[ad_1]

February is ending, but the ‘Alameda Gap’ is not.

As the second month of this year is wrapping up, the prices in the crypto market have somewhat recovered from last year’s crash. Still, the so-called ‘Alameda Gap’ resists filling, as the liquidity remains far from the levels seen before the infamous FTX collapse.

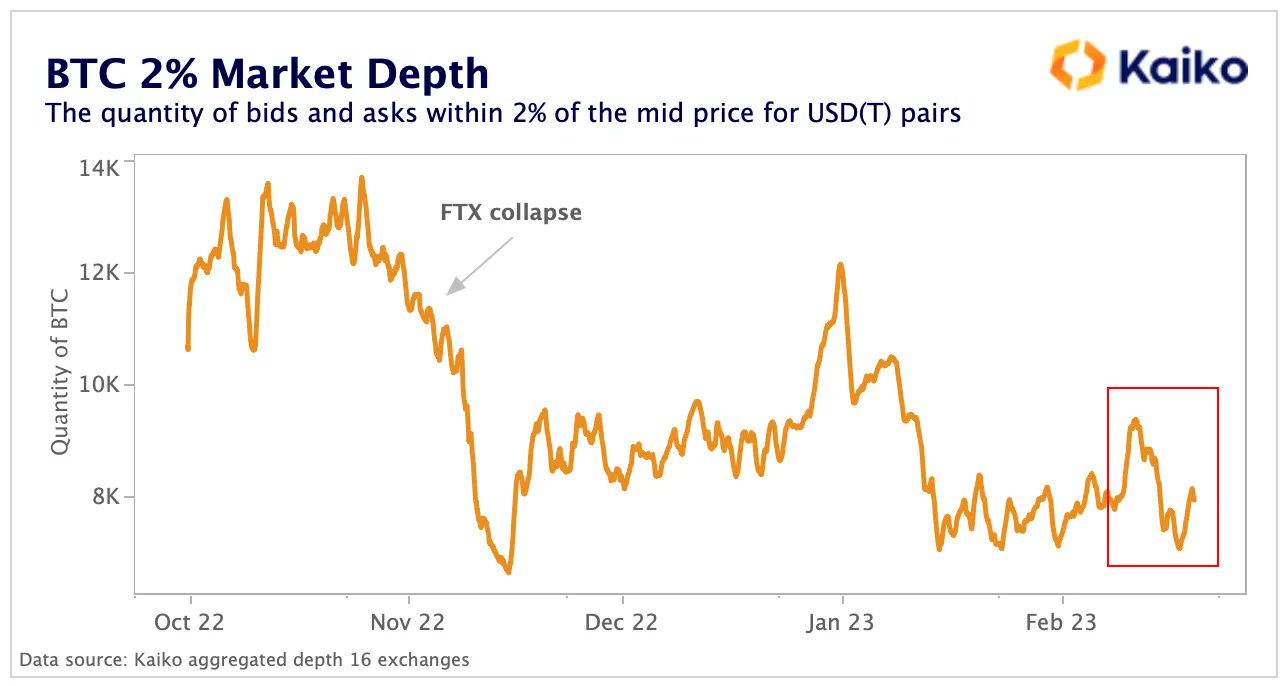

Researcher Kaiko tweeted that this month as well, the Gap persists, with bitcoin (BTC) “market depth still well below November levels.” It stated that,

“The quantity of BTC-USD(T) bids and asks within 2% of the mid-price aggregated on 16 exchanges hovered around 8k BTC in February — 40% less than in October.”

As a reminder, the FTX exchange, along with its parent company Alameda Research and a number of subsidiaries, filed for bankruptcy back in November last year – and these companies, along with the founder Sam Bankman-Fried, have been dealing with the regulatory and legal falout ever since (at the expense of the users).

Kaiko noted the existence of the ‘Alameda Gap’ that very same month, arguing that, typically, liquidity plunges occur during periods of volatility as market makers rush to manage risks.

“Crypto liquidity is dominated by just a handful of trading firms, including Wintermute, Amber Group, B2C2, Genesis, Cumberland and (the now defunct) Alameda. With the loss of one of the largest market makers, we can expect a significant drop in liquidity, which we will call the “Alameda Gap”,” it said at the time.

Riyad Carey, research analyst at the company, was quoted by Bloomberg on Friday as saying that,

“It’s not just Alameda, although they were one of the biggest. Other market-makers took a hit and are being more cautious. […] It really depends on the token, but I’d say there’s still a 20-40% gap from previous liquidity levels. When there’s less liquidity, we tend to see that prices are more volatile in both directions, which has been the case in the past couple months.”

Strahinja Savic, head of data and analytics at FRNT Financial, was quoted as saying that Three Arrows Capital (3AC), Celsius Network, “and numerous other crypto funds, both well-known and not,” are responsible for this gap. Therefore, the trading volumes drop at the end of 2022 can likely be tied back to the “elimination” of these companies.

