[ad_1]

On December 6, Bitcoin, the leading cryptocurrency, gave up most of its gains, having lost nearly 2% to trade at the $16,980 level. Most of the selling trends in the crypto market could be associated with a stronger US dollar. Interest rate speculation increased on Monday after a US services index indicated the economy was holding steady.

Following news that the Institute for Supply Management’s gauge of services increased unexpectedly in November, the Bloomberg Dollar Spot Index rose by as much as 0.8%, snapping a four-day losing streak.

Ethereum, the second-most valuable cryptocurrency, has lost ground and slipped under $1,300 psychological trading levels.

Major cryptocurrencies were trading in the green early on December 6, even though the global crypto market cap had dropped 0.86% to $856.36 billion on the previous day. Over the last 24 hours, the total crypto market volume has increased by 26.48% to $40.21 billion.

DeFi’s total volume is currently $2.84 billion, accounting for 7% of the total crypto market 24-hour volume. The total volume of all stablecoins is now $36.63 billion, accounting for 91.10% of the total 24-hour volume of the crypto market.

Let’s take a look at the top 24-hour altcoin gainers and losers.

Top Altcoin Gainers and Losers

Axie Infinity (AXS), Synthetix (SNX), and Stacks (STX) are three of the top 100 coins that have gained value in the last 24 hours. AXS’s price has risen nearly 22% to $8.75; SNX’s price has risen more than 7% to $1.96; LTC’s price has risen nearly 3.5%.

Cronos (CRO), GMX (GMX), and Celo (CELO) are three of the top 100 coins that have lost value in the last 24 hours. Whereas CRO has lost about 7.5% to trade at $0.066, GMX is down nearly 6% to trade at $51.50. At the same time, the CELO price is down over 5% to trade at $0.6488.

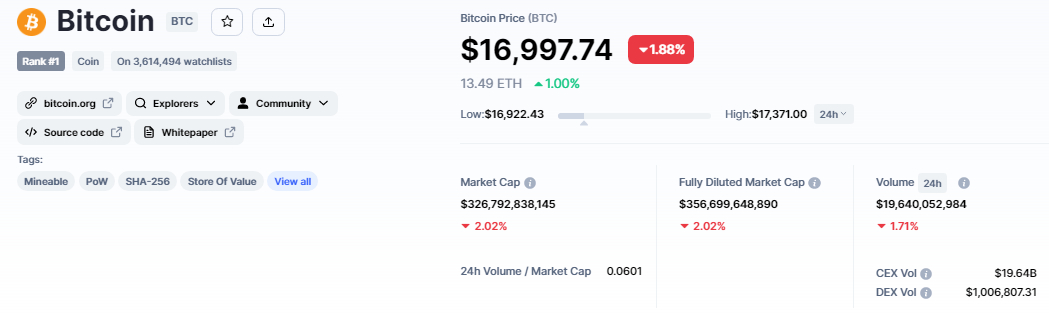

Bitcoin Price

The current Bitcoin price is $17,002, and the 24-hour trading volume is $19 billion. During the last 24 hours, the BTC/USD pair has lost nearly 2%, while CoinMarketCap currently ranks first with a live market cap of $357 billion, down from $363 billion yesterday.

It has a total supply of 21,000,000 BTC coins and a circulating supply of 19,225,600 BTC coins.

Following the release of stronger-than-expected ISM Services PMI figures from the US, the BTC/USD reversed below the $17,385 level, giving up most of its gains.

Furthermore, the leading cryptocurrency was technically overbought, and it required a bearish correction before continuing its upward movement. Early investors profited as well, and new investors have a good chance of entering the market above $16,850, a support level extended by an upward trendline.

Closing candles above $16,850 indicate a high likelihood of a bullish reversal. On the upside, Bitcoin may encounter resistance at $17,385; a bullish breakout above this level may open the door to further buying until $17,650 or $18,000.

On the downside, a break below $16,840 support can extend the selling trend until the $16,500 level.

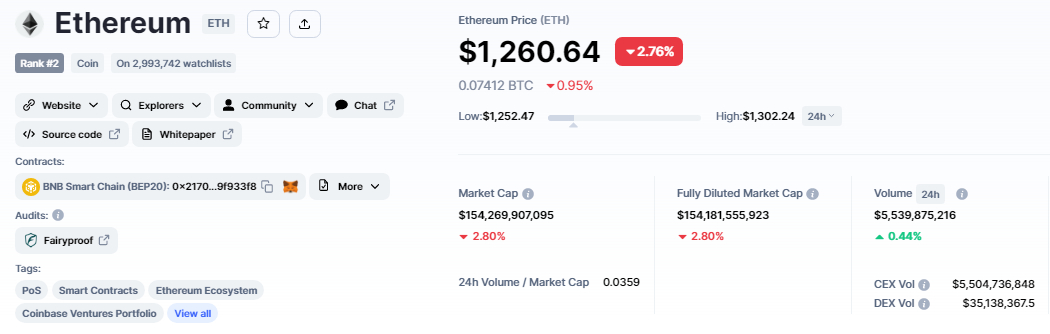

Ethereum Price

The current price of Ethereum is $1,259, with a 24-hour trading volume of $5.5 billion. In the last 24 hours, Ethereum has dropped over 2%. CoinMarketCap currently ranks #2, with a live market cap of $154 billion. It has a circulating supply of 122,373,866 ETH coins.

