[ad_1]

Bitcoin opened trading on January 24 at $22,910 and it’s currently trading at $22,895.00, up 0.40% in the last 24 hours. BTC/USD has ranged between a high of $23,154.00 and a low of $22,770.

Furthermore, its value has risen by more than 8% in the last week.

Why The SEC’s “One-Dimensional” Strategy Is Stifling Bitcoin Growth

Grayscale Investments CEO Michael Sonnenshein published a letter in The Wall Street Journal on January 23. The approach of the United States Securities and Exchange Commission (SEC) to crypto regulatory compliance, according to the CEO of a crypto asset management company, has slowed the growth of Bitcoin in the country.

He agreed that the SEC was “late to the game” when it came to regulating cryptocurrencies and mitigating FTX’s bankruptcy. Grayscale is now suing the SEC for refusing to convert their Bitcoin trust to a spot-based exchange-traded fund (ETF). Michael stated unequivocally that, while the SEC should undoubtedly strive to eliminate unethical actors, it should not obstruct efforts to enact appropriate legislation.

Furthermore, Sonnenshein stated that the regulator’s failure to prevent such unethical actors from entering the crypto sector hampered Bitcoin’s expansion into the US regulatory perimeter.

Because of the volatile nature of the cryptocurrency industry and the speculative nature of digital assets, regulators must engage and adopt the necessary legislation. The rules will also cause the BTC/USD to rise because investors will feel more secure.

What Does The Federal Reserve’s Pivotal Rate Hike Mean For You?

The cryptocurrency market could rise in February, signaling a positive change in the macroeconomic situation. The Federal Open Market Committee (FOMC) will meet on January 31 and February 1.

As a result, the Fed’s monetary policy forecast against the possibility of a US recession may determine how much Bitcoin will cost. Furthermore, a recent trend among Fed officials indicated that rate hikes would be slowed.

On January 23, a well-known figure in the US financial industry, Peter Schiff, tweeted about the possibility of a cryptocurrency price increase in the event of a Fed pivot.

Traders predict a 0.25% rate increase in February and a similar outcome in subsequent meetings. If this turns out to be true, the Bitcoin/USD price could skyrocket.

How BlockFi is Revolutionizing Bitcoin Mining Through $160 Million in Secured Loans

BlockFi Inc., a bankrupt cryptocurrency lender, intends to liquidate debts totaling approximately $160 million, which are secured by approximately 68,000 Bitcoin mining rigs.

According to a January 24 Bloomberg report, BlockFi began the process of selling off the loans last year. BlockFi has previously provided funding to Bitcoin miners who have been impacted by the crypto winter and falling BTC prices.

According to reports, lenders provided $4 billion in loans to crypto mining companies. BlockFi is now attempting to market Bitcoin mining machine-backed loans to consumers using its 68,000 rigs.

Given the drop in mining equipment prices, the $160 million in loans are expected to be undercollateralized. Despite rumors that crypto mining businesses are in trouble, BTC/USD has risen from low levels.

