[ad_1]

Bitcoin (BTC) continues to exit crypto exchanges since it’s recording a macro decline.

Market insight provider Glassnode explained:

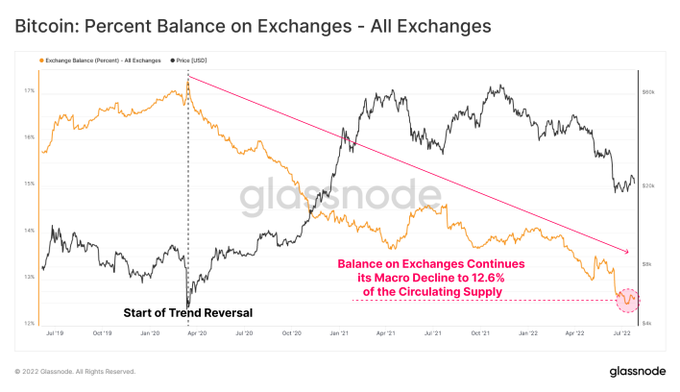

“Bitcoin balance on exchanges continues its macro decline, reaching 12.6% of the Circulating Supply (2.4M BTC). Exchange balances have now seen a macro outflow of over 4.6% of the circulating supply since the March 2020 ATH.”

Source:Glassnode

Bitcoin leaving exchanges is bullish because it signifies a holding culture, given that coins are transferred to digital wallets and cold storage for future purposes other than holding.

This might be a reason triggering BTC’s upward push. The leading cryptocurrency was up by 4.18% in the last 24 hours to hit $24,482 during intraday trading, according to CoinMarketCap.

The price surge has also boosted Bitcoin’s chances of breaking the 200-Week Moving Average (WMA). Crypto analyst Rekt Capital pointed out:

“BTC is very close to performing a Weekly Close above the 200-week MA. Technically, it looks like BTC is doing well to reclaim the 200-week MA as support.”

Source:TradingView/RektCapital

The 200 WMA shows the long-term trend of an asset and plays an instrumental role in showing whether the market is bullish or bearish.

Meanwhile, Bitcoin has been enjoying above-average buying volume, given that it has been able to drift away from the psychological price of $20K. Rekt Capital pointed out:

“BTC is enjoying above-average buy-side volume for the first time since January/February of this year when BTC performed relief rallies before further downside.”

Bloomberg analyst Mike McGlone recently stated that it seems Bitcoin was getting ready to return to winning ways, given that its volatility against the Bloomberg Commodity Index (BCOM) had reached historic lows.

Image source: Shutterstock

[ad_2]

blockchain.news