[ad_1]

Smart contracts are self-executing contracts containing an agreement between two or more parties directly written into code. They represent a collection of conditions and actions that automatically execute when predetermined requirements are satisfied. By leveraging blockchain technology, smart contracts provide a secure, transparent, and decentralized approach to executing transactions. This nitigates the need for intermediaries, such as banks or lawyers.

Historical Development and Evolution of Smart Contracts

The concept of smart contracts was first proposed by computer scientist Nick Szabo in 1994, when he defined them as “a set of promises, specified in digital form, including protocols within which the parties perform on these promises.” For many years, the idea remained a concept because the technology to support smart contracts had not yet been developed.

However, it was only in 2015, with the advent of Ethereum, that smart contracts gained significant traction. Ethereum introduced a Turing-complete programming language, Solidity, allowing developers to create and deploy fully-functional smart contracts on its blockchain network. This milestone marked the beginning of mainstream adoption of smart contracts and accelerated further development in this domain.

The Technology Underpinning Smart Contracts

Blockchain technology forms the backbone of smart contracts, serving as a decentralized and immutable ledger that stores and secures transactions. Essentially, a blockchain is a continuously growing list of records, called “blocks,” which are linked and secured using cryptography. This technology boasts several critical features that make it suitable for supporting smart contracts:

Decentralization: Blockchain eliminates the need for a central authority, enabling transparent and trustless transactions between parties.

Security: With cryptographic algorithms in place, blockchain ensures data integrity and protects against tampering and fraud.

Transparency: Transactions on the network are visible to all participants, ensuring accountability.

Immutability: Once recorded on the blockchain, transactions cannot be modified or removed, guaranteeing trustworthiness.

How Smart Contracts Work

In a smart contract, the terms of an agreement are translated into a set of rules or conditions, represented as code. When these conditions are met, the smart contract automatically triggers the corresponding actions. This eliminates the need for manual intervention by any of the involved parties. This automation speeds up transactions, reduces potential errors, and removes the possibility of manipulation or fraud.

To illustrate, consider a simple example: Alice wants to sell her digital artwork to Bob as an NFT. They can create a smart contract that only transfers the NFT from Alice to Bob upon receiving a specified amount of cryptocurrency from Bob. Once the smart contract confirms the payment from Bob, it automatically transfers the NFT ownership to Bob’s wallet address without any further action on Alice’s part.

During its execution, the smart contract will also communicate with “oracles,” which are trusted third-party services that provide real-world information (like asset prices or event outcomes). These oracles serve a crucial role in translating external data into a format that smart contracts can understand, enabling them to manage agreements based on real-world events.

The Role of Consensus Protocols in Validating Contract Terms

In a blockchain network, consensus protocols play a vital role in ensuring the validity and security of smart contracts. Essentially, a consensus protocol is a set of rules that enable the nodes participating in a network to reach an agreement on a single version of the truth. This includes verifying that a smart contract’s conditions have been met.

Various consensus mechanisms exist, including Proof of Work (PoW), Proof of Stake (PoS), and Delegated Proof of Stake (DPoS), among others. Each mechanism has its pros and cons, but the core function remains the same – to reach consensus among network nodes in order to confirm transactions and avoid issues like double-spending or malicious activities.

Immutable Nature of Smart Contracts Once Deployed

One of the most significant advantages of smart contracts is their immutability. This feature ensures that the terms of an agreement remain intact once a smart contract is in operation. Furthermore, it eliminates disputes that could arise from changes to the contract or attempts at manipulation.

This immutability is achieved because the smart contract code resides on the blockchain, which is designed to resist tampering or retroactive alteration of its contents. Consequently, changes to a deployed smart contract would necessitate the consensus of the majority of participating nodes, making collusion and manipulation extremely difficult, if not impossible.

However, this immutability also poses certain challenges, as any flaws or errors in the smart contract code might result in undesired consequences or vulnerabilities. Therefore, before deploying a smart contract, it is crucial to perform rigorous testing and auditing to identify and address any potential issues.

Smart Contracts and NFTs

Smart contracts play a pivotal role in the creation, or “minting,” of NFTs (Non-Fungible Tokens). NFTs are unique digital assets that represent ownership of scarce items like digital art, virtual real estate, collectibles, or even domain names. These tokens are based on smart contract standards, such as ERC-721 and ERC-1155, which provide a framework for creating, managing, and trading NFTs on platforms like Ethereum.

