[ad_1]

2022 is here, and it’s time to take a look at how the market has performed not just over the past month, but also in the 4th quarter of 2021, and during the full year behind us. And to summarize it all in one sentence: 2021 was mostly a good year for the crypto market, although it certainly saw its fair share of volatility.

Starting with the first half of 2021, market participants would probably say that the most memorable about this period was the epic rise in the price of both bitcoin (BTC) and many altcoins, which was followed by a crash in BTC of more than 50% between April and May.

However, a number of important events also took place during the first half of the year. Among these was the craze surrounding dogecoin (DOGE), which entered a parabolic rally to an all-time high of USD 0.74 in May, Tesla chief Elon Musk announcing that his company added USD 1.5bn worth of BTC to its balance sheet, and the beginning of “the great migration” of bitcoin miners out of China.

Moving forward and into the second half of 2021, July barely managed to end up in the green zone after most coins had fallen early in the month. At this point, however, the party had already ended for DOGE holders, who saw their favorite meme coin fall by 14% for the month (as the only coin in the top 10 that was down that month).

In August, decentralized finance (DeFi)-related tokens and smart contract platforms that aim to compete with Ethereum (ETH) stood out as the biggest winners. Cardano (ADA) and polkadot (DOT) both roughly doubled in price this month, while solana (SOL) saw a 250% rally.

Next, September was marked by two of the biggest stories of the entire year — namely the implementation of the law that made bitcoin legal tender in El Salvador, and China banning nearly all things crypto once again.

October, dubbed “Uptober” by the community, was – as the name suggests – a good month for the crypto market. Bitcoin holders could watch their coin touch the USD 67,000 mark for the first time, while the “dogecoin killer” shiba inu (SHIB) for the first time entered the top 10 list of the largest coins by market capitalization.

November was the month when both BTC and ETH reached their all-time highs, with BTC hitting USD 69,000 and ETH reaching close to USD 4,870. However, November was also the month when the meme coin craze ended (for now), with DOGE and SHIB down by 21% and 34%, respectively, for the month.

Lastly, the month of December saw mostly lower prices for major cryptocurrencies, with BTC and ETH both down by close to 20% for the month. The month was further marked by the confirmed failure of many of the most bullish BTC price predictions for 2021. Among these, bitcoin analyst PlanB’s “worst case” bitcoin price target for the end of 2021 of USD 135,000 is perhaps the best-known example.

