[ad_1]

On December 5, Bitcoin, the leading cryptocurrency, finally broke above the major resistance level of $17,000, and it is now heading north to $17,600. Similarly, Ethereum, the second-most valuable cryptocurrency, has broken through the $1,300 barrier and is on its way to $1,350.

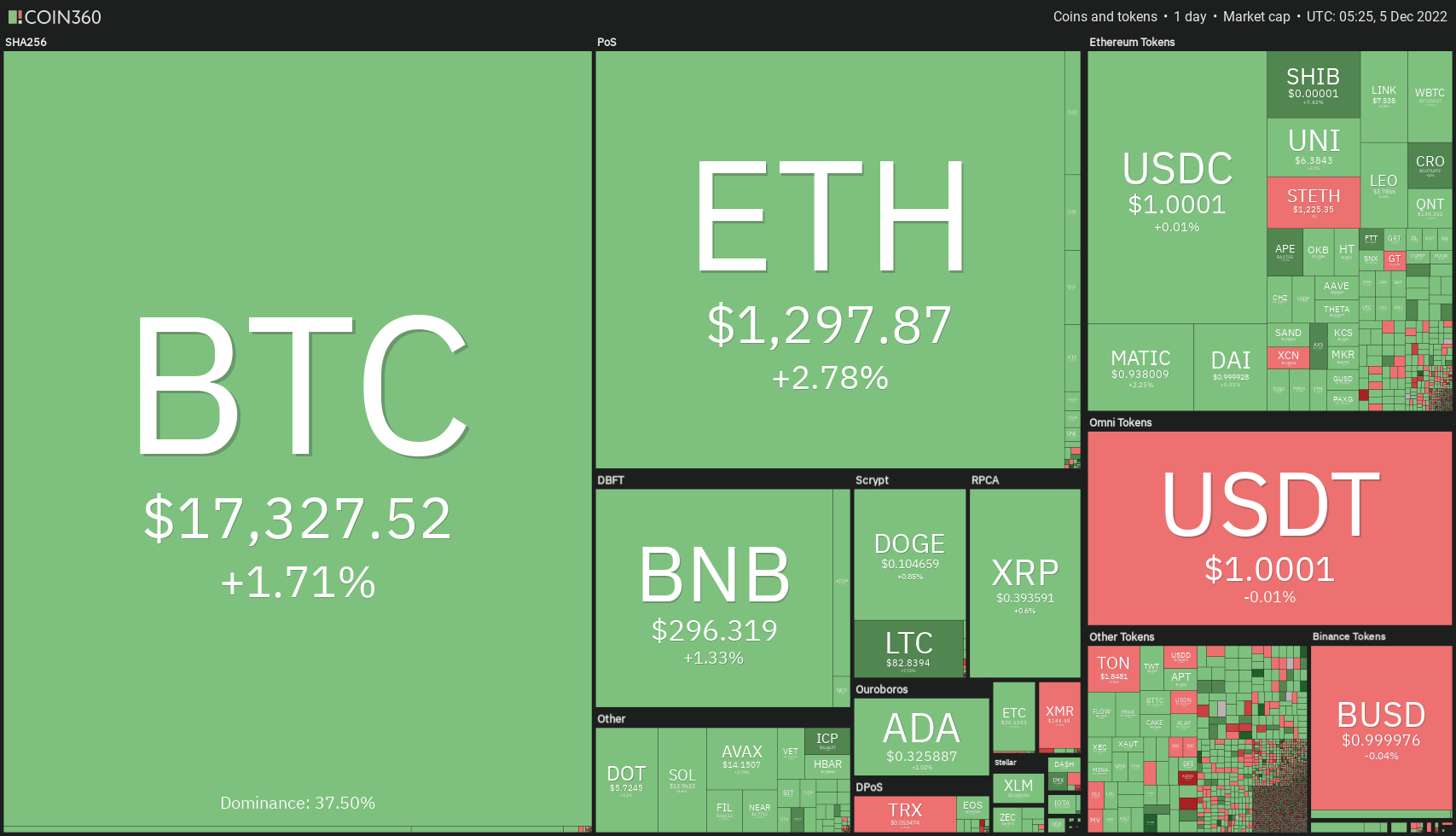

Major cryptocurrencies traded mixed early on December 5, as the global crypto market capitalization increased 1.58 % in the previous day to $865.67 billion. Over the last 24 hours, overall crypto market volume grew 5.91% to $32.24 billion.

The overall volume in DeFi was $2.42 billion, accounting for 7.49% of the total 24-hour volume in the crypto market. The overall volume of all stablecoins was $29.19 billion, accounting for 90.52% of the total 24-hour volume of the crypto market.

Let’s take a look at the top 24-hour altcoin gainers and losers.

Top Altcoin Gainers and Losers

Three of the top 100 coins that have gained value in the last 24 hours are Cronos (CRO), Celo (CELO), and Litecoin (LTC). The price of CRO has increased nearly 12% to $0.071; the price of CELO has increased by more than 11% to $0.6955, and the price of LTC is up by nearly 7.5%.

