[ad_1]

The Binance USD (BUSD) stablecoin continues to lose ground versus other stablecoins, and has over the past month lost as much as $2bn in market capitalization.

At its low on Wednesday this week, BUSD’s market cap touched $15.3bn, down more than $2bn compared to the $17.5bn market cap it had on the same date in December.

The fall in market cap for BUSD is notable given that no similar fall has been seen over the same time period for other major stablecoins like Tether (USDT) and USD Coin (USDC). However, a possible explanation for the offloading of BUSD could be fears related to Binance after the collapse of FTX.

Back in mid-December last year, Binance saw withdrawals from its platform of more than $3bn in a matter of just 24 hours as traders feared the exchange could face a similar destiny as FTX. The rush to withdraw then led Binance CEO Changpeng Zhao, better known as CZ, to come out and reassure users that all was fine with the exchange

According to CZ, some people had attacked Binance not because there was anything wrong with it, but because they don’t like centralized platforms. “Regardless if a CEX helps with crypto adoption at a faster rate, they just hate CEX,” CZ said at the time.

Community speculates on BUSD market cap

On Twitter, some members of the crypto community are now speculating that most of the buy pressure that has been seen in bitcoin (BTC) since the beginning of the year has come from BUSD.

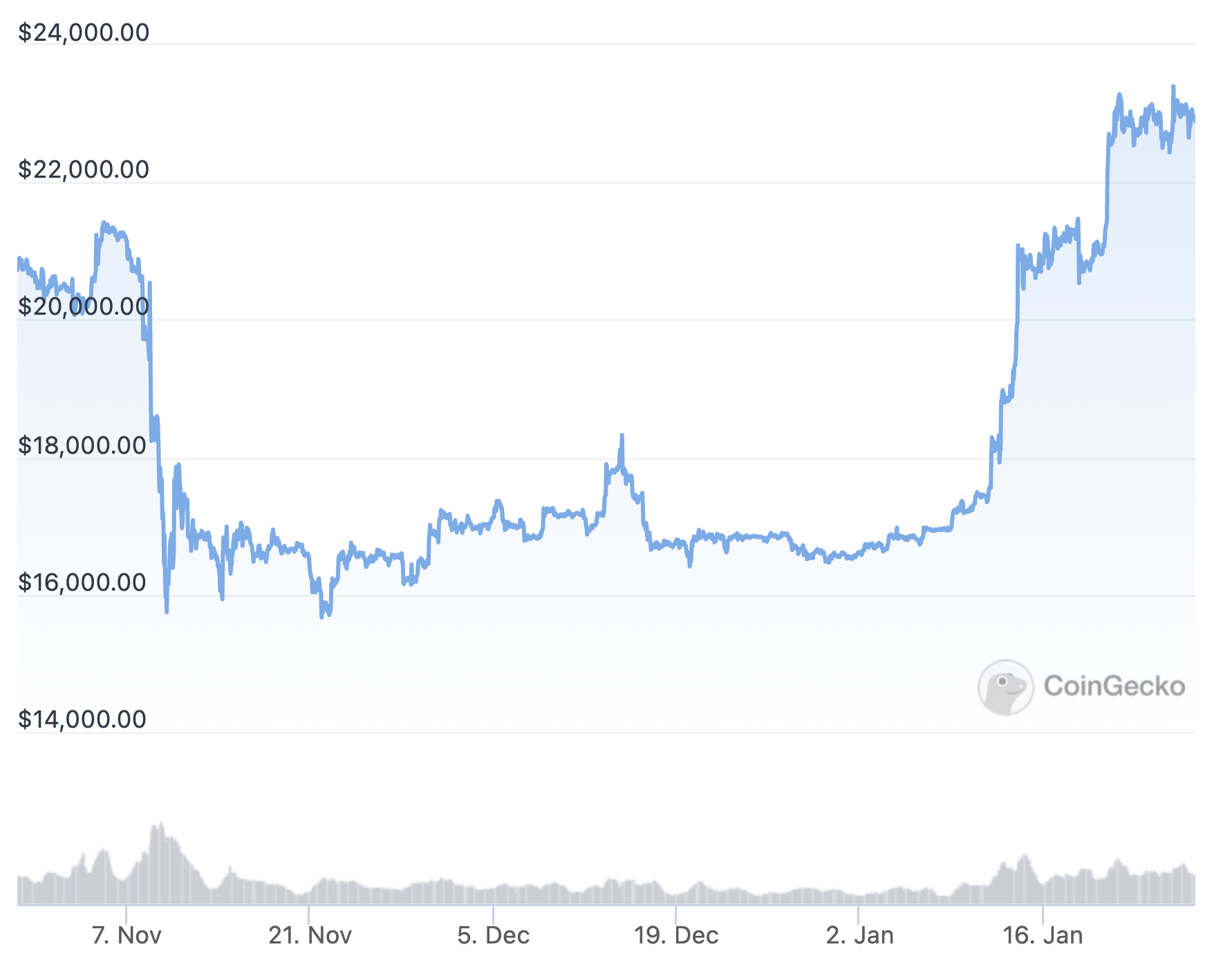

From a low of around $16,500 at the beginning of the year, bitcoin has now consolidated around the $23,000 mark in recent days.

Among those who hinted that unusual bitcoin buying activity could come from BUSD was the popular Twitter user @noblemillions, who asked “Why are they doing this?”

Other users have also commented on the situation, with one popular Bitcoin analyst claiming BTC’s rise from $17,000 to $23,000 was “pumped entirely with BUSD.”

Massive buying of BTC with BUSD would explain the fall in market cap for BUSD, as there would simply be less demand for holding the stablecoin – all else being equal.

BUSD not issued by Binance

Worth noting about BUSD is that the stablecoins is not issued by Binance itself, but rather by Paxos Trust Company using Binance’s name.

Paxos is a regulated trust company in the US that regularly publishes detailed reports about the backing of the stablecoins it issues. According to the latest attestation report from November 2022, BUSD is backed in full by a combination of US Government bonds and US dollars.

[ad_2]

cryptonews.com