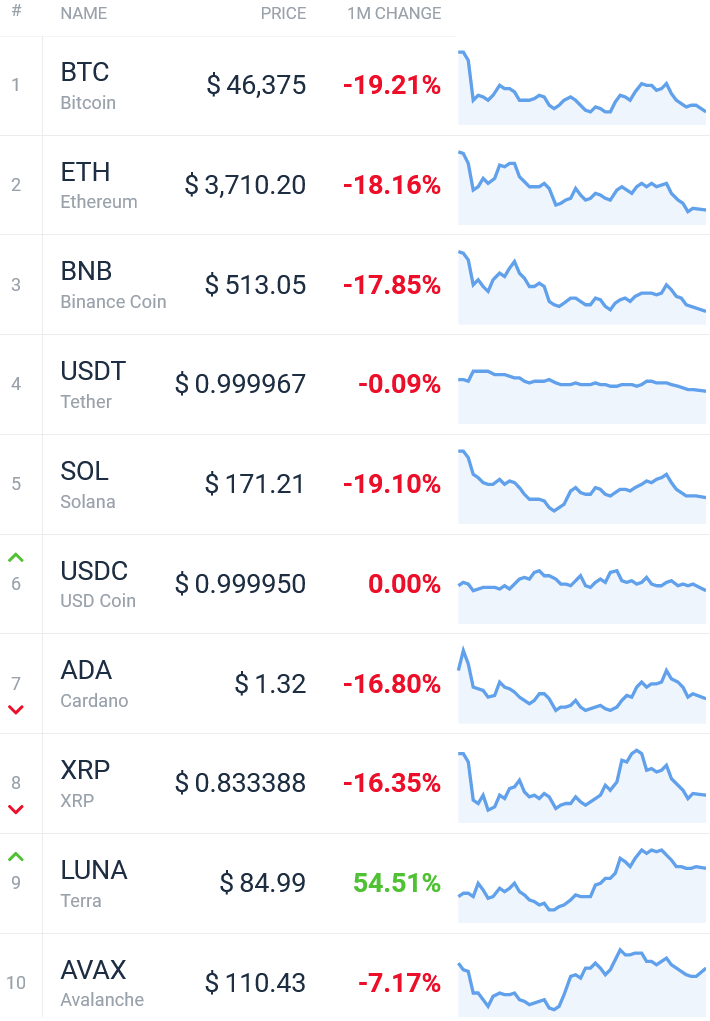

Top 10 coins in December, Q4 and 2021

The crypto market on the whole ended December in the red, with all coins in the top 10 seeing lower prices, with the exception of terra (LUNA), which gained nearly 55%.

The gain for LUNA came as Dan Morehead, CEO and founder of crypto investment fund Pantera Capital, in late December called it “one of the most promising coins for the coming year,” while adding that “so many people are just discovering it.”

Perhaps surprisingly, the biggest loser out of the top 10 coins this month was not some hyped-up altcoin, but rather bitcoin itself, with a drop of 19.2%. The largest cryptocurrency was closely followed by Solana’s SOL token, which fell by 19.1% for the month.

Binance’s exchange token binance coin (BNB), which was one of the strongest performers in November, dropped by nearly 18% in December.

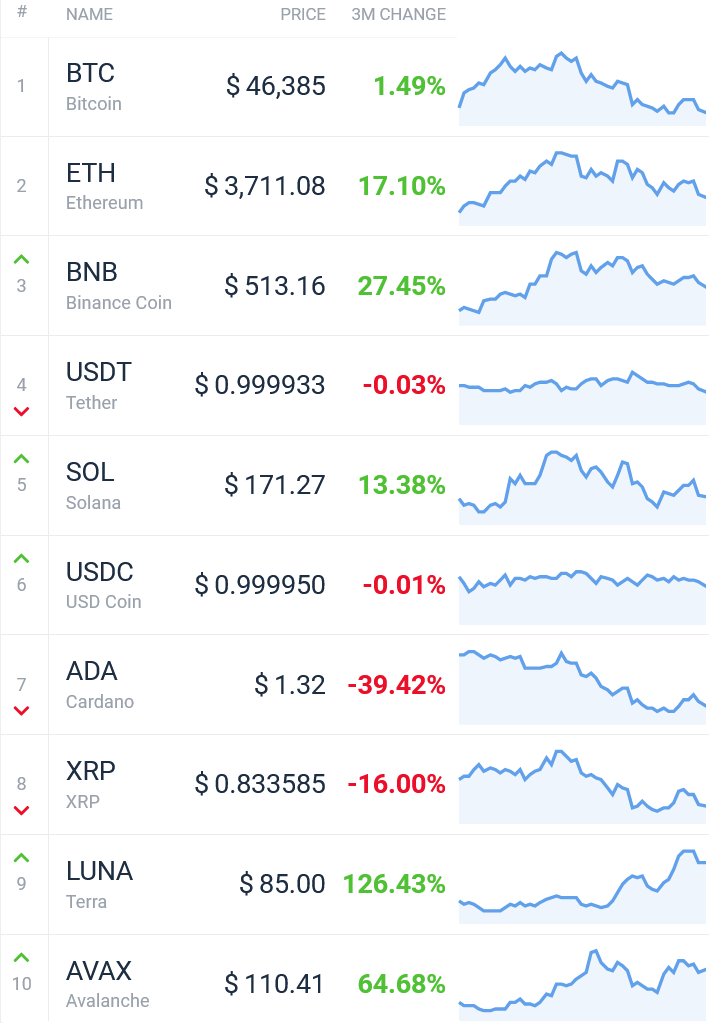

Moving further into the past to look at overall performance in the fourth quarter, we get more of a mixed picture.

In terms of quarterly performance, we can see that BTC barely managed to end up in the positive zone with a gain of merely 1.49%. At the same time, ETH rose by 17%, while LUNA was the strongest performer with a 126% rise.

The biggest loser for the quarter was Cardano’s native token ADA, which fell by almost 40%.