Monero (XMR), Neutrino USD (USDN), and TRON (TRX) are three of the top 100 coins that have lost value in the last 24 hours. Whereas XMR has lost about 1.30% to trade at $144.50, USDN is down nearly 1% to trade at $0.8890. At the same time, the TRX price is down over 0.50% to trade at $0.0535.

Bybit to Cut 30% of Workforce as Crypto Bear Market Deepens

Bybit, a centralized cryptocurrency exchange, has become the latest to lay off employees as the crypto winter continues. The company had already laid off workers in June of this year. Bybit, a company with headquarters in Singapore, has announced layoffs.

In addition, it’s all a part of the company’s continuing effort to restructure. It’s the latest cryptocurrency firm to shift priorities as the bear market worsens. Bybit co-founder and CEO Ben Zhou made the statement on December 4, adding that the layoffs would affect all departments.

Kraken to Remove Over 1,000 Employees as Crypto Winter Casualties Rise

Kraken co-founder and CEO Jesse Powell announced the company would be laying off nearly 1,100 workers, or 30% of its workforce, to “adapt to current market conditions.”

Specifically, Powell pointed to “macroeconomic and geopolitical concerns” as the root cause of the disappointingly weak growth. He pointed out that the recent market downturn has decreased trade volumes, new signups, and client demand.

Kraken claimed it was obliged to lay off many employees despite having already lowered personnel and marketing expenses. Kraken’s layoffs mirror reductions in personnel at other cryptocurrency companies this month due to the bear market.

Unchained Capital (which laid off 600 people) and Coinbase (which laid off 60) are among the companies that have recently reduced their workforce. In the wake of FTX’s collapse, the most publicized example of market volatility this year, BlockFi filed for bankruptcy earlier this week.

The exchange rate of the most popular cryptocurrency to the US dollar, BTC/USD, has hit a two-year low due to the crash.

This ultimately places a bearish impact on the cryptocurrency market, however, the technical outlook is driving a bullish trend in the leading crypto coins.

Bitcoin Price

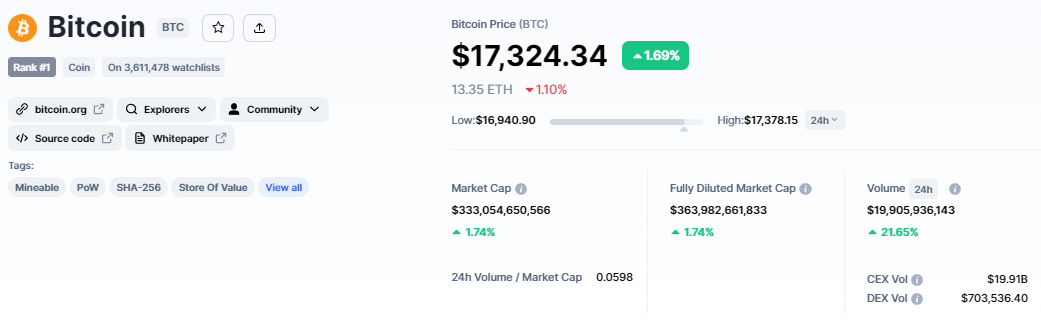

The current Bitcoin price is $17,332, and the 24-hour trading volume is $19 billion. During the last 24 hours, the BTC/USD pair has gained above 1.5%, while CoinMarketCap currently ranks first with a live market cap of $363 billion, above from $357 billion yesterday.

It has a total supply of 21,000,000 BTC coins and a circulating supply of 19,224,668 BTC coins.

The BTC/USD pair has broken through the $17,250 barrier, breaking through a narrow trading range of $16,800 to $17,250. The RSI and MACD indicators are in a positive territory, and the 50-day moving average is supporting BTC at $16,800.

On the plus side, Bitcoin is approaching the next resistance level of $17,650, and a break above this could expose BTC to $18,000. BTC has formed a bullish engulfing candle on the 4-hour timeframe, just above an upward trendline level of $17,000.

On the downside, Bitcoin support remains at $17,200, and a break below this level could lead BTC to $17,000 or even lower to the $16,750 level.