“These firms would have policed spreads, keeping them at bay, and supported market depth,” but their fall resulted in “an increase in certain inefficiencies in the crypto market,” said Savic.

“It’s also the result of Genesis bankruptcy, and incurred losses for other market makers related to both Genesis and FTX,” argued Vetle Lunde, senior analyst at K33 Research (formerly Arcane Research).

Traders are not back yet

All in all, according to Noelle Acheson, author of the “Crypto Is Macro Now” newsletter, thin liquidity suggests that larger traders are not back in the market.

Acheson was quoted by Bloomberg as saying that,

“I would expect the continued climb in volatility since the beginning of the year to gradually entice some of the large players back into the market, since the low levels in December-early January would have made the market just not interesting enough to be worth their time.”

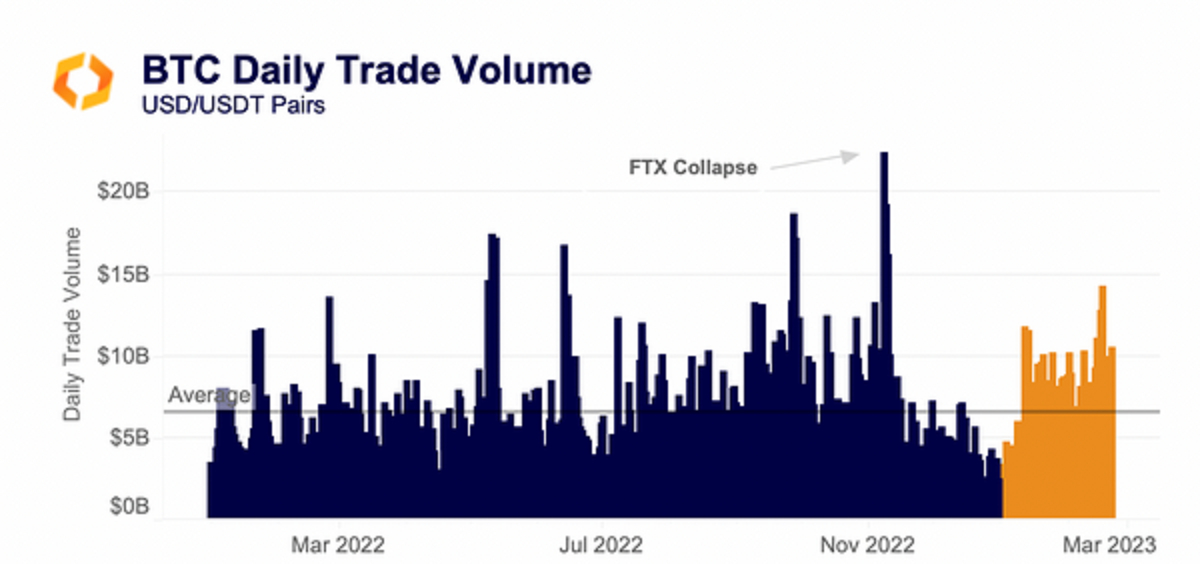

Meanwhile, in its weekly market overview, Kaiko stated that daily trade volume has been consistently higher this year. It fell to yearly lows at the end of 2022, partly due to poor sentiment among retail after FTX’s collapse.

That said, the sentiment seems to have picked up “significantly” so far in 2023, with daily BTC volume crossing $14 billion during February, it said.

The researcher added that,

“The overall level of volumes is also higher than the end of 2022, seemingly anchored to the $10bn daily volume number, as opposed to about half that to close last year.”

Kaiko also noted that BTC and ETH market depth hit its lowest point since May 2022. The “liquidity in native units continued falling last week, hitting its lowest level since the Terra collapse,” it said.

It added that BTC 2% market depth aggregated on 15 centralized exchages fell to 6,800 BTC, down almost three-fold since October’s highs. Market depth for ETH dropped to around 57,000 ETH, compared to 139,000 ETH in October.

As for the prices, back in November, BTC fell to the $15,700 level, but has since climbed up to the current $23,283. At 10:00 UTC on Tuesday morning, it was down 0.5% in a day and 6% in the past week.

At the same time, ETC was trading at $1,621, down 1% over the last 24 hours and 4.7% over the last 7 days. This is a significant rise since November 2022 when it had plunged to $1,095.

____

Learn more:

– FTX Founder Sam Bankman-Fried Faces More Criminal Charges – The Latest Twist in a High-Profile Case

– Report Claims Binance Commingled User Funds Similar to FTX

– FTX Japan Crypto Exchange to Resume Withdrawals Today – Here’s What’s Happening

– $200 Million Galois Crypto Hedge Fund Shuts Down as Half of Assets Stuck on FTX Exchange – This is What Happened

[ad_2]

cryptonews.com