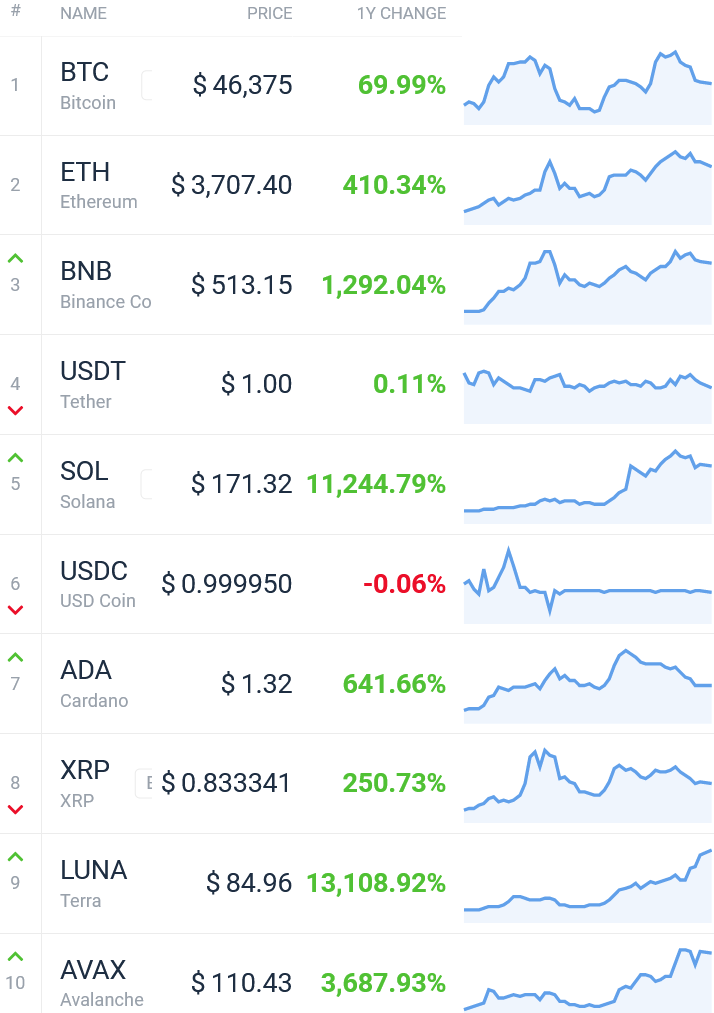

Looking at 2021 as a whole, we can see that two of the hottest tokens this year, LUNA and SOL, have both seen gains that dwarfed all others in the top 10.

The stablecoin protocol Terra’s LUNA token rose by more than 13,100%, while smart contract platform Solana’s SOL token rose by over 11,200%. The massive gains for the two altcoins compare to a relatively pale yearly gain of around 70% for BTC and a larger, 410% gain for ETH.

