[ad_1]

Bitcoin held close to yearly highs just below $25,000 on Monday, with the world’s largest cryptocurrency by market capitalization higher by about 2.0% on the day after rebounding strongly from a brief dip back under $24,000 earlier in the session. Bitcoin’s rebound from the $21,000s last week and ongoing resilience has surprised many analysts.

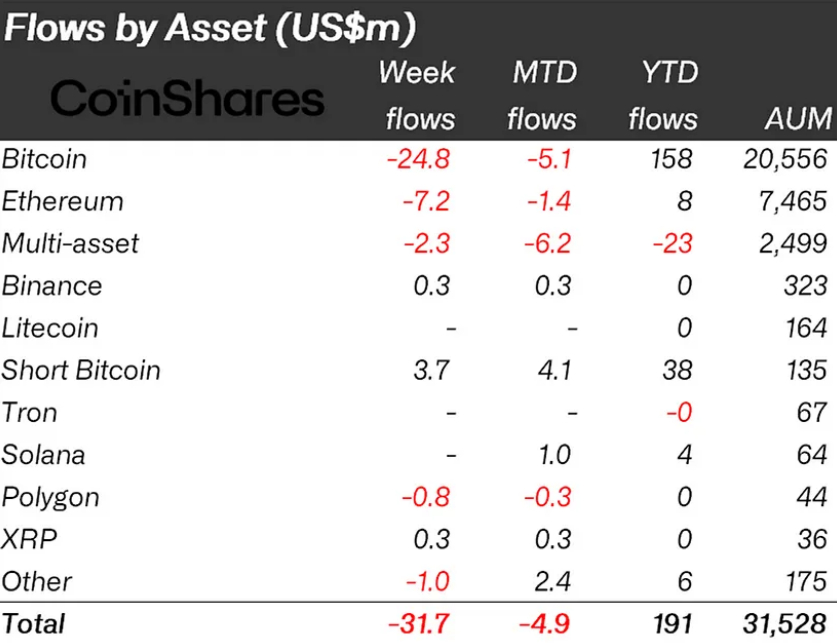

Many had been predicting an extension of the recent pullback from yearly highs, given ongoing strength in the US dollar, upside in US yields and downside in US equities as traders drove up Fed tightening bets, and given worries about an escalating US regulatory crackdown on crypto firms. That pessimism resulted in Bitcoin suffering from significant investor outflows last week, according to the latest CoinShares weekly funds flow report.

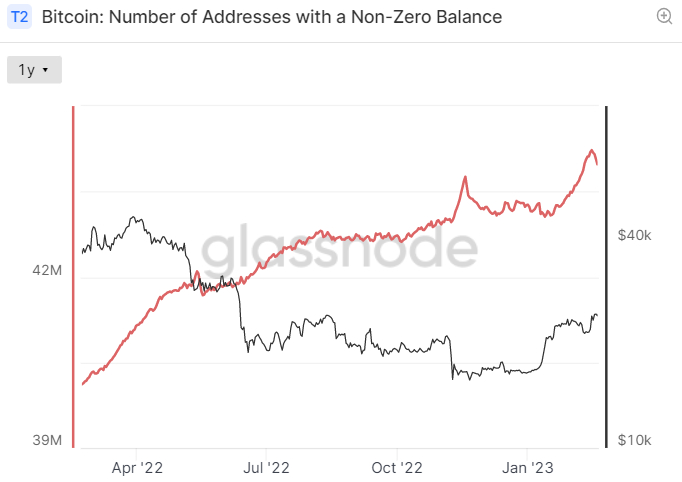

According to the report, Bitcoin investment products saw an outflow of just shy of $25 million, taking month-to-date flows to negative $5.1 million. Meanwhile, last week also saw a steady decline in the number of wallet addresses on the network that hold a non-zero balance. According to data presented by crypto analytics firm Glassnode, the number of non-zero balance addresses fell from a record high of 44.226 million on Wednesday to just under 44 million on Sunday.

That marked a decline of around 140,000 on the week, with declines witnessed across the major address cohorts. Addresses that hold at least 0.1 BTC dropped from a record high of around 4.231 million on Tuesday to around 4.225 million as of Sunday. Meanwhile, the number of addresses holding at least 1 BTC fell to around 1,500 between Tuesday and Sunday.

Outflows from Bitcoin investment products normally happen during periods of exacerbated selling and downside pressure on the BTC price. Falling non-zero wallet address numbers also normally occur at times when the BTC price is falling, with small investors presumably capitulating. Despite this, Bitcoin still ended the week up over 11% and at current levels in the $24,700s, is up around 7% on the month.

Bitcoin’s resilience in the face of these headwinds suggests that demand remains sufficiently strong to soak up-sell pressure from investors seeking to cash out in wake of this year’s positive price run. For reference, Bitcoin is currently up just shy of 50% on the year.

