out how much water and wastewater you need in a certain area — you’ve probably run into a few problems along the way. “But modeling and planning,” I hear you cry. “Isn’t that what computers are meant to be good at?”

Well, yes. No wonder, then, that Transcend scooped up a $20 million Series B round from Autodesk, among others.

It’s a brave new world of design that, frankly, I don’t know all that much about. But $20 million doesn’t lie, so let’s see where Transcend, er, transcends and where it remains painfully mortal.

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

The Transcend team shared its deck with us in a somewhat redacted state. I’m usually not a huge fan of that, but the team included as much of the deck as it could, with only minor edits. The redactions are as follows:

- Slide 11: Proprietary supply chain data point

- Slide 13: Product roadmap and financial projects per vertical

- Slide 14: Customer name, project names, revenue numbers and sale dates for OEM use case

- Slide 16: Financial objectives, including net revenue retention projections, CARR projections, ARR projections, cash flow margin projections and total capital projections

Apart from the above, the deck is as-pitched, so you should still be able to get a pretty good idea of the flow of the company’s narrative. This is the full breakdown of the slides in the deck:

- Cover slide

- Summary slide

- Problem and Solution slide

- Product slide

- Traction slide

- Benefits slide

- Virtual demo (video) slide

- Company/product history

- Differentiation slide

- Customer segment slide

- Value proposition per customer segment slide

- Market opportunity slide

- Product roadmap slide [redacted]

- Customer case study slide

- Team slide

- Use of funds slide

- Closing slide

Three things to love

The Transcend deck has a lot of really good examples. Here are my top three:

You spin me right out, baby, right out

It isn’t exactly rare for a startup to be spun out from another business, but telling the story of how and why that happened can be pretty tricky. But Transcend does it particularly well:

[Slide 8] An overnight success, 10 years later. Image Credits: Transcend

There’s usually a pretty good reason for a startup to spin out of a company. In this case, the tool at the center of Transcend is one that was built internally, before the company originating the tool realized that it might be useful for others. From product to product/market fit, via commercial validation, to a spinout that gets to build its own customer base can be an arduous path. The great thing, in this case, is that the spin-out was completed four years ago. Much of the risk associated with that part of the process should now have been resolved, but the benefits from being a 10-year-old product, rather than an energetic four-year-old should also be visible. Having this slide in the deck helps position the company in time and space (and answers the “why now?” question) .

Very well done!

Same tool, different benefits

Tools can be used for all sorts of things — that’s the beauty of a tool — but it’s difficult to explain that different target audiences can find value for different use cases.

[Slide 11] The design is giving me a cluster headache — but the information conveyed is great. Image Credits: Transcend

Let’s say very little about the design of this slide and focus on the content. Transcend does a good job showing how the different customer categories have different aspects of the business. In the market sizing slide, the company doubles down on how it is going to sell to all of these categories of customers; starting the conversation with what the benefits are is a great way to build a multilayered story.

Be careful, though: It’s great to have multiple categories of customers, but it’s easy for a startup to seem unfocused. Selling to schools is different from selling to hospitals or governments, and you often need different sales techniques for each. In this case, I’ll let Transcend off the hook; the number of organizations that have a need for infrastructure-scale design is probably limited, so outlining how the company can sell to multiple verticals at once helps tell the “Hey, the market size is totally reasonable” part of the story.