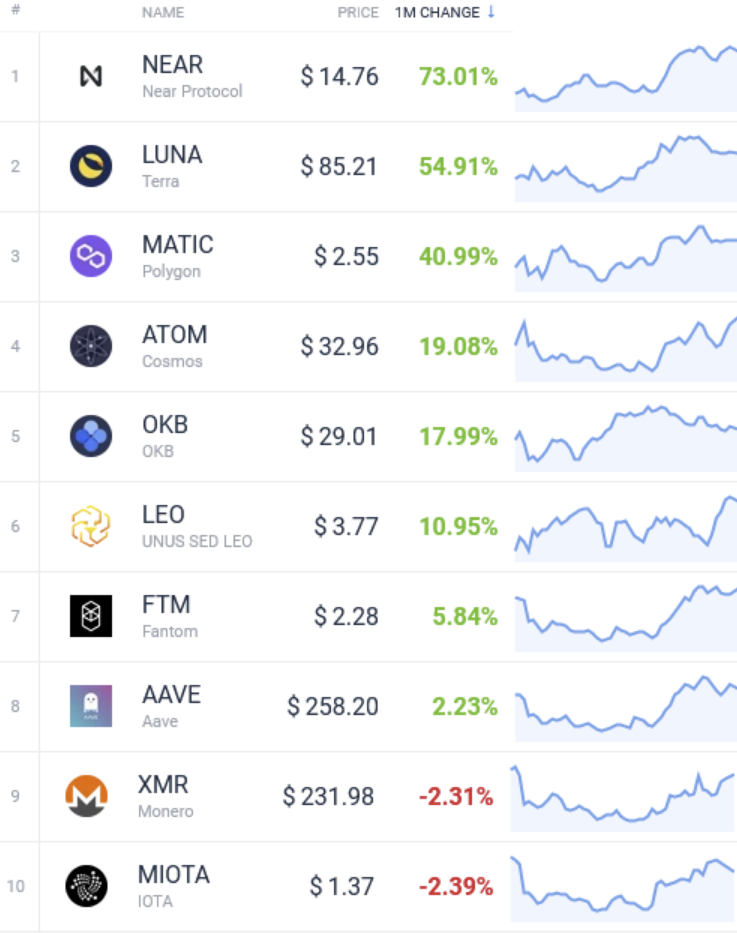

Best from the top 50 in December

Best from the top 50 in December was Near Protocol’s NEAR token, which rose by 73% for the month. Besides NEAR, Ethereum sidechain Polygon and its native token MATIC rose by 41%, while cosmos (ATOM) gained 19%.

Worst from the top 50 in December

In terms of the worst performers in December, internet computer (ICP), a project that rose quickly in value after it was launched in May 2021, fell by 41% for the month. The sharp monthly drop for ICP was followed by elrond (EGLD) and filecoin (FIL), which fell by 39% and 37%, respectively.

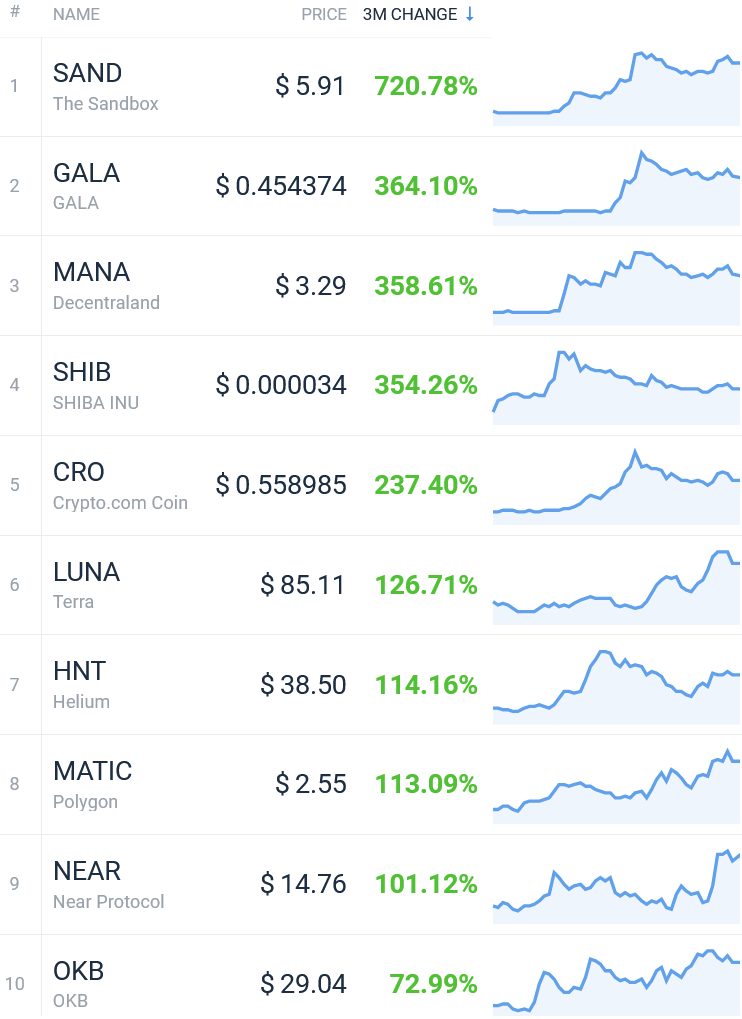

Best from the top 50 in Q4

Best out of the top 50 coins by market capitalization during the 4th quarter of 2021 was the sandbox (SAND), which gained an impressive 720% during the three months of October, November, and December. The gains came as the crypto-based gaming platform hosted a major play-to-earn event in late November, and amid reports that the value of virtual land in The Sandbox has skyrocketed.

