[ad_1]

Bitcoin, the leading cryptocurrency, struggled to break above the $17,250 level on December 4, and it is now heading lower to $16,900. Similarly, after being rejected at $1,300, Ethereum, the second-most valuable cryptocurrency, has fallen and is now consolidating near $1,275.

Over the last 24 hours, the global crypto market capitalization fell over 17% to $2.18 trillion. Over the last 24 hours, the overall crypto market volume has increased by 77% to $206.73 billion. The overall volume in DeFi is currently $26.15 billion, accounting for over 12% of the entire 24-hour volume in the crypto market.

The overall volume of all stablecoins is now $167.22 billion, accounting for 80% of the total 24-hour volume of the crypto market.

Let’s take a look at the top 24-hour altcoin gainers and losers.

Top Altcoin Gainers and Losers

Three of the top 100 coins that have gained value in the last 24 hours are Celo (CELO), Aptos (APT), and Nexo (NEXO). The price of CELO has increased by more than 10% to $0.6625; the price of APT has increased by more than 6.5% to $5.30; and the price of NEXO has increased by nearly 5%.

UNUS SED LEO (LEO), GMX (GMX), and Klaytn (KLAY) are three of the top 100 coins that have lost value in the last 24 hours. Whereas LEO has lost about 7% to trade at $3.75, GMX is down nearly 5.5% to trade at $54.75. At the same time, the KLAY price is down over 2.85% to trade at $0.1875.

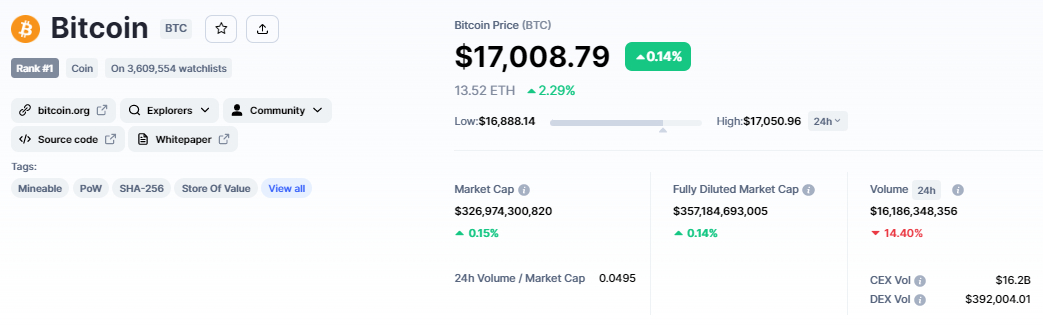

Bitcoin Price

The current Bitcoin price is $17,007, and the 24-hour trading volume is $16 billion. During the last 24 hours, the BTC/USD pair has gained above 0.10%, while CoinMarketCap currently ranks first with a live market cap of $357 billion, down from $357 billion yesterday.

It has a total supply of 21,000,000 BTC coins and a circulating supply of 19,223,837 BTC coins.

The BTC/USD pair has struggled to break over $17,250, and it’s trading sideways, maintaining a narrow trading range of $16,800 to $17,250.

On the downside, Bitcoin has completed a 23.6% Fibonacci retracement at $16,900, and closing candles below $16,950 may spark new selling until the $16,750 resistance level is reached.

Further down, Bitcoin can aim for the $16,600 level, a 50% Fib extension, and a break below this can expose BTC to the $16,450 level, a 61.8% Fib extension. On the plus side, a bullish break of the $17,250 resistance level might expose BTC to levels as high as 17,650 and $18,100.

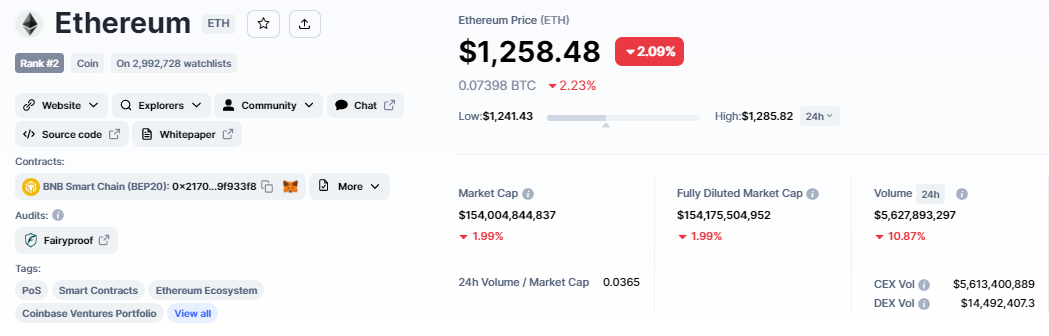

Ethereum Price

The current price of Ethereum is $1,258, with a 24-hour trading volume of $5.6 billion. In the last 24 hours, Ethereum has plunged nearly 2%. CoinMarketCap currently ranks #2, with a live market cap of $154 billion. It has a circulating supply of 122,373,866 ETH coins.

On the 4-hour chart, Ethereum traded bullishly but failed to break through the psychological trading level of $1,300, indicating the start of a downward correction. The 50-day moving average, however, is holding the coin around $1,240. Ethereum’s immediate support level is expected to be around $1,225, with a drop below $1,150 likely.