On the 4-hour chart, Ethereum fell to the previous support area of $1,250, and the closing of candles above this level has the potential to drive a rebound. On the upside, ETH can go after the $1,300 resistance level. The bullish bias remains strong, as the 50-day moving average is close to $1,250.

The RSI and MACD, on the other hand, have recently entered the selling zone, indicating a selling trend in ETH. But I believe this is just a bearish correction, and bulls remain optimistic until $1,250 is reached.

Increased selling pressure may result in a bearish breakout, allowing for more selling until the $1,220 or $1,185 levels. Let’s keep an eye on $1,250 today because it’s likely to act as a major pivot point.

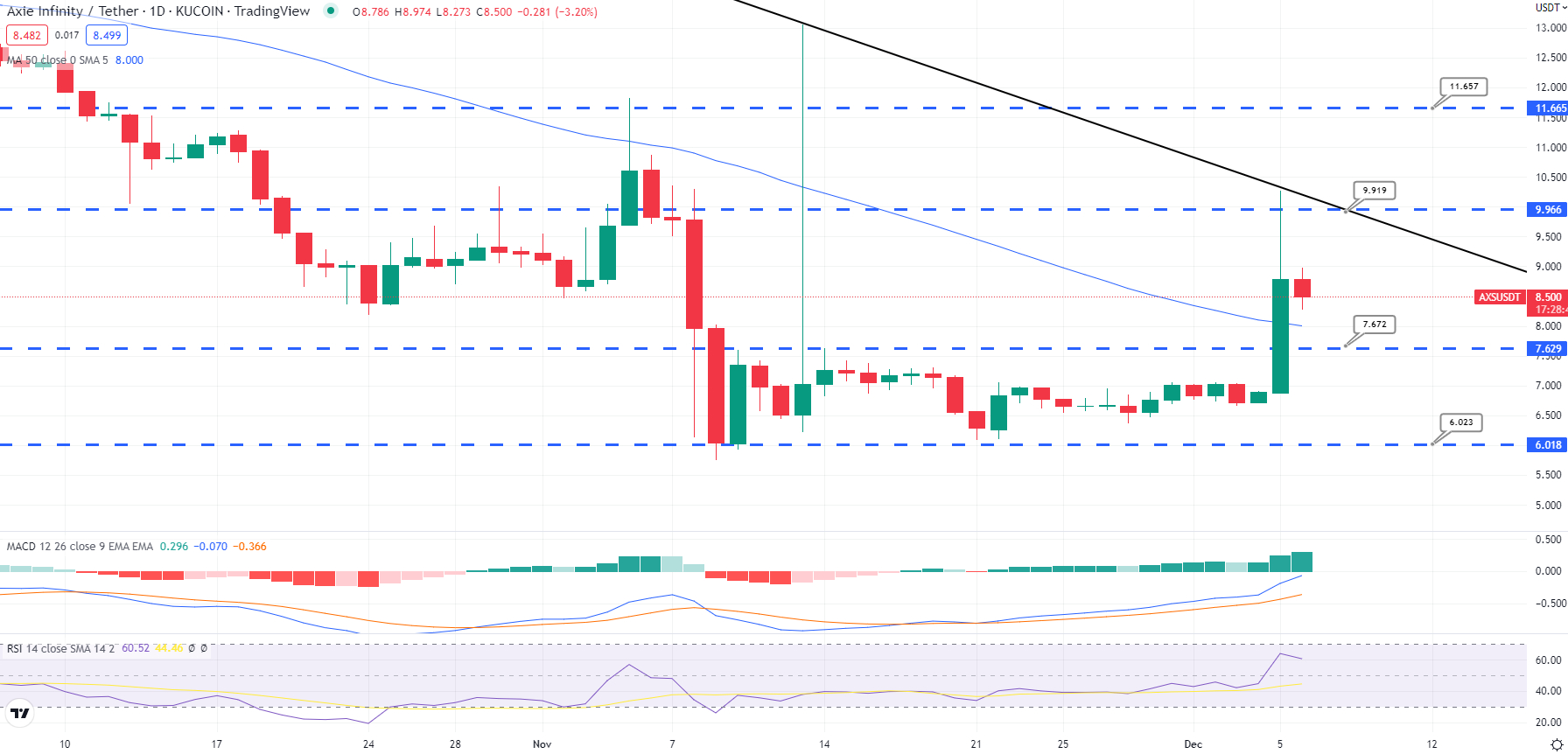

Axie Infinity Jumps 30%

The current price of Axie Infinity is $8.71, with a 24-hour trading volume of $716 million. Axie Infinity has increased by more than 21% in the last 24 hours. CoinMarketCap currently ranks #50, with a live market cap of $869 million. It has 99,854,114 AXS coins in circulation and a maximum supply of 270,000,000 AXS coins.

