[ad_1]

There haven’t been many neobanks cropping up lately, so I was a little surprised to learn that Lupiya recently raised a $8.3 million Series A. The company claims it is trying to make the world better “by creating a landscape that promotes an economically empowered Zambia.”

For the 69th installment (nice!) of the Pitch Deck Teardown series, let’s take a peek at how Lupiya told its story to close this round.

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

Lupiya’s deck is impressively compact at just 10 slides. A compact deck makes for a great way to tell the story quickly, but it also means you risk missing a couple of things.

The company said it has edited its traction slide to protect some sensitive details, but it did share some of the numbers with me in confidence. Suffice it to say the company has some pretty impressive metrics to back up its progress since it was founded in 2016.

Here are the slides in the deck:

- Cover slide

- Problem slide

- Solution slide

- Market size slide

- Business model slide

- Competition slide

- Traction slide

- Team slide

- Ask and use of funds slide

- Closing slide

Three things to love

There are always going to be some pieces missing in a 10-slide deck, but overall, I’m extremely impressed by what’s there. Here are three highlights:

A clear, metrics-forward problem statement

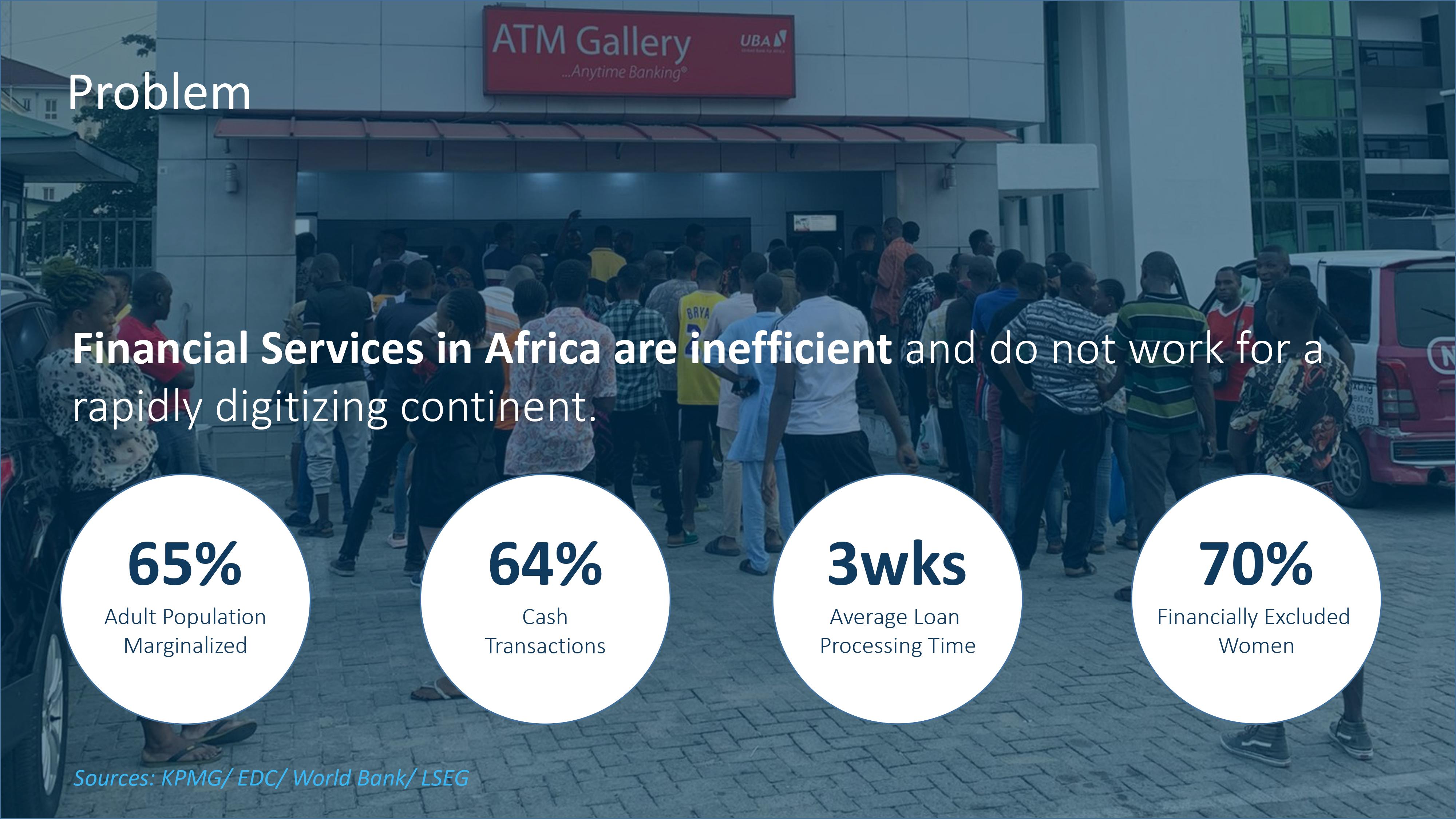

[Slide 2] Problem slide. Image Credits: Lupiya

A lot of startups give in to the temptation to only state the problem (“Financial services in Africa are inefficient”) and forget to bring the receipts.