During the minting process, the creator of an NFT must configure a smart contract that acts as a blueprint for their NFT, encoding crucial information such as metadata, ownership, and supply limits. Once the smart contract is deployed, the creator can proceed to mint their NFT, which is then assigned a unique token ID that differentiates it from other NFTs on the blockchain.

How Smart Contracts Ensure the Uniqueness and Scarcity of NFTs

Smart contracts have the unique ability to ensure the scarcity and uniqueness of NFTs. Through the inherent logic coded into the smart contract, an NFT’s supply can be explicitly limited, making it rare and difficult to replicate. This is in contrast to traditional digital files, which can be duplicated and disseminated without restrictions.

To create a sense of uniqueness, smart contracts also encode information within NFTs, including a unique identifier and metadata detailing the digital asset’s properties, such as the artist’s signature, creation date, and the artwork’s history. This metadata can even be extended to include things like animated visuals, soundtracks, or interactive elements, which differentiate one NFT from another.

Verification of Ownership and Transfer of NFTs Through Smart Contracts

One of the central features of smart contracts in the context of NFTs is their capacity to facilitate ownership verification and token transfer. Each token is tied to a unique digital signature, allowing it to be linked to a specific wallet. This digital signature serves as a ‘proof of ownership’ for an NFT.

When an NFT is sold or transferred, the associated smart contract updates the owner’s field for that NFT on the blockchain. This ensures that the ownership information is always up-to-date and that the transfer of ownership happens securely and transparently, without the need for third-party intermediaries.

Moreover, the history of ownership transfers is permanently recorded on the blockchain, allowing anyone to audit the provenance of an NFT.

Authenticity and Provenance

One of the issues frequently encountered in the art world, whether physical or digital, is the authenticity and provenance of the artwork. Provenance refers to the chronology of the ownership or location of an artwork from its creation to the present day.

Blockchain technology, combined with smart contracts, provides a groundbreaking solution to this problem. Each token transaction, whether a transfer, sale, or minting, is permanently and immutably recorded on the blockchain. The blockchain serves as a decentralized authority, maintaining a verifiable and unhackable record of the artwork from its inception to its current ownership.

This ensures that the collected details cannot be tampered with and establishes the artwork’s authenticity. Authenticity and provenance are particularly critical for high-value digital art, where establishing the original creator and the artwork’s history can significantly impact the art’s value.

Ensuring Authenticity Through Timestamping and Metadata Within Smart Contracts

In ensuring an NFT’s authenticity, smart contracts play a crucial role. They can incorporate metadata (which may describe the art piece, author, creation time, etc.) and provide a timestamp for when the NFT was minted.

The inclusion of metadata—details about the artwork—and a timestamp, which records the time at which an action was taken upon the artwork, helps to ascertain the digital asset’s authenticity. This information is stored on the blockchain, securely and immutably, meaning it can always be referred to and cannot be altered.

