[ad_1]

Bitcoin is steady on December 13 during the Asian session after regaining bullish momentum above the $17,000 level. Similarly, Ethereum has followed suit, gaining control above $1,272 as investors await the US CPI figures, which are scheduled for 13:30 GMT.

The global crypto market cap increased 0.27% to $848.96 billion in the previous day, as major cryptocurrencies traded in the green early on December 13. The total crypto market volume in the last 24 hours has increased by 29.04% to $35.10 billion.

DeFi’s total volume is currently $2.13 billion, accounting for 6.06% of the total crypto market 24-hour volume. The total volume of all stablecoins is now $33.82 billion, accounting for 96.35% of the total 24-hour volume of the crypto market.

Let’s take a look at the top 24-hour altcoin gainers and losers.

Market Braces for US CPI Today

The final significant piece of economic news before the Fed meeting, November inflation data, is expected to show easing price pressures. Indicators point to a 0.3% increase over the previous month, which is slightly slower than the 0.4% increase seen in October.

On an annualized basis, inflation is expected to fall from 7.7% to 7.3%. Much more work is needed to reduce inflation, but the trend is positive for the time being.

BTC Upgraded Functionality: Smart Contract

The DFINITY Foundation created the Internet Computer (IC), the first public blockchain designed for the internet. The IC mainnet has announced its integration with Bitcoin, making state-of-the-art smart contract capability available on the world’s most popular cryptocurrency.

It’s possible that the Internet Computer will soon serve as Bitcoin’s Layer 2, enabling smart contracts to store, send, and receive bitcoin directly without going through any blockchain bridges. It provides a reliable foundation for developing Bitcoin-based DeFi and Web3 applications.

Threshold ECDSA bridges, a more secure alternative to centralized bridges, are available through the Internet Computer’s Bitcoin integration (Elliptic Curve Digital Signature Algorithm).

Through ECDSA’s fix, Internet Computer’s canister smart contracts can conduct Bitcoin transactions directly, without needing a middleman or a bridge. It paves the way for trustless support of Bitcoin-based DeFi apps and makes it possible for IC developers to create Bitcoin code in its native language. The BTC/USD benefited from the announcement of the integration, as the price rose.

