[ad_1]

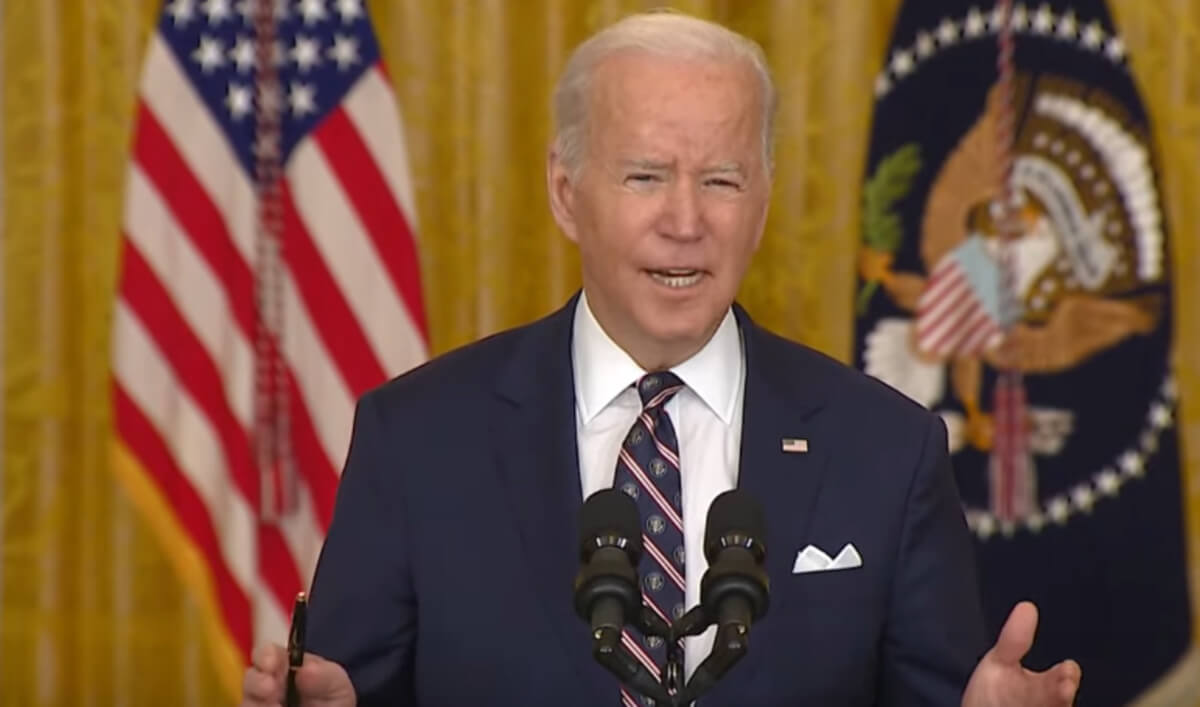

While the US President Joe Biden is reportedly set to sign a new crypto- and central bank digital currency (CBDC)-related executive order, the European Union is set for a vote on the much-discussed Markets in Crypto Assets (MiCA) framework.

Biden is expected to sign an executive order this week, mandating several federal agencies to explore the national security and economic impact of digital assets, as well as to study the ramifications of creating a CBDC.

The order would set a 180-day deadline for the agencies, which includes the Treasury Department, Commerce Department, National Science Foundation, and national security agencies, to deliver reports on digital assets and “the future of money,” Reuters reported, citing people familiar with the matter.

“We could see a significant shift in policy in 180 days. This is a likely step toward creation of a central bank digital currency,” the report said.

More specifically, the order is expected to ask the Department of Justice to explore whether a new law is needed to address digital assets, while the Federal Trade Commission, the Consumer Financial Protection Commission, and other agencies would mainly focus on the impact on consumers.

The order comes as concerns around the use of cryptoassets by “[Vladimir] Putin and his cronies” to evade international economic sanctions have heightened.

“Criminals can use cryptocurrency to move money in the shadows, opening a door for Putin & his cronies to evade economic sanctions,” said Senator Elizabeth Warren, asking the US Treasury to ensure crypto does not undermine the efficiency of sanctions.

Notably, crypto veterans have disavowed this claim, arguing that crypto’s transparent nature makes it an inefficient tool for sanctions evaders.

“Digital assets can actually enhance our ability to detect and deter evasion compared to the traditional financial system,” said Paul Grewal, Chief Legal Officer (CLO) of major crypto exchange Coinbase.

In the EU, meanwhile, the Monetary Committee of the European Union’s parliament has scheduled a vote on the Markets in Crypto Assets (MiCA) framework on March 14 after the submission of a final draft of the bill.

An earlier draft of the bill included wording that could have banned proof-of-work (PoW) cryptoassets like bitcoin (BTC). However, Stefan Berger, a member of the European parliament in charge of shepherding MiCA, has claimed that “an independent discussion” of PoW is no longer planned.

“With MiCA, the EU can set global standards,” a rough translation of Berger’s tweet reads. “Therefore, all those involved are now asked to support the submitted draft & to vote for MiCA. Strong support for MiCA is a strong signal from the EU Parliament for a technology-neutral and innovation-friendly financial sector.”

Berger argued that the MiCA framework offers a “crypto regulation that is a pioneer in terms of innovation, consumer protection, legal certainty and the creation of reliable supervisory structures in the area of crypto assets.”

____

Learn more:

– Council of European Union Advances Talks On MiCA, DORA Regulations

– Germany-Led Group Wants a New EU Watchdog to Regulate Crypto Firms

– US Fed Wants Answers To 22 Questions About Digital Dollar

– US Regulator Launches Probe Into NFT Sales

– Washington, Europe Vow to Target Russian Crypto Sanctions Evasion Efforts

– Crypto Can Better Deter Sanction Evasion Compared to TradFi – Coinbase

[ad_2]

cryptonews.com