Case Studies of How Provenance is Recorded for High-Profile NFTs

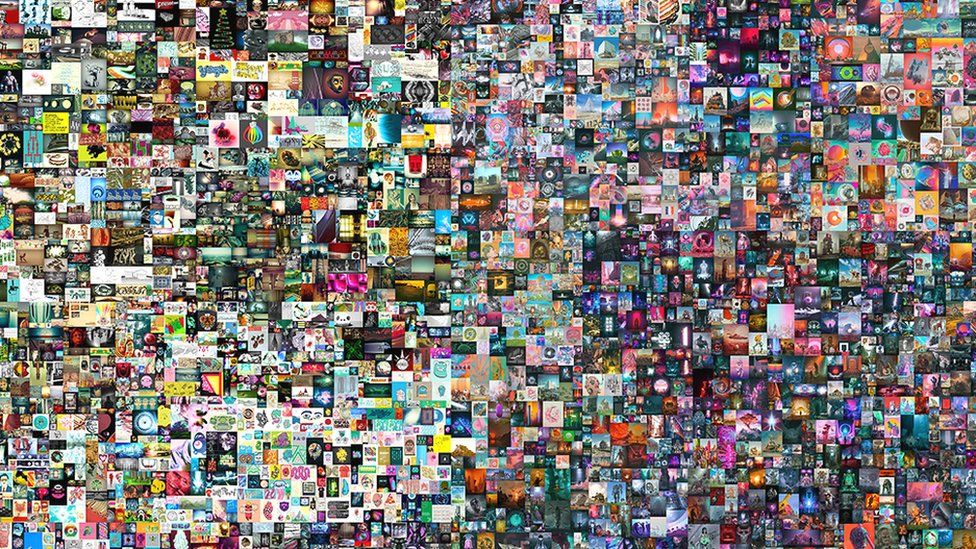

A high-profile example of how provenance is recorded via smart contracts can be illustrated by “Everydays: The First 5000 Days,” an artwork by digital artist Beeple. This piece—minted as an NFT and sold at Christie’s auction house for an astounding $69 million—encapsulates 5,000 individual images created by Beeple every day for 14 years.

The record of this NFT’s creation, sale, and subsequent ownership is recorded on the blockchain, and it is available for anyone to verify. For each of these transactions, there is a digital signature that confirms that the transfer was authorized by the current owner. Blockchain technology ensures that this provenance cannot be disputed, making it a revolutionary tool in the art world.

Smart Contracts in Digital Art and Beyond

Smart contracts have already begun to transform the landscape of digital art sales and auctions. Artists can now bypass traditional art market intermediaries, like galleries, auction houses, and art dealers, and interact directly with collectors.

Launchpad platforms for NFT art, like SuperRare, OpenSea, or Async Art, have built their entire ecosystems around the use of smart contracts. These platforms incorporate smart contracts to facilitate secure transactions, authentic verification, and to copyright enforcement.

They also enable artists to earn royalties on their work. Using built-in royalty structures, smart contracts can be programmed to automatically pay a percentage of secondary sales directly to the artist’s wallet, allowing them to benefit from their artwork’s appreciation.

Beyond Art: Use Cases in Other Sectors

While the popularity of NFTs and smart contracts have surged mainly through digital art, their applications extend far beyond this space. They have promising use-cases in several sectors:

Real Estate: Tokenizing property on a blockchain allows assets to be divided and sold in parts, providing access to real estate investment to a larger populace. It also facilitates trustless property sales and rental agreements via smart contracts.

Finance: Decentralized Finance, or DeFi, leverages smart contracts to create transparent and automated financial instruments, removing the need for intermediaries.

Supply Chain Management: Smart contracts offer opportunities to streamline supply chain operations and establish transparent and tamper-proof product tracking, improving traceability and reducing fraud.

User Interfaces and Platforms for Interacting with Smart Contracts

Interacting with smart contracts can seem daunting due to their technical nature. However, several user-friendly interfaces and platforms simplify this process:

MetaMask: This is a browser-based wallet used for interacting with the Ethereum blockchain. It allows users to manage their Ethereum account, hold NFTs, and interact with Ethereum dApps and smart contracts.

MyEtherWallet (MEW): This is another interface to the Ethereum blockchain, providing an array of features to manage Ethereum accounts and interact with smart contracts.

Remix: This is a powerful, open-source development environment for writing, testing, debugging, and deploying smart contracts written in Solidity.

These interfaces democratize access to smart contracts, allowing developers and non-technical individuals to participate in the blockchain space.

The Role of Wallets in Managing NFTs

Digital wallets, like MetaMask or MyEtherWallet, are crucial for managing and transacting with NFTs. Wallets store and secure the digital keys needed to interact with the Ethereum (or any other) blockchain.

Wallets essentially serve as user accounts for the blockchain. They are required to initiate transactions, whether that involves transferring, buying or selling NFTs.

When a user purchases or receives an NFT, ownership of the token is transferred to their wallet address. This makes the user the proven owner of the NFT according to what’s recorded on the blockchain. Wallets ensure this transaction is secure by demanding a digital signature confirming that the user approves the transaction.

Security Aspects of Smart Contracts

Despite their many advantages, smart contracts can also have vulnerabilities. Errors in coding can lead to devastating financial losses, as illustrated by a few high-profile incidents:

The DAO Hack: In 2016, a decentralized investment fund called “The DAO” lost ≈$50 million worth of Ether due to a bug in its smart contract. This led to a contentious hard fork in the Ethereum network, creating what we know today as Ethereum and Ethereum Classic.