Apropos market size

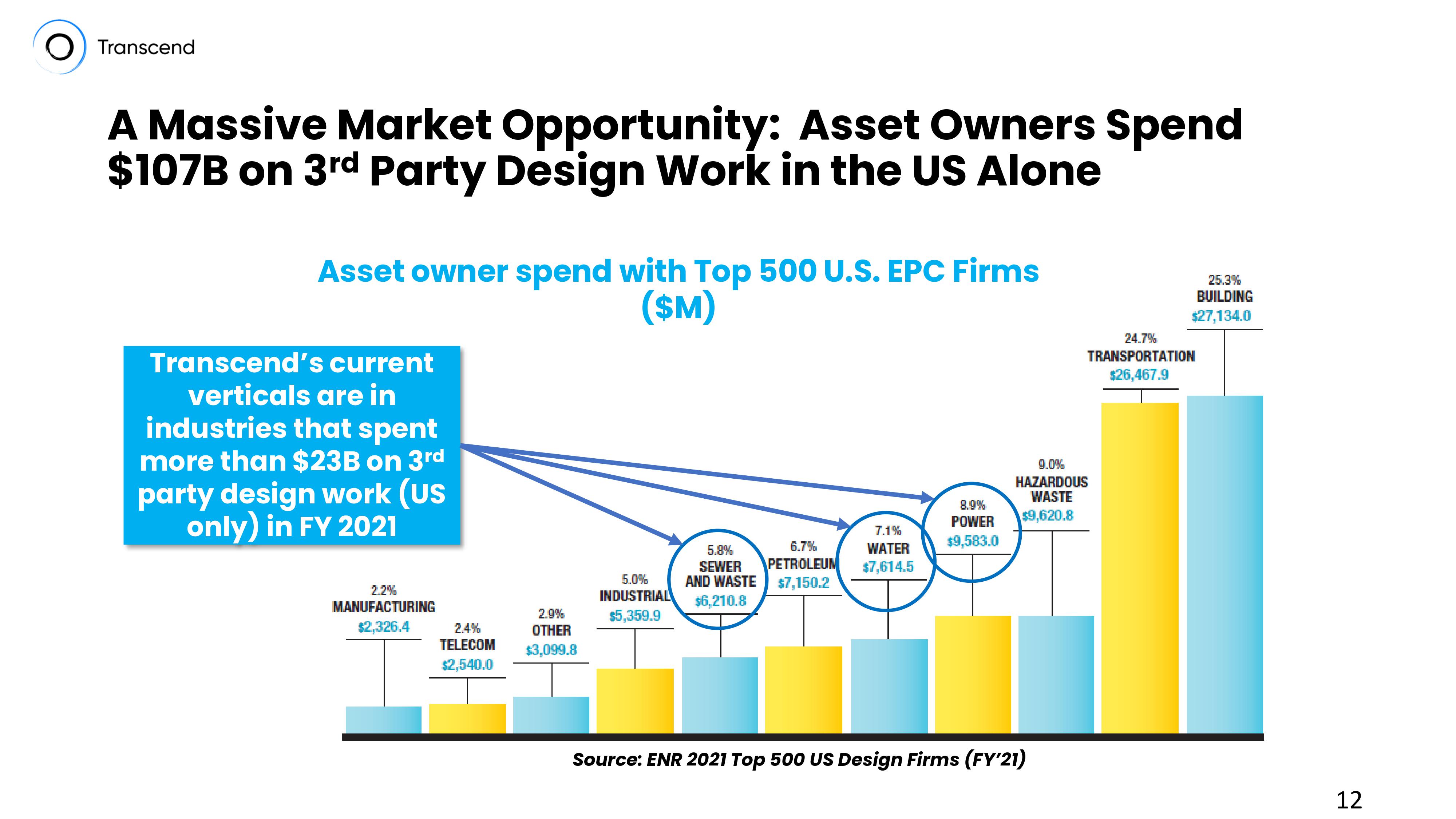

[Slide 12] Helloooo, market size(s). Image Credits: Transcend.

It’s a little odd to have a graph that seems to go up and to the right; you’d expect the Y axis to be “time.” That isn’t the case; this graph describes the various industries. Transcend focuses on three of them (sewer/wastewater, water, and power) and shows that it might potentially expand to others in the future.

Graphic and information design aside, I love that this slide gives a very clear indication of how big the opportunity is today, and how big it could grow if the company added additional verticals to its focus list. I don’t know this industry well enough to know whether the $100 billion+ spent on design work is a number that Transcend could realistically go after (in other words, if it sucks up the whole market share, would Transcend be a $100 billion per year company? That seems a bit ambitious, but I’m not actually sure how to sense-check that). Presumably, investors who are active in this space would immediately be able to know whether this is realistic.

As a startup, what you can learn here is to keep in mind that vertical expansions can offer huge opportunities. If relevant to your company, paint the picture — it can help illustrate the size of your ambition, and, ultimately, the opportunity to the investors.

In the rest of this teardown, we’ll look at three things Transcend could have improved or done differently, along with its full pitch deck!

[ad_2]

techcrunch.com