[ad_1]

Binance CEO Changpeng Zhao’s plan to rescue the cryptocurrency market has fallen short of expectations eleven months after launch.

Since the launch of the Industry Recovery Initiative (IRI), the company has only spent less than $15 million out of an announced $1 billion fund, Bloomberg wrote.

Last year was plagued by two major falls which sent the market to sharp lows; the Terra Network and the cryptocurrency exchange, FTX.

After the collapse of FTX, the ripple effect was seen both in plunging asset prices and in struggling firms who were exposed to the company.

Zhao became a hero when he announced a plan to partner with leading industry players to raise $1 billion to save startups within the ecosystem. Notable firms like Jump Crypto and Animoca Brands joined in the fund.

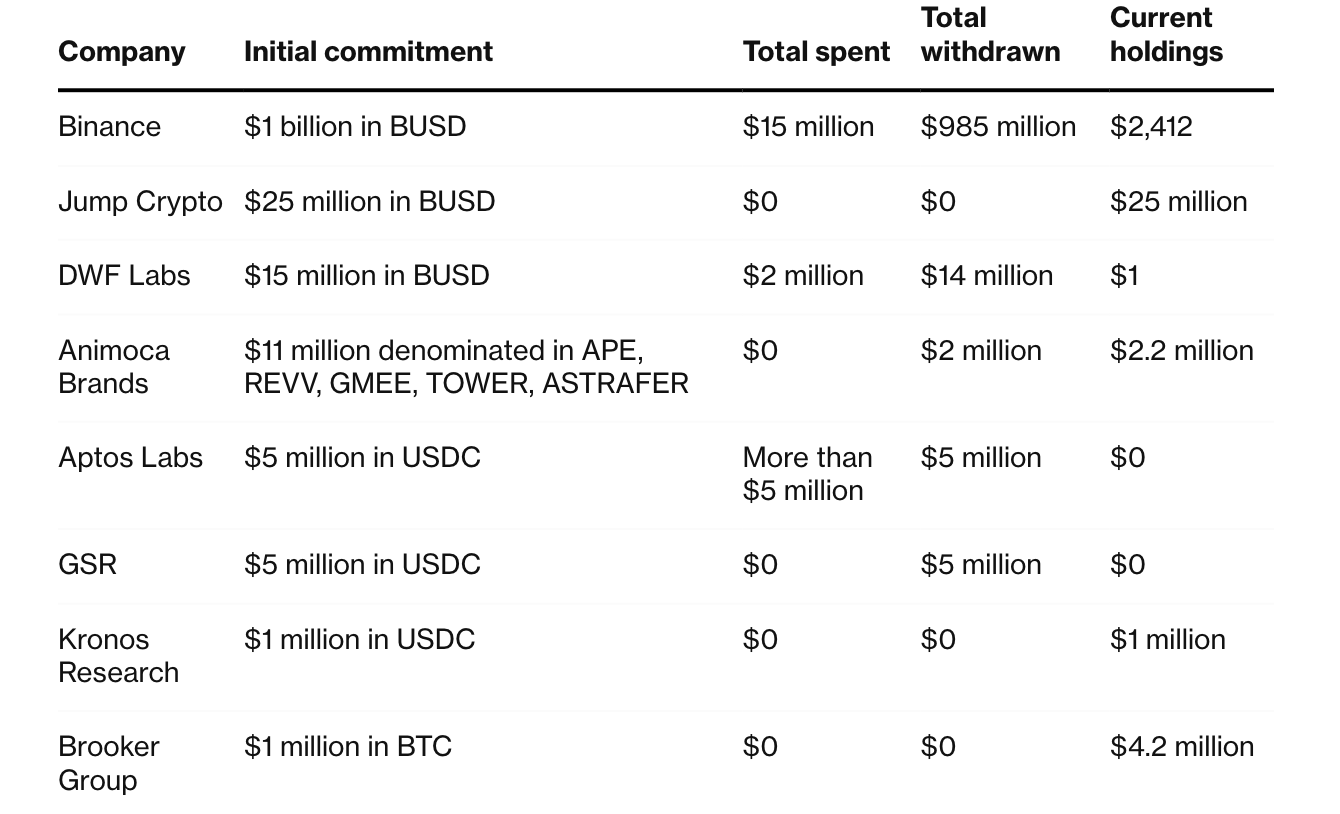

Binance has spent just $15 million from its total commitment and now transferred the remaining $985 million to its corporate treasury.

Before this, the exchange announced a conversion from BUSD to other cryptocurrencies citing increasing regulatory pressure on stablecoins.

Projects funded since IRI

So far, Binance claims that the industry rescue fund has been applied to 14 projects although 13 of those remain undisclosed announcing only the funding of Gopax, a South Korean cryptocurrency exchange.

At the time CZ stressed the importance of the fund to save web3 projects adding that,

“The Industry Recovery Initiative was created to support promising companies that were negatively impacted by the events of last year. We hope that taking this step with GOPAX will further rebuild the Korean crypto and blockchain industry.”

A few months after the announcement of the IRI m, about 18 firms had also contributed $100 million towards the cause although only nine were publicly identified.

Jump Crypto pledged $25 million while DWF labs budgeted $15 million and has utilized $2 million with a withdrawal of $14 million.

Aptos on the other hand pledges $5 million and has utilized the same amount for the project. While the fund remains underutilized, Binance has explained that most firms failed to meet the criteria.

Aptos on the other hand pledges $5 million and has utilized the same amount for the project. While the fund remains underutilized, Binance has explained that most firms failed to meet the criteria.

“We didn’t identify as many projects who would meet our criteria, and this is the same for the other investors,” Dan Hou, head of Business Strategy and Operations at Binance.

FTX’s negative impact on VC funding

The impacts of the post-FTX saga can be seen in plummeting venture capital investments from Q3 2022.

Blockchain intelligence firm, Messari noted that VC volume last quarter stood at $2.1 billion down from its all-time high of $17 billion in 2021.

VC volumes in crypto slid 36% from Q2 2023 after recording slight growth on the back of numerous spot Bitcoin ETF applications amid renewed institutional demand.

In total, VC volumes in crypto assets have been down by 70% since the collapse of FTX although recent developments show a slight change in the stance of institutional investors.

[ad_2]

cryptonews.com