But New Address Momentum Remains Positive

Analysts probably won’t read too much into the recent drop in non-zero balance addresses, as this never just goes up in a straight line all the time, even when Bitcoin’s price is performing well, as it has been recently.

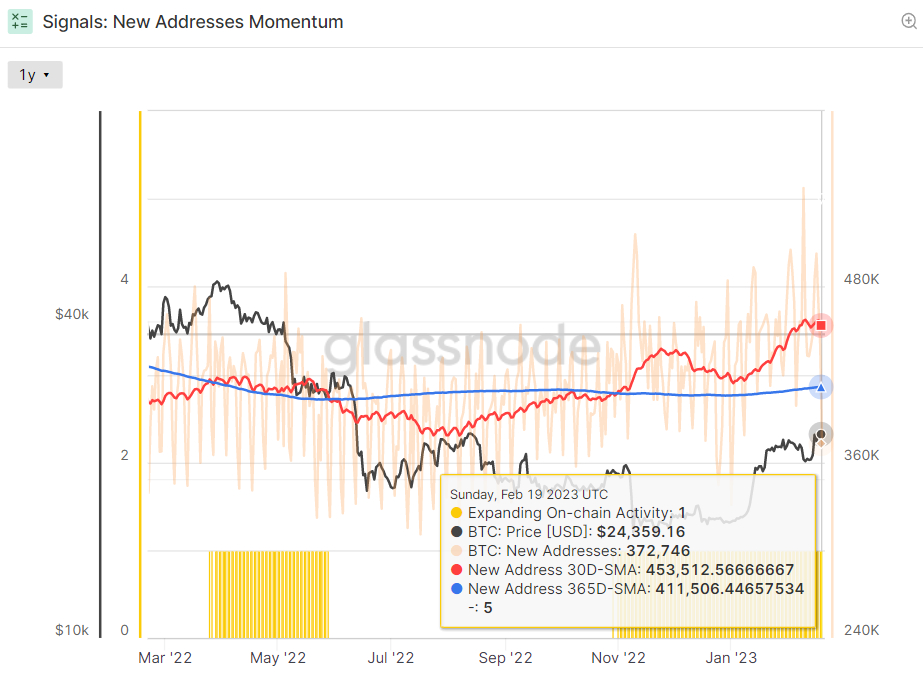

Glassnode’s New Address Momentum indicator, which tracks the 30 and 365-day moving averages (DMA) of new addresses (thus giving a higher conviction signal) continues to suggest that the address trend in the Bitcoin network remains positive.

The 30DMA of new addresses crossed above the 365DMA in early Q4 2022 and has continued to move higher ever since. “Healthy network adoption is often characterized by an uptick in daily active users, more transaction throughput, and increased demand for block space (and vice-versa)”, explains Glassnode.

When the monthly (30DMA) is above the yearly (365DMA), this “indicates an expansion in on-chain activity, typical of improving network fundamentals, and growing network utilization”. As a result, it perhaps isn’t surprising to see that Bitcoin bull markets often coincide with periods where the 30DMA of new addresses is both rising and above its 365DMA, which is the case right now.

Here’s Where the BTC Price Could Go Next

Some analysts have put Bitcoin’s recent strong performance in the face of US regulatory and macro concerns down to optimism about recent developments in Asia. Namely, since departing from its controversial and economically stifling zero Covid-19 policy last year, China has been pumping liquidity into its financial markets this year. The PBoC just injected a massive 835 billion CNY via reverse repos into its banking system, the largest move in over a year.

And people aren’t just getting excited about easing liquidity conditions in Asia. Hong Kong has openly expressed its desire to become a global crypto hub and, on Monday, proposed new legislation that would let retail investors trade blue chip cryptocurrencies on licensed exchanges. That is in stark contrast to China, where all retail crypto investment is banned.

Analysts have been theorizing that China is using Hong Kong as a petri-dish to experiment with crypto, before potentially easing off on its own ban. In the meantime, Hong Kong could act as a gateway for Chinese capital to enter global crypto markets. “My working thesis atm (at the moment) is that the next bull run is going to start in the East,” Gemini co-founder Cameron Winklevoss proclaimed on Twitter over the weekend.

Easing Asian liquidity conditions and hopes that regulatory easing in Hong Kong might facilitate Chinese flows into crypto may continue to cushion prices in the days and weeks ahead, even if upcoming US macro data does point to a still-hot economy, potentially resulting in a further ramp-up of Fed tightening bets.

Looking at BTC/USD on the four-hour candle sticks, the cryptocurrency appears to be forming an ascending triangle. These typically suggest a build-up of buying pressure and often form ahead of a bullish breakout. If Bitcoin was to break above resistance in the low $25,000s, the path towards a swift rally towards $28,000 (the late May 2022 low) would be unlocked. That would mark a further than 13% rally from current levels, and would take Bitcoin’s on-the-year gains to close to 7.0%.

[ad_2]

cryptonews.com