[ad_1]

In the past week, Bitcoin has seen a 10% rise in its value, leading many to believe that a bull market is arriving. The price of Bitcoin can be unpredictable, however there are certain factors to consider when predicting its potential future performance.

On January 28, the BTC/USD market opened at $23,067.00 and has since gained 0.07% in 24 hours to reach a current price of $22,971.00.

Moreover, its value has been on an upward trend and it has increased by more than 1% in the past week. It’s been trading within a range of $23,181 to $22,942 for most of this period.

Arizona Senator Proposes Bills That Would Make Bitcoin a Legal Currency

Wendy Rogers, a United States state senator from Arizona, tweeted about a cryptocurrency bill on January 25. Wendy cited Goldman Sachs data indicating that Bitcoin is the world’s best-performing asset. She also introduced legislation to make bitcoin legal payment in Arizona and to allow state agencies to accept bitcoin.

The SB 1235 bill is one of several proposals in Arizona that would allow businesses to accept cryptocurrency as payment for rent, taxes, and fines. It would include the ability to use bitcoin for all US dollar-based transactions, allowing both individuals and businesses to use the currency.

If the bill is passed, Arizona will be the first state in the United States to accept Bitcoin as payment for any financial debt. As a result, it is good news for BTC/USD.

The SEC’s Latest Crypto Regulations: What You Need To Know

On January 20, Hester Peirce, a commissioner with the US Securities and Exchange Commission (SEC), spoke about cryptocurrency regulation at the “Digital Assets at Duke” conference. The commissioner emphasized that the securities regulator has pursued registration violations at random.

According to reports, the SEC is also interviewing investment advisors who hold customer funds on exchanges such as FTX. According to reports, the SEC spent months investigating how financial advisors handle client cryptocurrency custody. However, since FTX declared bankruptcy and millions of depositors were left without funds, the investigation has accelerated.

The US agency has now submitted its investigation to determine whether investment advisors violated the regulations. Investment advisers are not permitted to have custody of client funds if they do not follow certain SEC rules. Furthermore, advisors must keep the funds with a “qualified custodian,” among other things.

The SEC is stepping up its efforts to regulate the cryptocurrency industry. The authority has been under considerable pressure to act in this manner, particularly since FTX’s demise. If the SEC investigation confirms regulations, it may boost institutional trust in cryptocurrency. As a result, it may be beneficial for BTC/USD.

What To Look For At The Next Fed Meeting

Positive economic data, high employment, and a declining inflation rate gave reason to believe that the rate of interest rate increases would slow. As a result, markets are now anticipating a reduction in rate hikes. The Federal Open Market Committee (FOMC) will meet on February 1.

Traders are currently focused on the upcoming FOMC meeting because experts believe the outcome will have an impact on the market’s direction. Furthermore, the FOMC is likely to scale back the 50 basis point rate increases seen in December and only raise rates by 25 basis points at its next meeting in February.

The outcome of the upcoming meeting will have a significant impact on the cryptocurrency market’s sentiment as well as the price of BTC/USD.

Bitcoin Price

Bitcoin is currently trading at $23,017; has a 24-hour trading volume of $17 billion. The BTC/USD pair is trading above the support line at roughly $22,325 with Doji and spinning top candles closing around the $22,340 to $23,400 region.

Bitcoin is facing a large barrier around $23,250, but if it can break through, its value might rise dramatically to $23,900 or even higher to $25,150.

On the downside, a negative breakout of the $22,325 barrier might expose BTC/USD to the downward, resulting in a bearish market shift. A similar action might cause Bitcoin to fall to $21,500, and possibly as low as $20,450.

Buy BTC Now

Bitcoin Alternatives

CryptoNews just listed the 15 most promising cryptocurrencies for 2023. If you want to invest, there are alternative ventures out there that could provide a nice return if you do your homework.

Cryptocurrency investors and traders are always monitoring altcoins and ICOs in the digital asset arena in order to stay up to date on all emerging trends and opportunities.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

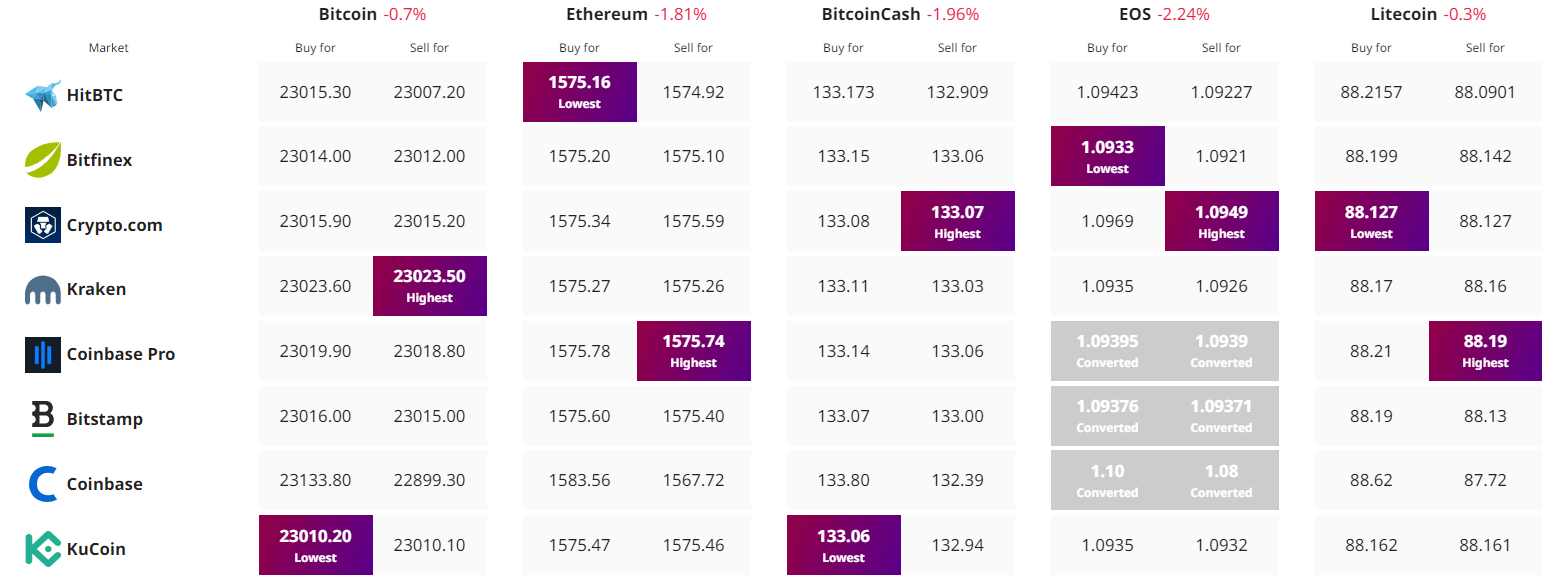

Find The Best Price to Buy/Sell Cryptocurrency

[ad_2]

cryptonews.com