Nigerian fintech Cleva, focused on creating a banking platform for African individuals and businesses to receive international payments by opening USD accounts, has raised $1.5 million in pre-seed funding.

The round was led by 1984 Ventures, an early-stage venture capital firm based in San Francisco. Other participants in the round include The Raba Partnership, Byld Ventures, FirstCheck Africa, and several angel investors.

Aaron Michael, a partner at 1984 Ventures, expressed support for Cleva’s founders, Tolu Alabi and Philip Abel, noting that their product provides a means for Africans to navigate hyperinflation challenges, which he describes as a massive opportunity. “The team is uniquely qualified to address this given their experience building banking products at Stripe and robust platforms at AWS. The impressive early growth is a testament to the team’s unique capacity to execute across Africa and the U.S.,” he added.

Y Combinator also participated in Cleva’s pre-seed round as the fintech begins its involvement in the accelerator’s winter 2024 batch this month. The famed accelerator has previously backed African startups helping freelancers and remote workers on the continent open U.S. bank accounts for receiving payments, savings, and currency exchange, such as Grey Finance and Elevate (formerly Bloom).

CEO Alabi, in an interview with TechCrunch, explained the rationale behind launching the platform in August despite a competitive landscape with other platforms like Techstars-backed Geegpay and Payday.

First, she underscored the persistent challenges Africans still face in receiving international payments for their skills and products, a pain point both founders identified through secondhand experience and extensive research. They estimate the market for facilitating payments for remote workers and freelancers in Africa to be an $18 billion opportunity.

Image Credits: Cleva

Another crucial factor is founder-market fit. Both founders share a strong connection with the African market. Born and raised in Nigeria, they moved to the U.S. on college scholarships, where Abel attended MIT while Alabi subsequently went to business school at Stanford. Notably, they bring valuable technical and product experience from their roles at major tech companies, including Amazon, Stripe, AWS and Twilio.

“Then there’s the market opportunity,” noted Alabi in the interview. “The problem that we’re trying to solve, which is enabling people to receive international payments, is not a Nigerian problem nor an African one. It’s a global problem; people in Latin America, Asia, and even Canada need to receive dollars for their work and service. We’re starting with Nigeria because we know the market and it’s also a big market. But we feel like because of our backgrounds, we’re very well positioned to solve this problem at a global scale.”

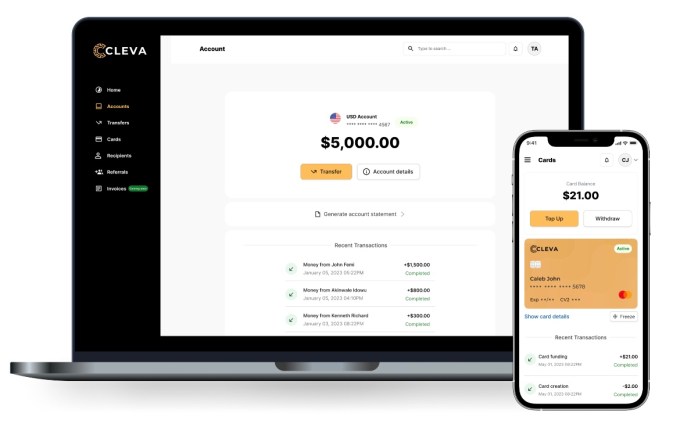

Cleva has initially launched its services to Nigerians, allowing users to open USD accounts, with onboarding requiring a Bank Verification Number (BVN) and a government-issued ID. (It’s worth highlighting that while Cleva exclusively provides USD accounts, other players offer GBP and EUR accounts.) In the four months since its launch, the Delaware- and Lagos-based fintech has facilitated the opening of US-based accounts for “thousands” of Nigerians, processing over $1 million in monthly payments while experiencing month-on-month revenue growth of 100%, according to the CEO.

As Alabi highlights, the fintech differentiates itself from the competition in two key areas: customer experience and business model. “We believe in going above and beyond for our customers to have a great experience. This is the feedback we’ve gotten from customers. They know that when they email us or reach out to our customer support, it won’t take one week or two weeks,” she remarked.

Meanwhile, the YC-backed startup, which generates revenue when users swap and exchange their funds (in USD accounts) for the local currency (in naira for now), also charges a 0.9% fee on deposits into customers’ USD accounts. Notably, Cleva caps fees at $20, distinguishing itself from competitors who often apply an uncapped 1% fee regardless of the amount received.

Looking ahead, Cleva has several upcoming products in its pipeline to diversify revenue streams, including USD cards and savings in U.S. assets, CTO Abel said in the interview. Also, Cleva, which has had to scale through the common challenges for fintechs in its category, such as finding the right banking partner and talent, will soon target Africans in the diaspora. To that end, other upcoming products, per its website, include allowing users to create professional invoices and send USD globally, entering a competitive remittance category where platforms like Flutterwave’s Send, Chipper Cash, Lemfi, and Afriex are active.

The total addressable market for fintechs focusing on freelancers and Africans in the diaspora is poised for sustained growth. This trend is fueled by a globalizing world, where more young Africans upskill and export their talents to meet the increasing demand for skilled individuals. “Long term, we are open to Cleva evolving from just being a product-only service to being a platform issuing APIs to do a bunch of other things that help us distribute services across other African countries or around the world,” Abel said, providing more details on Cleva’s future roadmap.

techcrunch.com