Smartphone sales will mount a comeback starting in 2024, defying growing warnings of a prolonged slump across the mobile sector, according to separate projections by Goldman Sachs and Morgan Stanley reviewed by TechCrunch.

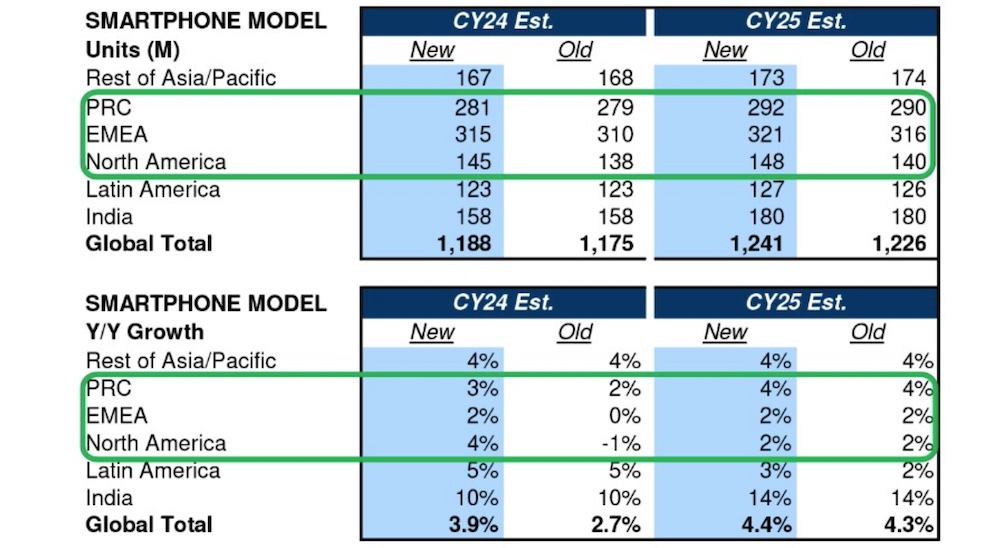

Morgan Stanley’s report predicts global smartphone shipments will rebound by nearly 4% in 2024 and by 4.4% in 2025, shrugging off comparisons to the PC industry’s multi-year downdrafts.

Driving the smartphone turnaround will be new on-device AI capabilities unlocking fresh demand, Morgan Stanley says. The investment bank raised its projections for 2025 worldwide phone volumes, citing the sizable potential of so-called edge AI to enable advances from enhanced photography to speech recognition while protecting user privacy.

Smartphone makers including Apple, Vivo, Xiaomi and Samsung have already started to express their bullishness on AI. Vivo’s new X100 with on-device AI saw explosive sales, while Xiaomi touted 6x usual volume for its AI-packed flagship. Samsung plans built-in generative AI for 2024 models, aiming to offer ChatGPT-style features processed directly on phones, not the cloud.

“The largest pushback is that there is no visibility on when the ‘killer app’ will be developed. If we take desktop internet and mobile internet as examples, the emergence of a new killer app usually comes 1-2 years after the initial breakthrough,” Morgan Stanley wrote in a report this week.

“While there is no guarantee that the killer app in Edge AI will follow the same timetable, the emergence of Microsoft’s CoPilot as the potential PC AI killer app could set the early foundation for popularizing AI at the edge (implying AI features/function on the device, not relying on cloud), and help to give investors confidence that a similar, but different, killer app for the smartphone will also emerge.”

Smartphone projection by Morgan Stanley. India is the only market slated for a double digit growth. (Chart and data: Morgan Stanley)

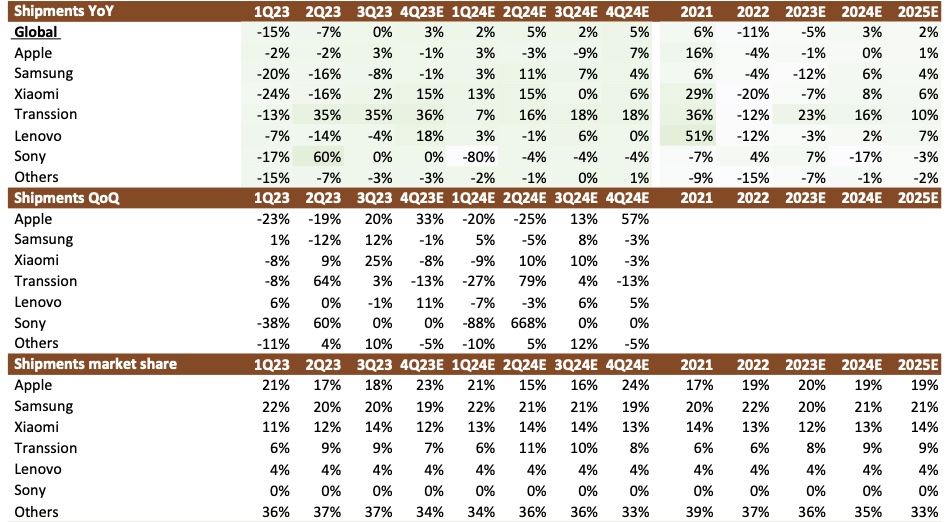

Goldman Sachs estimates that global smartphone volumes in 2023 will end at a 5% y-o-y dip to 1.148 billion units, down from an estimated 1.206 billion phones shipped last year. The 2023 decline would mark a second straight annual drop following much steeper falls in 2022.

But Goldman said momentum will rebuild in 2024 and 2025, fueled by new product launches. It forecasts worldwide smartphone shipments rising 3% to 1.186 billion in 2024, then climbing another 5% to 1.209 billion in 2025.

“With the holiday season and continuous restocking, along with better guidance from the supply chain on a market recovery, we revised up 2023-25E smartphone shipments; however, we continue to expect low single digit growth in 2024-25E, and global smartphone shipment to gradually get back to the 2022A level by 2025E,” Goldman Sachs analysts wrote.

The brightening mobile outlook diverges from consensus views that maturing smartphones face similar inertia and substitution threats as personal computers over the last decade. But Morgan Stanley said replacement cycles and use cases still favor mobile phones.

“Tablets and smartphones have been taking share from PCs since 2011. In other words, PC shipment declines have been caused by the emergence of new devices, not the disappearance of demand in general. We do not see smartphones facing a similar substitution risk from technologies like AR/VR anytime soon. Smartphone replacement cycles are shorter because they are used more frequently and have smaller batteries. Use cases for smartphones are still expanding, with Edge AI set to unlock a new wave of innovation.”

Goldman Sachs’ projections for top smartphone vendors. (Chart and data: Goldman Sachs)

techcrunch.com