[ad_1]

Major crypto exchange Binance kept collateral for some of the cryptoassets it issues in the same wallet as the customer funds by mistake, Bloomberg reported, citing a Binance spokesperson.

On Monday, Binance released a proof-of-collateral report for B-Tokens, which are the 94 Binance-minted tokens. The report, however, showed that reserves for nearly 50% of all these coins that Binance issues, were at that point stored in a single wallet called ‘Binance 8’.

This wallet held far more tokens in reserve than is required by the amount of B-Tokens, which suggested that collateral was being mixed with customers’ funds instead of being stored separately.

The problem was found even earlier, on January 17, by DataFinnovation and ChainArgos co-founder Jonathan Reiter, who said that the excessive overcollateralization of some B-Tokens and Binance’s use of the Binance 8 wallet showed “obvious mixing of client and peg-backing funds.”

Not having separate, dedicated wallets for customer and exchange funds goes against the exchange’s own guidelines.

According to Bloomberg, a spokesperson said that,

“Binance 8’ is an exchange cold wallet. Collateral assets have previously been moved into this wallet in error and referenced accordingly on the B-Token Proof of Collateral page.”

The person further said that assets held with the exchange “have been and continue to be backed 1:1,” and that,

“Binance is aware of this mistake and is in the process of transferring these assets to dedicated collateral wallets.”

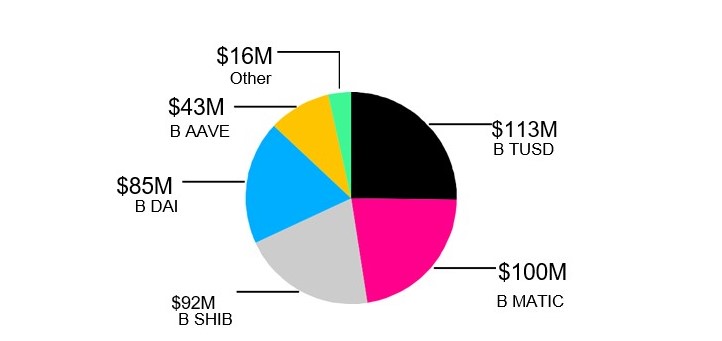

Bloomberg calculated (based on Binance data from January 20) that Binance issued more than $539 million of the 41 B-Tokens that have Binance 8 as their collateral wallet, while the wallet itself holds more than $1.8 billion in related assets. Overall, Binance 8 holds more than $16.5 billion in various cryptoassets beyond B-Tokens.

Meanwhile, Binance was named in relation to another problem just recently: on January 19, it was identified as a counterparty to the little-known exchange Bitzlato, which is facing money laundering charges in the US. The US Department of the Treasury wrote in an order that Binance was Bitzlato’s top receiving counterparty of bitcoin (BTC) between May 2018 and September 2022.

Reuters reported on January 24 that the exchange processed almost $346 million in bitcoin for Bitzlato, citing data by blockchain research firm Chainalysis.

A Binance spokesperson, however, said that it had “provided substantial assistance” to international law enforcement to support their investigation of Bitzlato.

____

Learn more:

– Binance Banking Partner Restricts Crypto Transactions to $100,000 and Above – Here’s Why

– Binance has Grabbed Two-Thirds of all Crypto Trading Volume – What Happened to the Decentralization of Finance?

– Binance CEO CZ Clarifies Reasons Behind Recent FUD Surrounding the Exchange – This is What he Said

– Bankman-Fried Continues to Blame Binance for the Collapse of His Crypto Empire

[ad_2]

cryptonews.com