Early this year, it was hinted that plans were already in motion to guarantee that Axie Infinity will eventually go towards decentralization, and now we have concrete evidence of that. Axie tweeted on December 5 that it had begun the process of progressive decentralization.

The company has released a statement saying it has formally launched under the name “Town Builders.” Axie thinks that the Town Builders established a firm basis for local government.

Another new addition to Axie is a feature called Axie Contributors. Participants will learn from Town Builder-led discussions, form new friendships, and test out various forms of community leadership. The Town Builders and the Donors will work together to create a framework for local government. Hence, this is keeping the Axie trend bullish.

IMPT Presale Ends Soon: 1 Week to Buy

IMPT is yet another Ethereum-based network that will reward users for doing business with environmentally conscious companies. These benefits will be provided by the company’s IMPT token, which can be used to purchase NFT-based carbon offsets, which can then be sold or retired.

Since its initial public offering in October, IMPT has raised more than $14 million, with 1 IMPT currently trading at $0.023.

Due to its extraordinary success, IMPT.io, a groundbreaking platform for carbon offsetting and carbon credits trading, will end its token presale on December 11th.

Visit IMPT Now

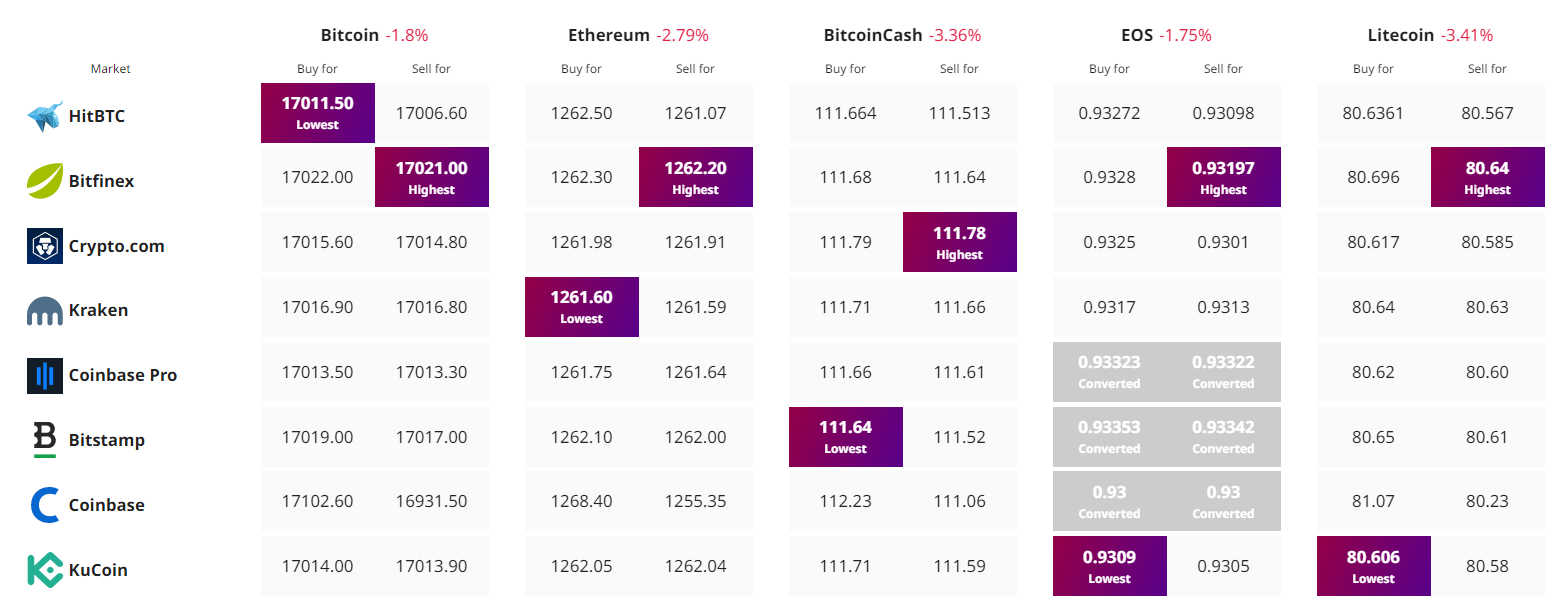

Find The Best Price to Buy/Sell Cryptocurrency

[ad_2]

cryptonews.com