The two indicators are diverging because the MACD is in a selling zone while the RSI is still in a buying zone. Furthermore, the 50-day simple moving average (SMA) remains positive, indicating a buying tendency.

A bullish breakout of the $1,300 level, on the other hand, might expose the ETH price to the $1,354 level.

Fantom Pumps 28% in Seven Days

Fantom’s current price is $0.24034, with a 24-hour trading volume of $119 million. In the last 24 hours, Fantom has been down 1.75% and is up nearly 28%. With a live market cap of $611 million, CoinMarketCap now ranks #65.

There are 2,545,006,273 FTM coins in circulation, with a maximum supply of 3,175,000,000.

Using Fantom (FTM) to Overcome These EVM Constraints

To address the technical design problems that plague Ethereum Virtual Machine (EVM), a recent paper suggests using Fantom (FTM), a next-generation smart contract platform that uses parallel computations to achieve vertical scalability.

Balance Capital, an investment and infrastructure firm with a focus on the cryptocurrency Fantom, released a thread on December 2, 2022, detailing the major limitations of the Ethereum Virtual Machine (EVM) and how Fantom’s VM overcomes them.

When compared to what is possible with EVM, Fantom Virtual Machine’s primary goal is to achieve far higher throughput. Fantom (FTM) can process hundreds of TPS, but Ethereum (ETH) can only process 18.

Balance Capital thinks EVM is overly cautious because it hasn’t been updated since its initial releases. Because of this, dApp developers may find the constantly updated mechanisms of Fantom more appealing.

According to Balance Capital, Fantom’s secret to success in terms of scalability is its capacity to execute transactions in parallel. It improves Fantom’s dApps’ scalability and productivity.

IMPT Presale Ends Soon: 1 Week to Buy

IMPT is another Ethereum-based network that will reward users for doing business with environmentally responsible firms. These advantages will be provided through the company’s IMPT token, which can be used to acquire NFT-based carbon offsets that may be sold or retired.

IMPT has raised more than $13.6 million since its initial public offering in October, with 1 IMPT currently trading at $0.023.

IMPT.io, a groundbreaking platform for carbon offsetting and carbon credits trading, will end its token presale on December 11th due to extraordinary success.

Visit IMPT Now

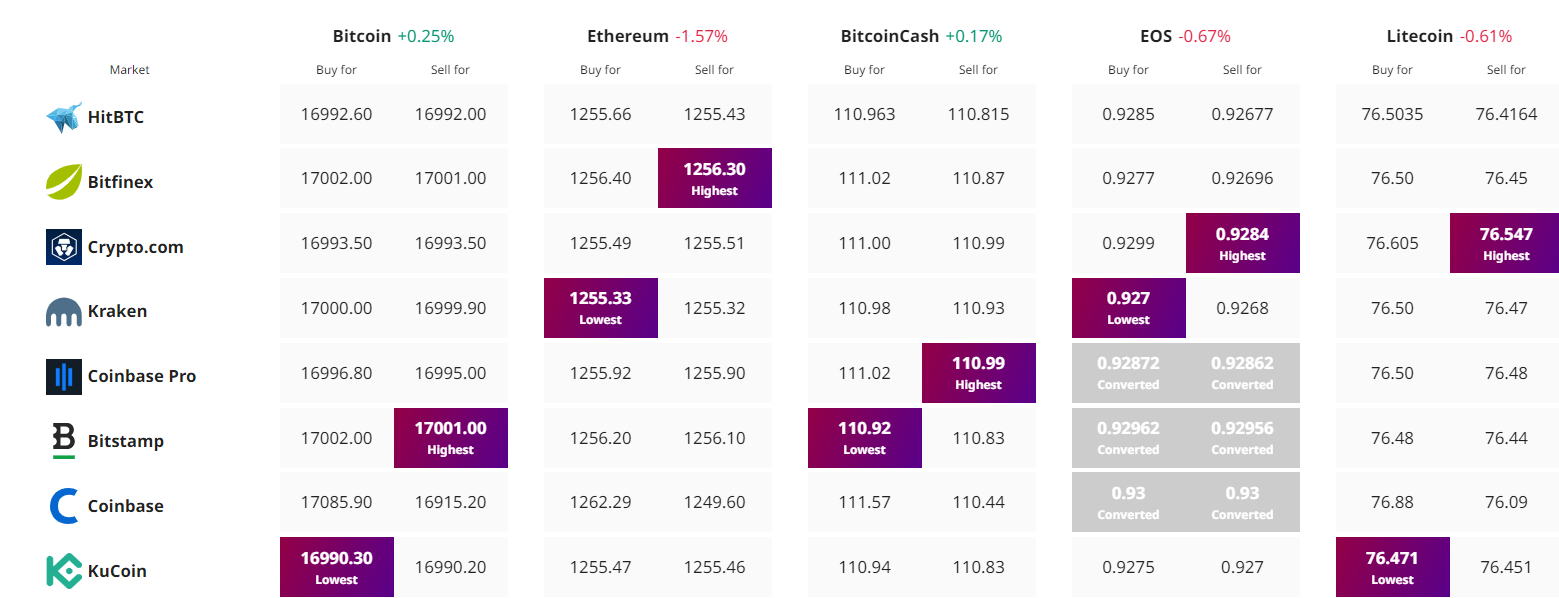

Find The Best Price to Buy/Sell Cryptocurrency

[ad_2]

cryptonews.com