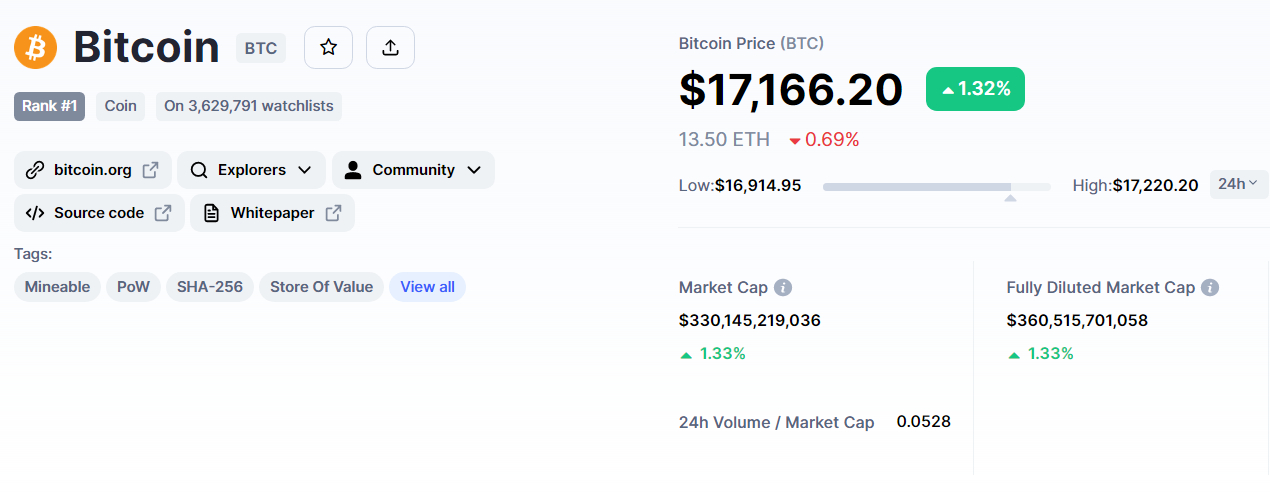

Bitcoin Price

Bitcoin’s current price is $17,179, and the 24-hour trading volume is $17 billion. The BTC/USD pair has gained nearly 1.3% in the last 24 hours, while CoinMarketCap currently ranks first with a live market cap of $360 billion, up from $325 billion yesterday.

On the technical front, Bitcoin has regained bullish momentum above the $19,900 major support level. Bitcoin is trading in a bullish channel on the 4-hour timeframe, which is likely to support it near $16,900.

Bitcoin’s major resistance remains at $17,350, and a bullish crossover above this level could expose BTC to $17,760.

Because the MACD and RSI indicators indicate a buying trend, investors should look for a buying position above $17,350 today.

A bearish breakout of the $16,900 level, on the other hand, could expose BTC to the $16,700 level. Further down, Bitcoin’s next supports are likely to be around $16,350 and $16,000.

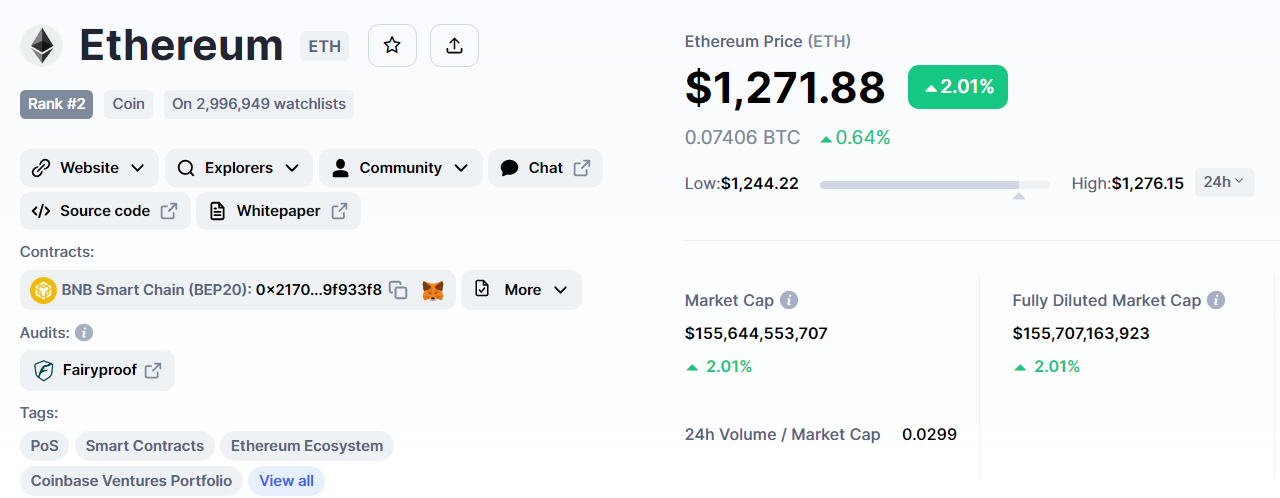

Ethereum Price

Ethereum’s current price is $1,271, with a $4 billion 24-hour trading volume. In the last 24 hours, Ethereum has gained nearly 2%, and CoinMarketCap currently ranks second, with a live market cap of $155 billion.

On the 4-hour chart, Ethereum has crossed above the 50-day simple moving average, which had been extending resistance at $1,260. This level is now acting as a support. The bullish bias is indicated by the 50-day moving average, RSI, and MACD indicators.