Bitcoin Price

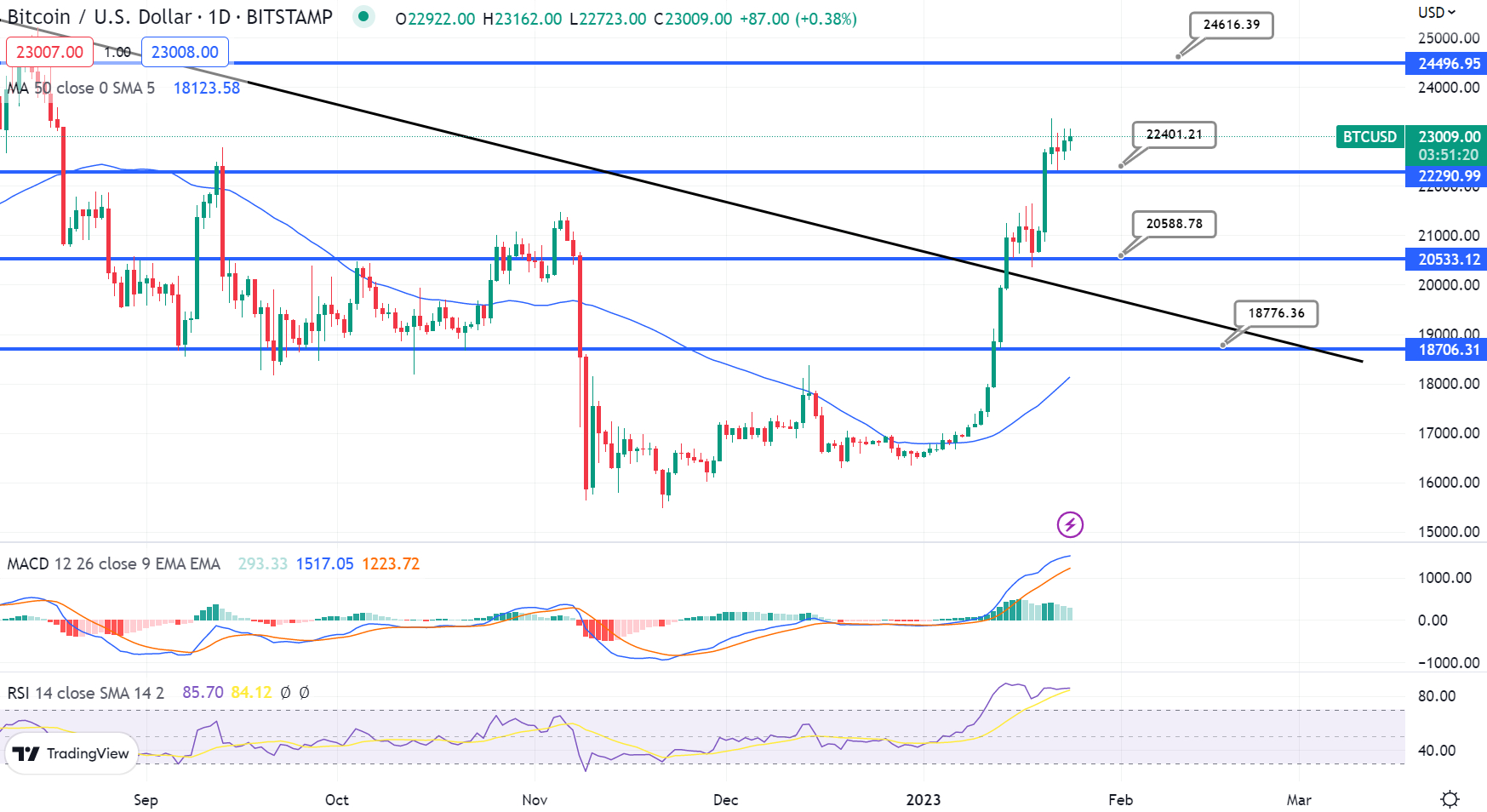

Bitcoin is currently valued at $23,020 and has a $23 billion 24-hour trading volume. Bitcoin has gained nearly 1% in the last 24 hours. With a live market worth of $443 billion, CoinMarketCap presently ranks top.

Bitcoin is currently facing a significant barrier near $23,250, with immediate support at $22,500. If the candles fall below $22,500, a bearish correction will almost surely begin and extend until the $21,500 barrier is reached.

Bitcoin might go as low as $20,450 if it falls below $21,500.

The RSI and MACD indicators are overbought, but the recent bullish engulfing candle suggests that the bullish trend may continue.

Bitcoin’s immediate resistance level is $23,250, and a break above this level might expose BTC to levels as high as $23,900 and $25,150.

Buy BTC Now

Bitcoin Alternatives

CryptoNews Industry Talk has reviewed the top 15 cryptocurrencies for 2023. If you’re looking for a higher potential investment opportunity, there are plenty of other projects worth considering.

The list is updated weekly with new altcoins and ICO projects.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

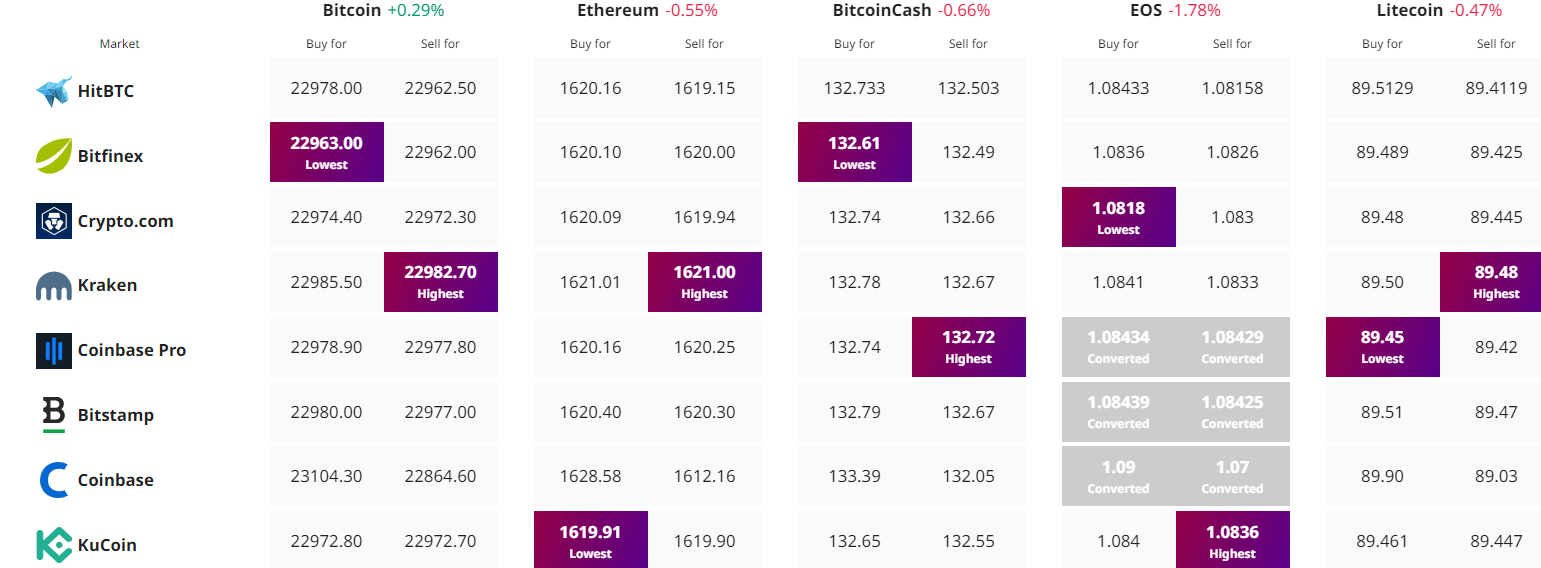

Find The Best Price to Buy/Sell Cryptocurrency

[ad_2]

cryptonews.com