[ad_1]

Stablecoin “whale wallets” containing more than USD 1m controlled the lion’s share of stablecoin volume in 2021, despite the once-dominant Tether (USDT) increasingly being challenged by other stablecoins, according to on-chain analytics firm Nansen.

In their recent report, the analysts said that whale wallets made up more than 50% of total stablecoin volume in 2021, which the firm suggested is due to the Ethereum (ETH) network becoming “a playground for whales,” likely thanks to high transaction fees driving smaller players away.

Further, the report said that the dominance that Tether has enjoyed in the stablecoin market has been challenged by several smaller stablecoins over the past year, partly due to “increased regulatory scrutiny” on the top stablecoin.

Among these smaller stablecoins was USD Coin (USDC), which has “found its niche as the preferred stablecoin in decentralized trades,” with the coin catching up with USDT in terms of on-chain volume in 2021.

Additionally, Pax Dollar (USDP) was also highlighted by Nansen, with the firm noting that it grew 6-fold in 2021, making it one of the top 5 stablecoins on the Ethereum network.

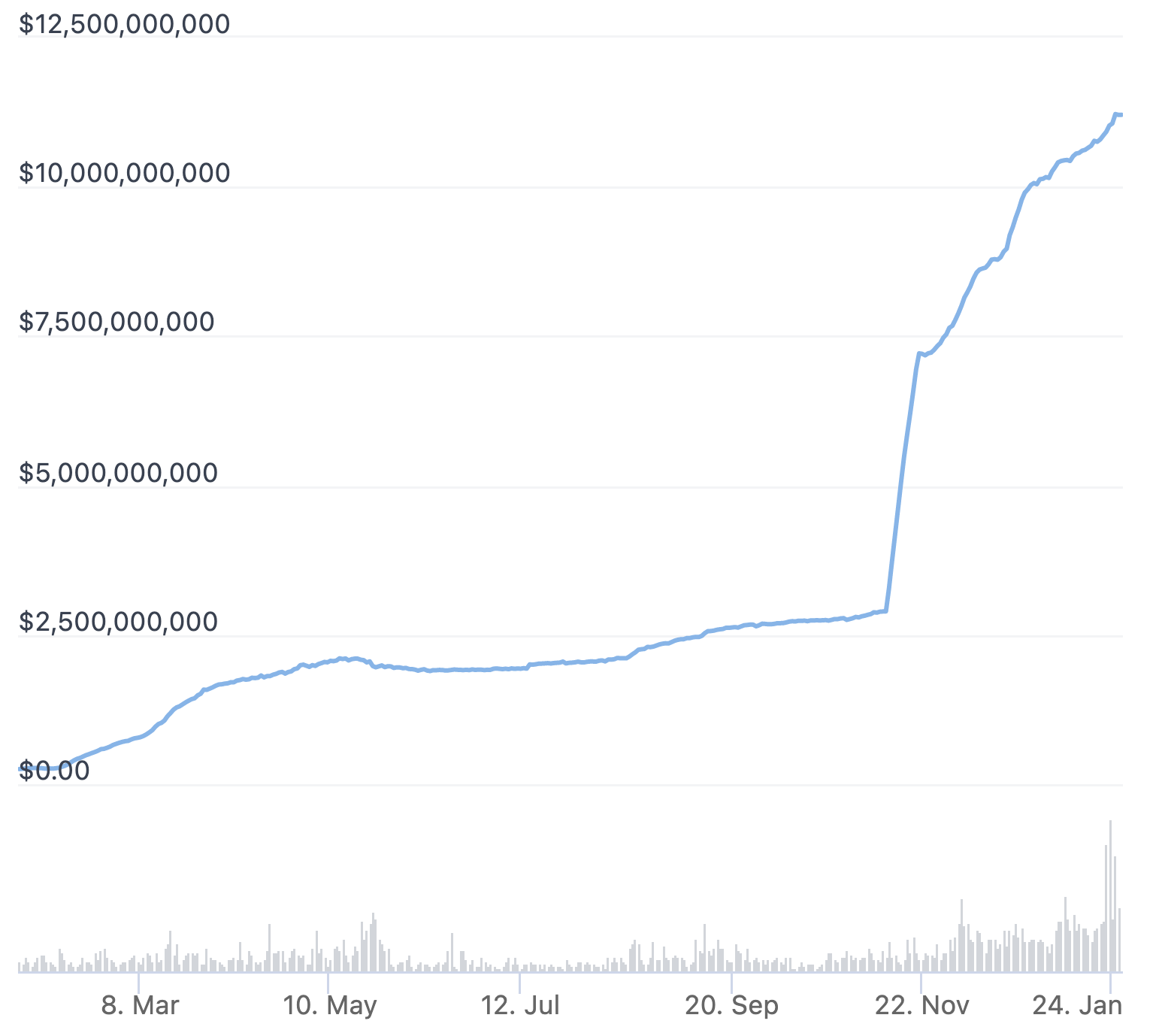

Another example pointed to in the report was the TerraUSD (UST), which the authors called “promising,” and said had performed “particularly well” in 2021, reaching a market capitalization of more than USD 10bn by the end of last year.

UST is built on the Terra (LUNA) blockchain, a network that last month was described by Pantera Capital CEO & founder Dan Morehead as growing at “a very, very rapid rate,” and with the native LUNA token being called “one of the most promising coins” for 2022.

Market capitalization of TerraUSD (UST) over the past year:

The past year’s trend of smaller stablecoins gaining market share at Tether’s expense likely means that we could see a further reduction in Tether’s dominance in the years ahead, the report further said.

It added that smaller blockchains other than Ethereum have benefitted from the reduction in Tether’s dominance over the course of 2021, while further predicting that multi-chain applications “will be the norm in 2022.”

Growth of various stablecoins in 2021:

The rise of stablecoins on smaller blockchains pointed to by Nansen follows a year where the Ethereum network has been plagued by congestion and record-high transaction fees.

The high fees have made some decentralized finance (DeFi) related activities on the network expensive, with many newer users in particular seeking out alternative blockchains like Solana (SOL), Fantom (FTM), Binance Smart Chain, and others for lower fees and faster transactions.

___

Learn more:

– US Regulator Calls For Stablecoin Bank Regulation, Coordinated Regulatory Approach To Crypto

– Tether Freezes USD 160M-Heavy Addresses on Law Enforcement Request

– How to Earn Interest on Stablecoins: A Beginner’s Guide

– Myanmar’s Exiled Government Embraces Tether To Combat Military Regime

– USDC Issuer Circle Set to Turn Into Full-Reserve National Commercial Bank

– Stablecoins Reign Among Top Coins: Why and What It Might Mean

[ad_2]

cryptonews.com