Following SAND, GALA, decentraland (MANA), and shiba inu were other hot tokens during the quarter, with all three rising between 354% and 364%.

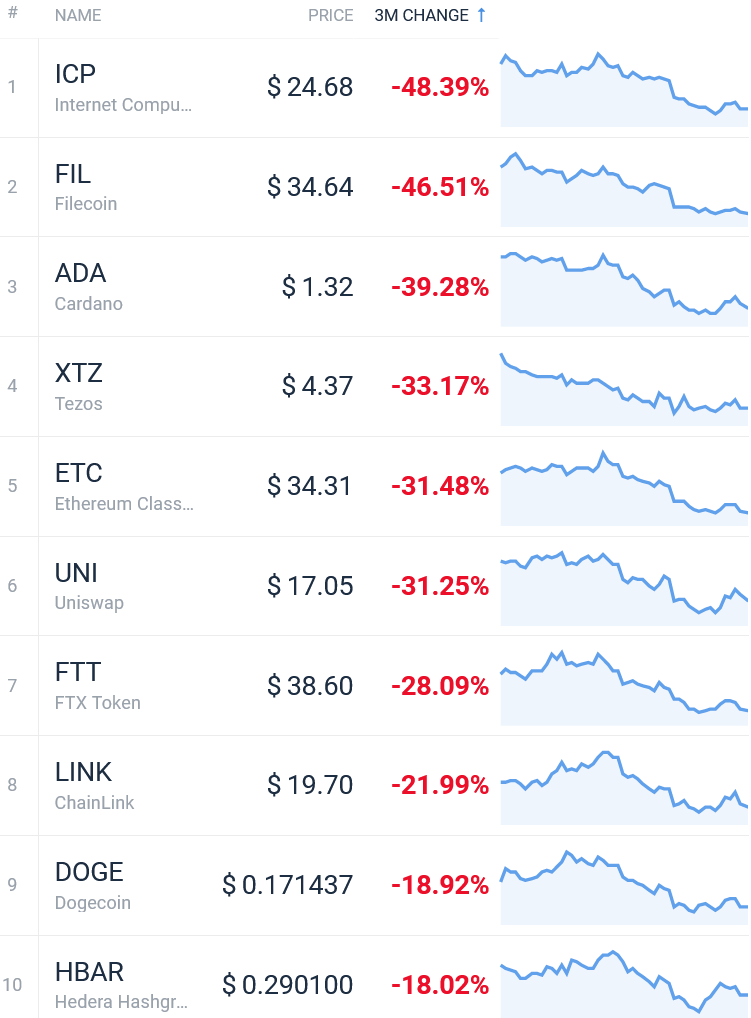

Worst from the top 50 in Q4

As the worst performer in the 4th quarter, we once again see ICP, which was also December’s worst investment. In terms of other coins outside of the top 10, tezos (XTZ) saw a fall of more than 33%, while the Ethereum fork ethereum classic (ETC) dropped by 31.5%.