Well, take a leaf out of Lupiya’s book: Bring the numbers to show the scope and severity of the problem. It’s almost like a sneaky preview of the market size rolled in with the problem statement. Very well done.

Clear and clean business model

I don’t know about you, but I found it pretty interesting to see the numbers Lupiya has baked into its business model, especially when compared to the numbers I’m used to from banking services elsewhere in the world:

[Slide 5] Business model. Image Credits: Lupiya

As an investor who’s not from the region, I’d be curious to know what the average deal offering is across the area. Is a 10% service fee and 8% interest common? Is that market rate or a competitive edge?

In any case, I like a good, clean, simple business model, and this ticks that box.

Solution brevity

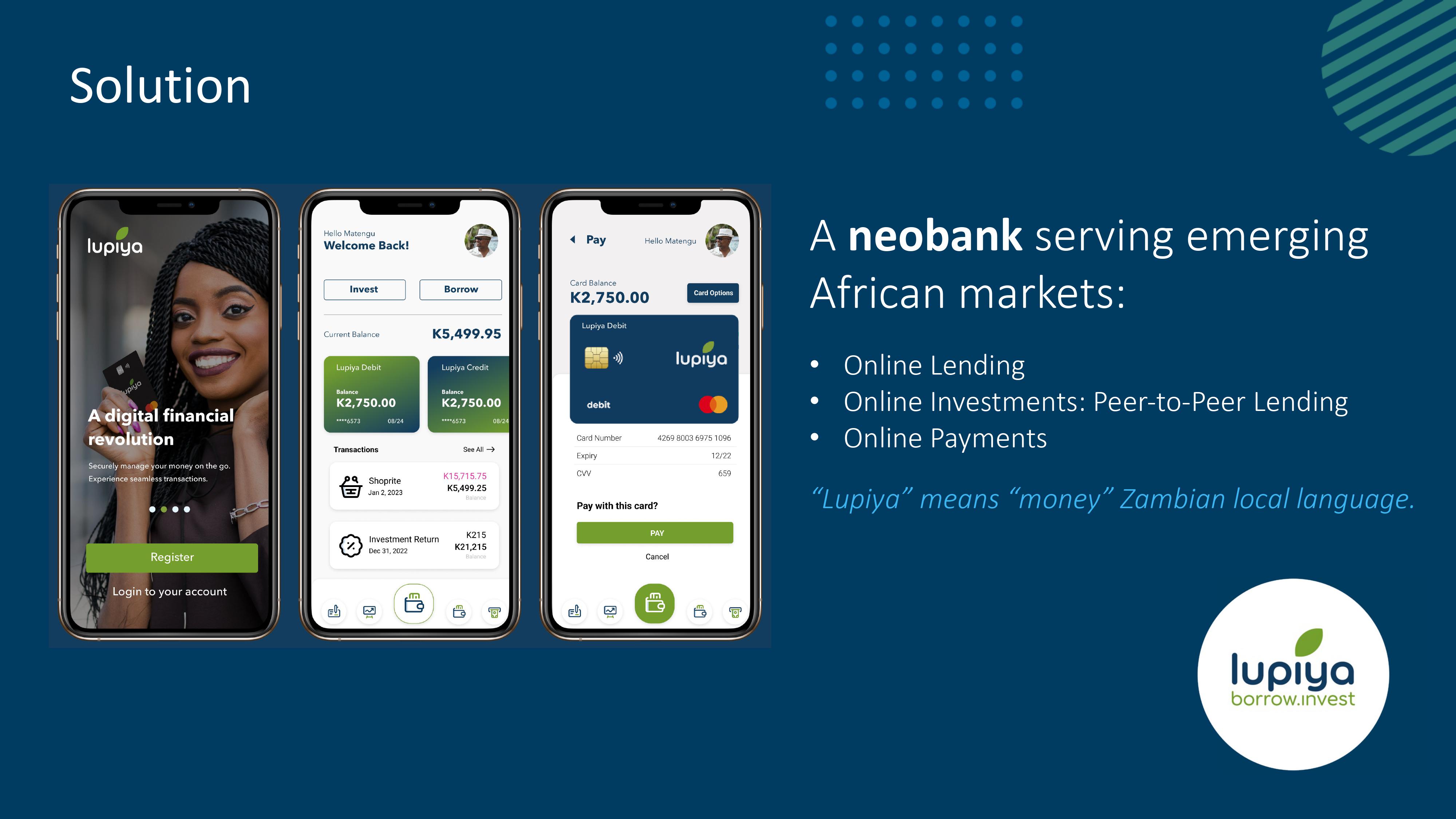

[Slide 3] Solution / product slide. Image Credits: Lupiya

I often argue that startups spend way too much time on their product slides, so I was impressed with Lupiya’s execution on this front. It shies away from the desire to include pages upon pages of details about its product, instead summarizing the whole thing with three screenshots and three bullet points. In the vast majority of cases, that’s enough for the first pitch; you can always demo the product in a later meeting. Very well done.

In the rest of this teardown, we’ll take a look at three things Lupiya could have improved or done differently, along with its full pitch deck.

[ad_2]

techcrunch.com