[ad_1]

Companies could still be grappling with lower demand

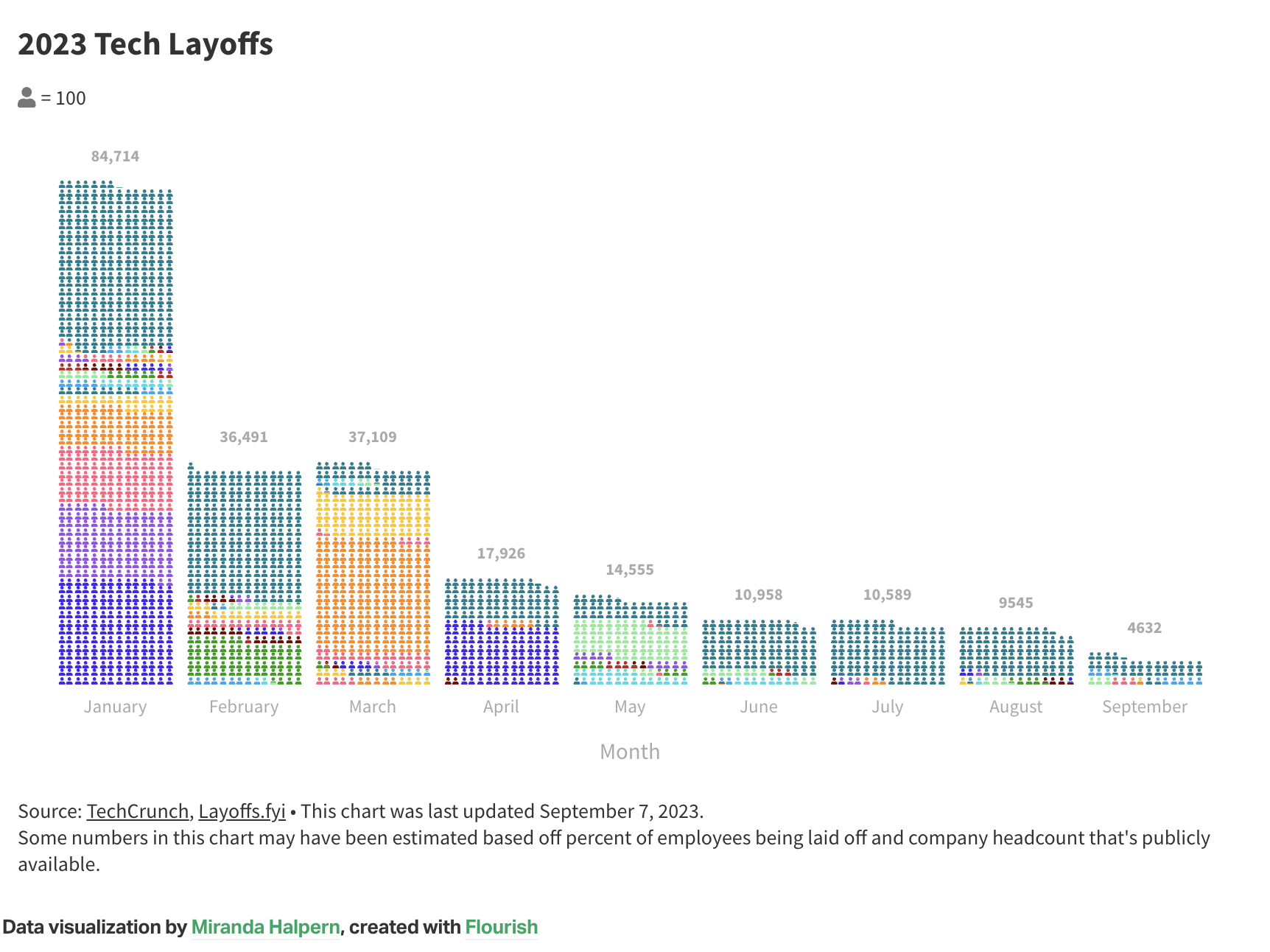

In January, nearly 90,000 tech workers were laid off. By September that number had dipped to under 5,000, suggesting that perhaps massive layoffs were mercifully over, and we could look ahead to a brighter 2024 with improving economic conditions. Then came October with a fresh wave of layoffs from companies large and small.

At first blush it feels perplexing. Some of the economic factors that were putting pressure on companies late last year and into this year felt like they were easing, and that would suggest a turnaround at some point, even if it took a while. Many economists have been saying recently that we will actually avoid a recession, which would seem like a reason for optimism. Yet tech companies keep cutting their workforces.

Image Credits: TechCrunch

Sure, Nokia, after a terrible quarter in which it saw profits drop an astounding 69%, announced last week it was laying off 14,000 employees. The business reasons seem crystal clear here, even while that huge number kicks up the overall numbers for October by a fair bit. But it didn’t happen in isolation. In fact, it comes on the heels of Qualcomm announcing it was laying off over 1,200 people, Qualtrics 780 and LinkedIn 668. It was no better at startups; Flexport laid off 600, Stitch Fix 558, Hopper 250, and on and on it went. And October isn’t even over yet.

But let’s not forget as we dig into the reasons why we are seeing a new wave of tech layoffs that this is more than an academic exploration; it involves real people losing their jobs, and perhaps it’s useful to understand why these people are having their lives blown up: because the businesses they were working for couldn’t meet their revenue numbers.

The economic/buyer conundrum

If the economy is indeed improving, it’s been a frustratingly slow process. Just last week, Federal Reserve chair Jerome Powell indicated that there would be no additional rate hike in November, but said the Fed would continue watching the economic signals, while not ruling out additional hikes in the future.

“The consensus among economists seems to be that the U.S. will avoid a recession at this point. However, no one is expecting a rapid bounce back either,” said Atta Tarki, founder and chairman of executive search and staffing firm ECA Partners and author of the book “Evidence-Based Recruiting.” Yet his forecast for next year and beyond doesn’t feel terribly promising, either.

[ad_2]

techcrunch.com