Ethereum Price

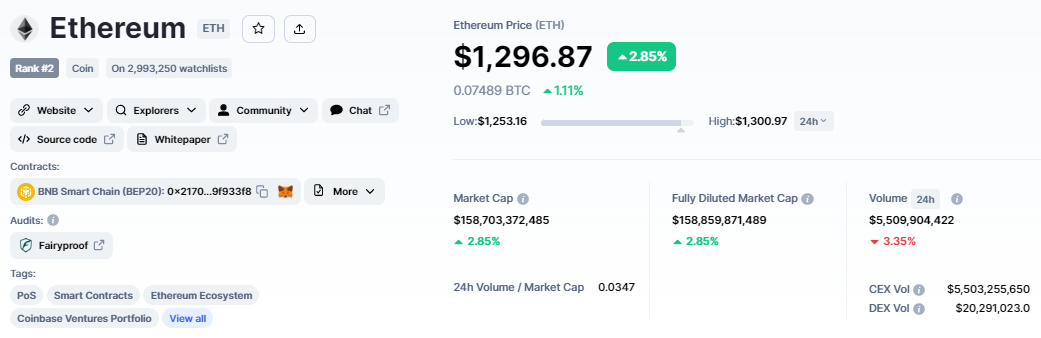

The current price of Ethereum is $1,296, with a 24-hour trading volume of $5.5 billion. In the last 24 hours, Ethereum has surged nearly 2%. CoinMarketCap currently ranks #2, with a live market cap of $158 billion. It has a circulating supply of 122,373,866 ETH coins.

On the 4-hour chart, Ethereum is trading bullish above the $1,250 psychological level, and it is now trading bearish above and below the $1,300 psychological level.

The bullish bias remains strong, as the 50-day moving average is close to $1,250. The RSI and MACD have recently entered the buying zone, indicating a good opportunity to go long.

Increased demand for ETH has the potential to push its price up to the $1,350 resistance level. If ETH fails to close candles above the $1,300 level, the price may fall toward the $1,250 or $1,220 support zones.

Keep an eye on the $1,300 level, which is likely to act as a pivot point today.

IMPT Presale Ends Soon: 1 Week to Buy

IMPT is another Ethereum-based network that will reward users for doing business with environmentally responsible firms. These advantages will be provided through the company’s IMPT token, which can be used to acquire NFT-based carbon offsets that may be sold or retired.

IMPT has raised more than $14 million since its initial public offering in October, with 1 IMPT currently trading at $0.023.

IMPT.io, a groundbreaking platform for carbon offsetting and carbon credits trading, will end its token presale on December 11th due to extraordinary success.

Visit IMPT Now

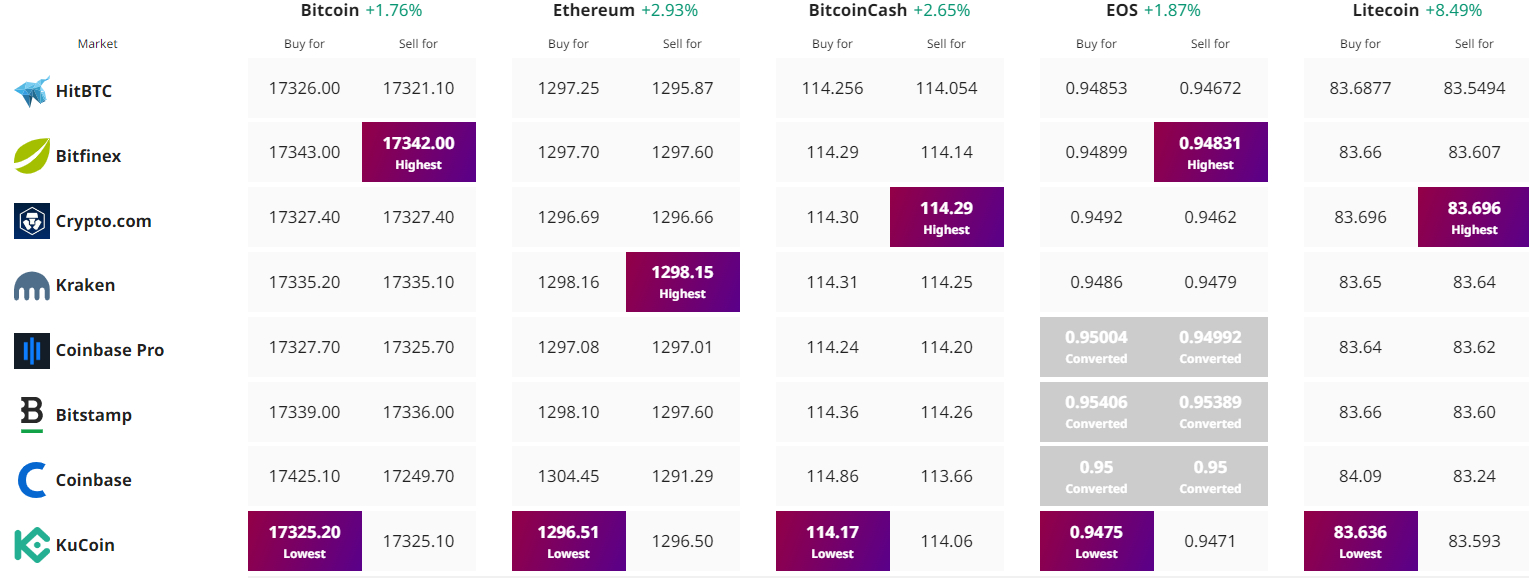

Find The Best Price to Buy/Sell Cryptocurrency

[ad_2]

cryptonews.com