[ad_1]

The crypto market experienced a bloodbath on Feb 18, as Bitcoin (BTC) was dropping below the psychological price of $40,000 for the first time in two weeks.

The leading cryptocurrency has been choppy since it set a new all-time high (ATH) of $69,000 in November 2021, but it has been trying to find its right footing ever since.

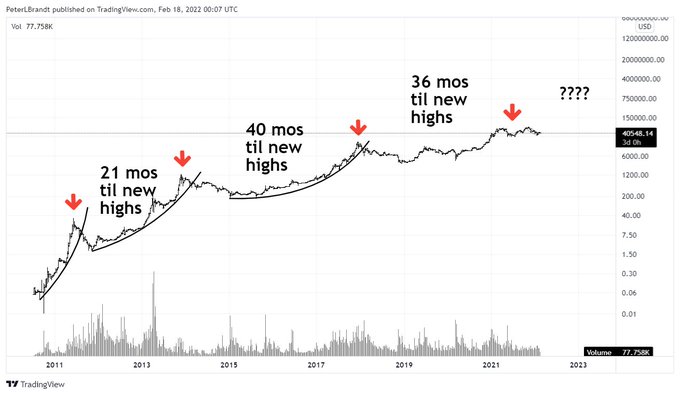

Veteran analyst Peter Brandt believes that new ATHs take quite some time before being realized; thus, long-endurance is of the essence. He explained:

“Bitcoin – major highs and length to exceed them Cheerleaders who constantly beat the drums of ‘to the moon’ are doing a huge disservice to BTC investors. Corrections can be lengthy, long endurance, not constant hype, should be the message.”

Source: TradingView

Therefore, market forces play an instrumental role in determining how the price move. For instance, daily active addresses have been below the highs experienced in a bull market.

Market insight provider Glassnode stated:

“There are currently ~275k daily active entities on the #Bitcoin network. This level of activity is far below bull market highs, indicative of tepid demand from new users. However, the activity floor continues to climb in bearish markets, reflecting longer-term network effects.”

Source: Glassnode

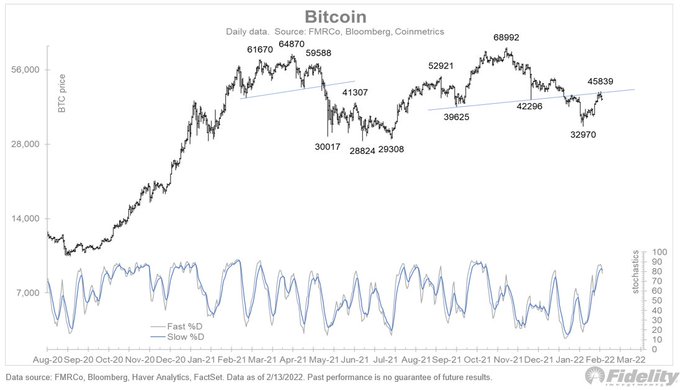

Bitcoin has also been trading in a broad range between the $30K and $65K range for nearly a year.

Source: Fidelity

With a price of $39,125 during intraday trading, it remains to be seen how the top cryptocurrency plays out in the short-term because previous analysis showed that BTC had to break the $44.5K resistance for sustained bullish momentum.

Meanwhile, the legalization of Bitcoin in Ukraine amid tension with Russia reaches a fever pitch. The legislation called “Law of Ukraine on Virtual Assets” is seen as a stepping stone towards more crypto investments.

Image source: Shutterstock

[ad_2]

blockchain.news