On the upside, Ethereum’s immediate resistance remains at $1,300, and a bullish crossover above this psychological trading level could expose ETH to $1,345 territory.

Alternatively, a break below $1,260 may expose ETH to the $1,220 level.

Dash 2 Trade (D2T) – Final Stage of Presale

Dash 2 Trade is an Ethereum-based trading intelligence platform that provides investors with real-time analytics and social trading data to assist them in making better trading decisions. It will go live in early 2023, and its D2T token will be used to pay platform subscription costs on a monthly basis.

The Dash 2 Trade presale, which is now in its fourth and final stage, has already raised over $9.6 million. It has also announced early next year listings on Uniswap, BitMart, and LBANK Exchange, meaning that early investors will soon be able to lock in some profits.

Visit Dash 2 Trade Now

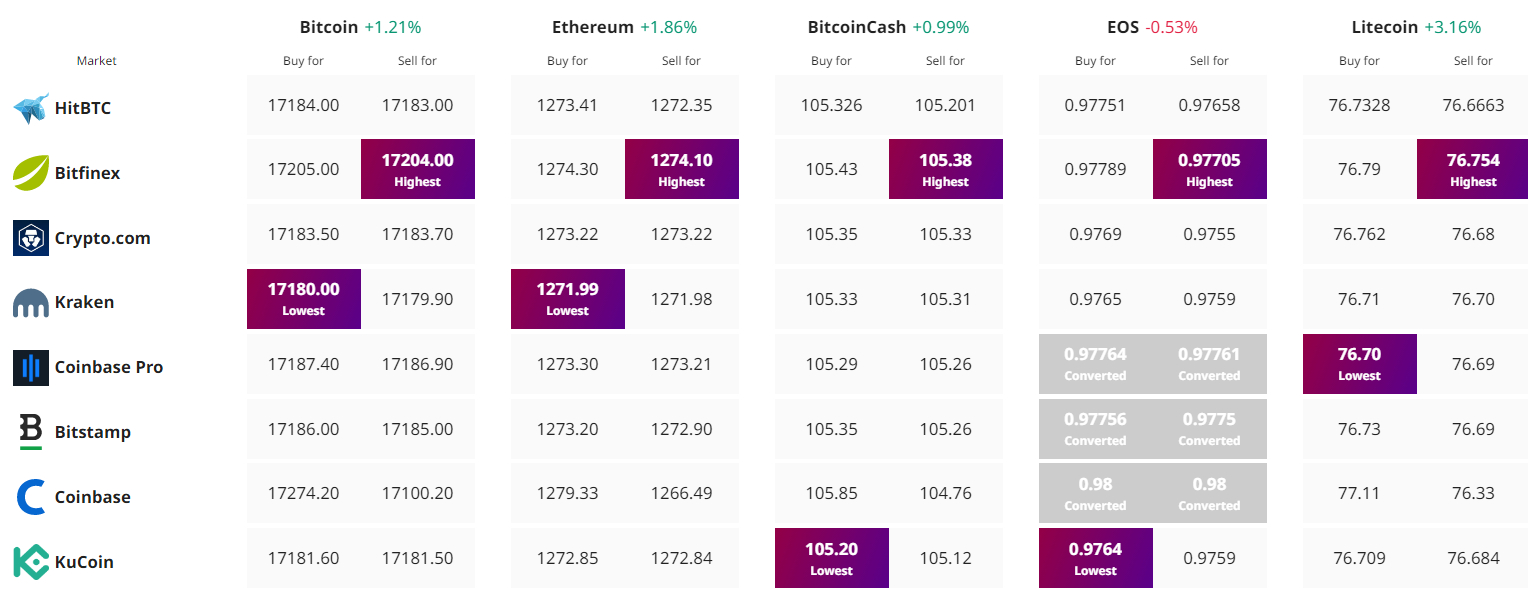

Find The Best Price to Buy/Sell Cryptocurrency

[ad_2]

cryptonews.com