[ad_1]

The UK Parliament has passed a bill that allows law enforcement authorities to seize cryptocurrencies associated with illicit activities.

This includes investment scams, hacks, terrorism financing, money laundering, and drug trafficking.

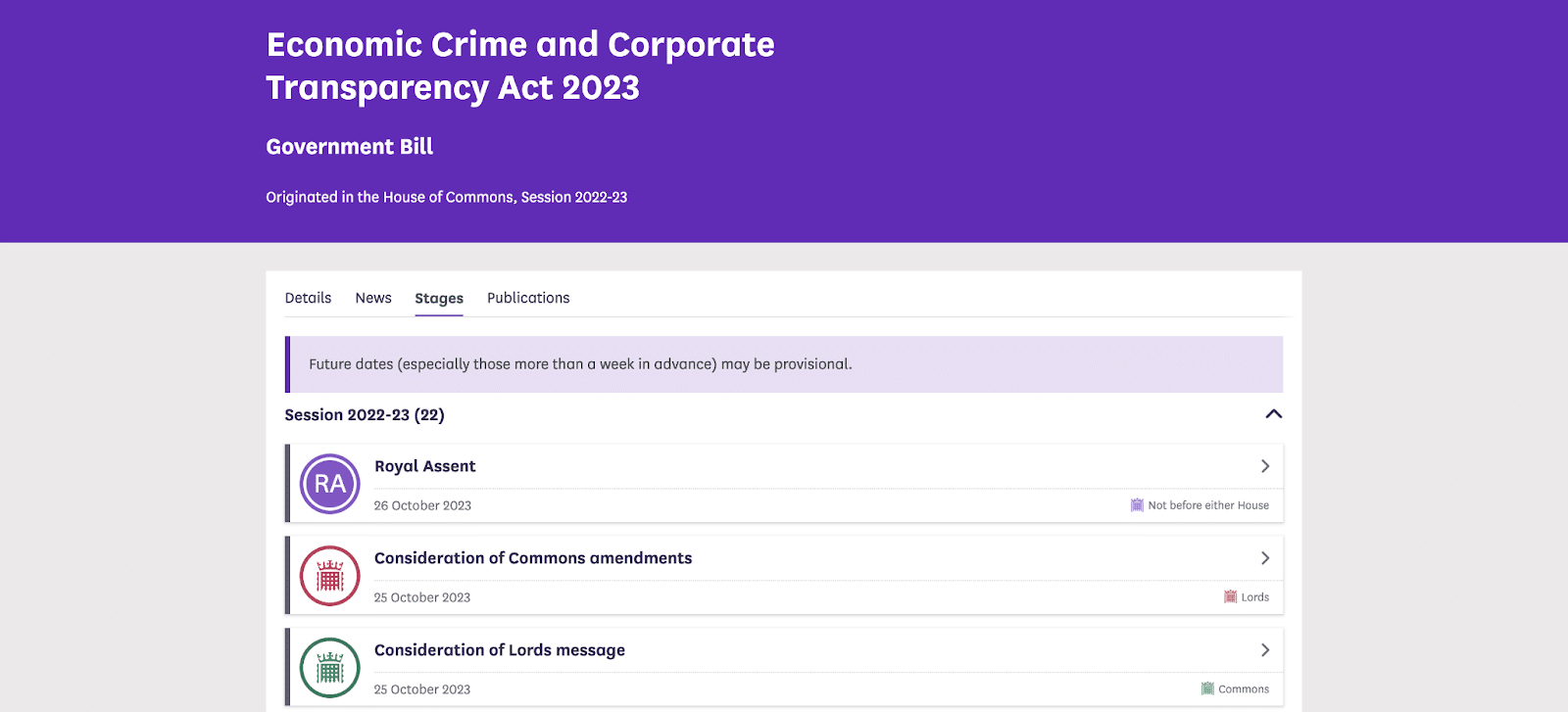

Per an official announcement on its website, the new bill, dubbed the ‘Economic Crime and Corporate Transparency Act,’ will expand the authority of local law enforcement to clamp down and recover digital assets linked to cybercrimes.

Today the Economic Crime Act became law.

This is landmark legislation that should significantly strengthen Britain’s defences against fraud and money laundering, clamping down on those who abuse our economy for their own private gain.

📹 @duncanhames pic.twitter.com/jR0Y3dHitB

— Transparency International UK (@TransparencyUK) October 26, 2023

The Economic Crime and Corporate Transparency Bill was passed on October 25 and received formal approval (Royal Assent) on October 26.

One of the bill’s provisions is the confiscation of digital assets linked to illicit activities without conviction. Additionally, the law intends to combat using cryptocurrencies to fund terrorism.

This is an issue the United States is facing with the ongoing post-Isreal war with Hamas, a military Sect in Palestine.

In the past, law enforcement in the UK had to wait for a successful prosecution before seizing digital assets.

However, the new legislature offers a much quicker solution that empowers local enforcement units to process crypto-recovery actions.

The bill was originally introduced in September 2022 but has now been revised to encompass terrorism-related crimes and assist authorities in tracking transactions.

Despite the UK’s efforts to support and promote the cryptocurrency industry, it has integrated stringent laws and intensified efforts to mitigate crypto crimes.

The UK’s Economic Crime Plan Suffers Limitation

While the Parliament is making headway with laws, the Financial Conduct Authority (FCA) is encountering difficulties regulating cryptocurrency firms that violate its new regulations.

Recently, global exchange Binance had to shut down the registration of new customers in the UK due to the FCA suspending RebuildingSociety.

According to a statement by the FCA on October 25, crypto firms have breached the marketing rules up to 221 times.

Find out the 3 common issues we’ve identified with #cryptoasset financial promotions.

Consumers should check the FCA Warning List before making any investment in #cryptohttps://t.co/CKn4cFxb11

— Financial Conduct Authority (@TheFCA) October 25, 2023

The UK regulator’s latest announcement comes after it reported the issuance of 146 alerts on October 9 due to the breaches of its promotion rules 24 hours after they were enacted.

Rather than provide standard information about risks associated with assets offered, trading platforms keep making claims about safety, security, and the ease of crypto trades.

Before this latest rule breach, the UK’s financial watchdog integrated a stringent financial promotion framework on October 8, requiring exchanges to stop promoting faux trading investment schemes to entice residents.

The new rules cite that crypto-related advertisements can only be promoted or approved by FCA-authorized firms and apply to all businesses, even those without a UK presence.

The promotions must have detailed information on assets and trading risk and not use incentives like referral bonuses and memes to lure trades to invest.

Failure to provide accurate marketing information to traders included penalties such as fines and potential jail terms.

In addition, offenders face being added to the regulator’s warning list, which already contains Huobi, KuCoin, and 143 other exchanges.

While FCA lacks the wits to keep crypto platforms in check, collaborations with app stores, social media platforms, domain name registers, and search engines are in motion to stop the flow of operations on banned platforms.

[ad_2]

cryptonews.com