Parity Wallet Freeze: In 2017, a vulnerability in the Parity multi-signature wallet smart contract led to about 513,774.16 Ether being permanently locked, making it inaccessible to the owners.

These incidents highlight the acute need for proper testing, auditing, and security measures in smart contract development.

Measures to Ensure Security and Integrity

To safeguard against such vulnerabilities, several measures can be undertaken to ensure the security and integrity of smart contracts:

Thorough Testing: Comprehensive testing helps identify bugs or vulnerabilities in the contract’s code.

Security Audits: External audit firms can review the contract’s codebase for potential flaws or vulnerabilities.

Using Formal Verification: This mathematical approach proves or disproves the correctness of a smart contract against its specification.

Following Best Practices: Best practices ensure that the contract’s logic and code are secure and maintainable. These include coding standards, style guidelines, and standardized and tested libraries and frameworks.

Challenges and Limitations

There are noteworthy challenges to implementing smart contracts. These include:

Privacy Concerns: As all transactions are publicly verifiable on a blockchain, this openness may not be suitable for transactions requiring confidentiality.

Energy Consumption: Blockchains like Ethereum, which use energy-intensive PoW consensus algorithms, have significant environmental impact.

Legal and Regulatory Policies: Policies regulating the use of blockchain and smart contracts vary across jurisdictions, introducing uncertainty.

Knowledge Gap: The widespread adoption of smart contracts can be hindered by the lack of skilled blockchain developers.

Current Limitations

Despite the enormous potential of smart contracts, certain technological barriers limit their current capabilities:

Scalability: The Ethereum blockchain, currently the most popular for deploying smart contracts, struggles with network congestion and high transaction fees.

Lack of Privacy: Smart contracts on public blockchains lack a way to hide sensitive transaction data.

Cross-Chain Interoperability: Smart contracts on one blockchain can’t natively communicate with those on other networks.

Addressing these limitations is a focal point of current and future research and development in blockchain technology.

Legal Considerations

The legal status of smart contracts can vary substantially across different jurisdictions. For instance, some countries like Arizona, Nevada, and Tennessee in the USA have legally recognized the use of smart contracts. However, others may not have specific legal frameworks addressing smart contracts, leaving them in a legal gray area.

Challenges in Integrating Smart Contracts

Integrating smart contracts within existing legal systems can be challenging. Some, like consumer protection and dispute resolution mechanisms, are hard to reconcile with the immutability and self-executing nature of smart contracts.

The Future of Smart Contracts and NFTs

As blockchain technology progresses, various trends and innovations are emerging in smart contracts, which will likely shape their future:

Layer-2 Scaling Solutions: Technologies like Lightning Network, Plasma, and Rollups are being developed to alleviate the scalability issues of blockchains.

Zero-knowledge Proofs: These offer potential solutions to reconcile the transparent nature of smart contracts with the need for privacy.

Sharding: Sharding involves dividing the blockchain into smaller chunks, or “shards,” to improve the scalability and efficiency of the network.

Predicted Developments

Smart contracts and NFTs are predicted to revolutionize various industries. Sophisticated financial mechanisms, digital ownership, tribute to artists, and supply chain management are only a few fields that can be automated and made secure, transparent, and efficient by leveraging smart contracts.

Major advancements in these fields will necessarily transform traditional business models and pave the way for novel, scalable, and potentially more democratic avenues of conducting business.

Conclusion

In conclusion, smart contracts have become integral building blocks for NFT transactions. They bring about new ways of verifying, ensuring ownership, and tracking the authenticity of digital tokens securely. They’ve gone beyond powering NFTs and digital art marketplaces and found utility in a myriad of other sectors.

However, while they are undoubtedly transformative, smart contracts also come with their structural and security challenges. These challenges do not undermine the technology; instead, they represent areas of growth, innovation, and opportunities in the decentralized economy.

With ongoing research and development, it could be expected that smart contracts and their use in NFTs become more robust, versatile, and widely adopted in the future. They promise a future of transactions and agreements that are more transparent, decentralized, and secure.

[ad_2]

By: Seamus O Connor

nftnewstoday.com