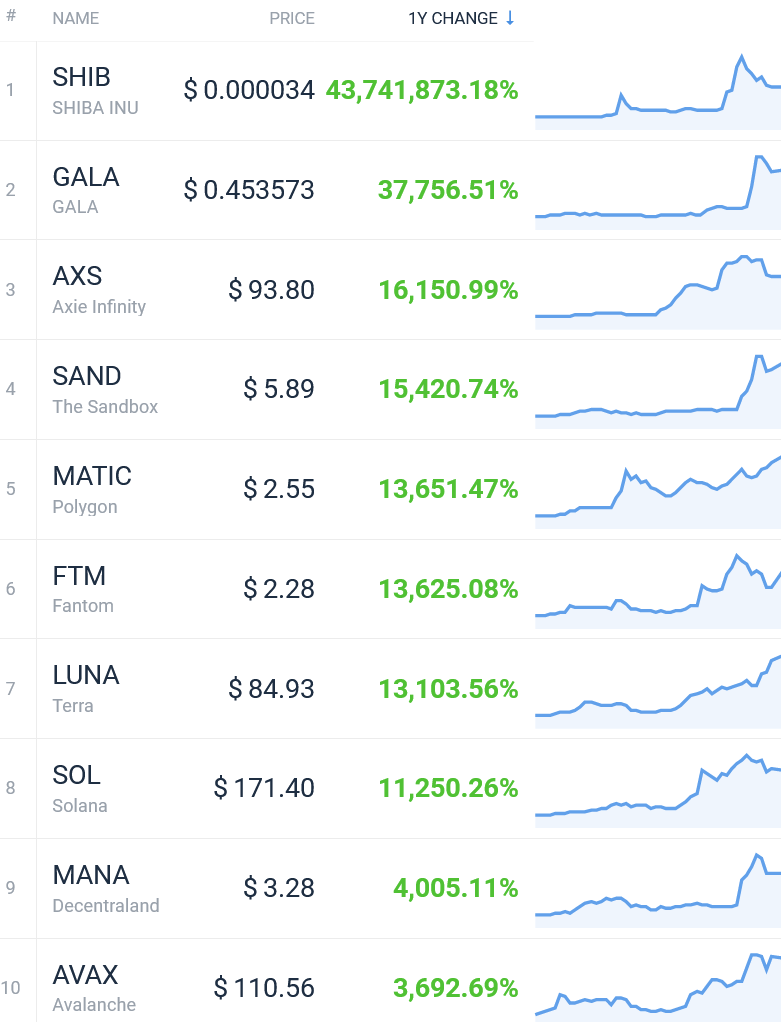

Best from the top 50 in 2021

Zooming out even more to cover the entire year, there’s no question who this year’s top performer was — namely shiba inu. The popular Ethereum-based meme coin and self-proclaimed “dogecoin killer” rose by well over 43 million percent. It moved from being practically worthless at the beginning of the year, to reach a market capitalization of over USD 18.3bn as of the end of 2021.

Following SHIB, other notable performers include the popular play-to-earn game Axie Infinity’s utility token AXS, which rose by 16,150%, and smart contract protocol Fantom’s FTM token, which rose by over 13,600%.

Worst from the top 50 in 2021

In terms of the year’s worst performers, ICP again stands at the top, with a yearly decline of 92%. Other than that, however, the yearly overview illustrates well how strong the crypto market has been over the past year, with not a single other coin in the red (not taking minor changes for some stablecoins into account).

Despite being up for the year, however, some coins performed worse than many had argued they would. Among these were litecoin (LTC), which rose by just 14.6% for the year, and the bitcoin fork advocated by the early bitcoin evangelist Roger Ver, bitcoin cash (BCH), which rose by nearly 23%.

Winners & losers from top 100 in 2021

From the top 100, SHIB, GALA, and AXS once again top the list of the best performers. Among other coins not mentioned elsewhere in the article, the digital collectibles platform ECOMI (OMI) saw a yearly gain of 15,591%, while the smart contract protocol Kadena’s KDA token rose by just over 8,200%.

In terms of the weakest performers among the 100 most valuable coins in the market which haven’t already been mentioned, safemoon (MOON) – the coin that promises to bring holders “safely to the moon” – dropped by more than 56% for the year, while olympus (OHM) and NEM (XEM) dropped by 49% and 45%, respectively.

Bitcoin SV (BSV), the bitcoin fork promoted by self-proclaimed Bitcoin creator Satoshi Nakamoto, Craig White, dropped by close to 27% for the year, to a price of USD 121 per coin.

____

Learn more:

– Bitcoin and Ethereum Price Predictions for 2022

– Crypto Adoption in 2022: What to Expect?

– 2022 Crypto Regulation Trends: Focus on DeFi, Stablecoins, NFTs, and More

– DeFi Trends in 2022: Growing Interest, Regulation & New Roles for DAOs, DEXes, NFTs, and Gaming

– Crypto Security in 2022: Prepare for More DeFi Hacks, Exchange Outages, and Noob Mistakes

– How Global Economy Might Affect Bitcoin, Ethereum, and Crypto in 2022

– Crypto Exchanges in 2022: More Services, More Compliance, and Competition

– Crypto Investment Trends in 2022: Brace for More Institutions and Meme Manias

Find more predictions for 2022 here.

[ad_2]

cryptonews.com